Question: Question Completion Status: Question 11 2 points Pyramid Wines Equipment sells its product for $11,000 per unit. The variable costs per unit as follows: manufacturing,

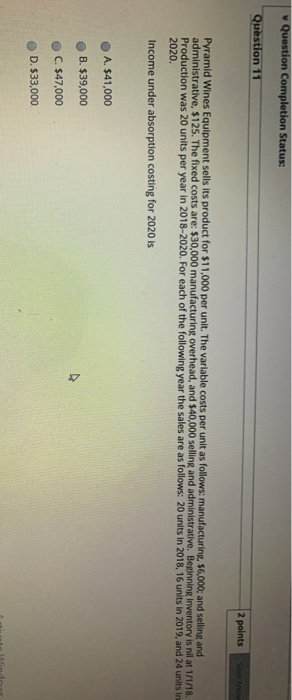

Question Completion Status: Question 11 2 points Pyramid Wines Equipment sells its product for $11,000 per unit. The variable costs per unit as follows: manufacturing, $6,000; and selling and administrative, $125. The fixed costs are: $30,000 manufacturing overhead, and $40,000 selling and administrative Beginning inventory is nil at 1/1/18. Production was 20 units per year in 2018-2020. For each of the following year the sales are as follows: 20 units in 2018, 16 units in 2019, and 24 units in 2020. Income under absorption costing for 2020 is A. $41,000 B. $39,000 C. $47,000 D. $33,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts