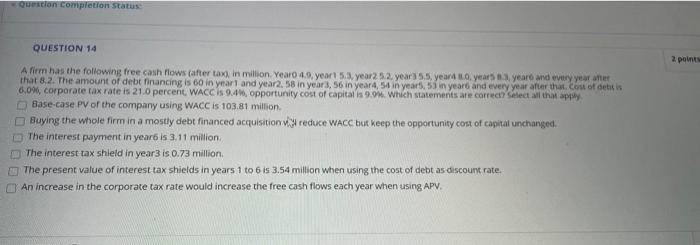

Question: Question completion status QUESTION 14 2 points A firm has the following free cash flows after tax, in million Year 4.9. year 5.3. year252. year

Question completion status QUESTION 14 2 points A firm has the following free cash flows after tax, in million Year 4.9. year 5.3. year252. year 5.5 year, years 3 year and every year that 8,2. The amount of debt financing is 60 in year and year2. 58 in year 3,56 in year 4,5 in years, 53 in years and every year after the cost of dentis 6.0%, corporate tax rate is 21.0 percent, WACC is 9.4%, opportunity cost of capitalis 9.0. Which statements are correc Select all that apply Base-case PV of the company using WACC is 103.81 million Buying the whole firm in a mostly debt financed acquisition will reduce WACC but keep the opportunity cost of capital unchanged. The interest payment in year is 3.11 million The interest tax shield in year is 0.73 million The present value of interest tax shields in years 1 to 6 is 3.54 million when using the cost of debt as discount rate. An increase in the corporate tax rate would increase the free cash flows each year when using APV. Question completion status QUESTION 14 2 points A firm has the following free cash flows after tax, in million Year 4.9. year 5.3. year252. year 5.5 year, years 3 year and every year that 8,2. The amount of debt financing is 60 in year and year2. 58 in year 3,56 in year 4,5 in years, 53 in years and every year after the cost of dentis 6.0%, corporate tax rate is 21.0 percent, WACC is 9.4%, opportunity cost of capitalis 9.0. Which statements are correc Select all that apply Base-case PV of the company using WACC is 103.81 million Buying the whole firm in a mostly debt financed acquisition will reduce WACC but keep the opportunity cost of capital unchanged. The interest payment in year is 3.11 million The interest tax shield in year is 0.73 million The present value of interest tax shields in years 1 to 6 is 3.54 million when using the cost of debt as discount rate. An increase in the corporate tax rate would increase the free cash flows each year when using APV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts