Question: * Question Completion Status: QUESTION 14 7 points Save Answer Zippon is considering a new project whose success is uncertain. If it is successful Zippon

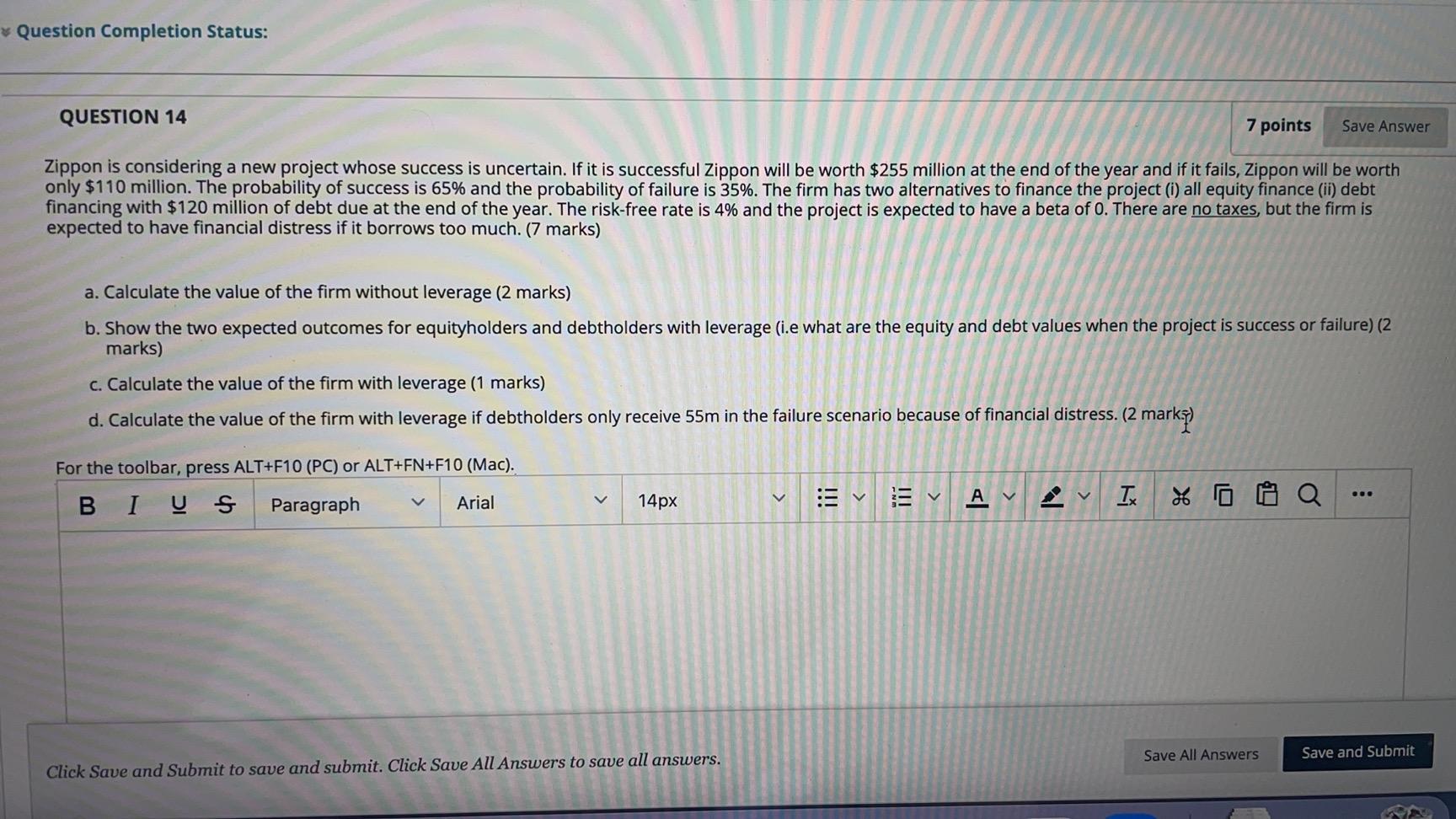

* Question Completion Status: QUESTION 14 7 points Save Answer Zippon is considering a new project whose success is uncertain. If it is successful Zippon will be worth $255 million at the end of the year and if it fails, Zippon will be worth only $110 million. The probability of success is 65% and the probability of failure is 35%. The firm has two alternatives to finance the project (1) all equity finance (ii) debt financing with $120 million of debt due at the end of the year. The risk-free rate is 4% and the project is expected to have a beta of 0. There are no taxes, but the firm is expected to have financial distress if it borrows too much. (7 marks) a. Calculate the value of the firm without leverage (2 marks) b. Show the two expected outcomes for equityholders and debtholders with leverage (i.e what are the equity and debt values when the project is success or failure) (2 marks) c. Calculate the value of the firm with leverage (1 marks) d. Calculate the value of the firm with leverage if debtholders only receive 55m in the failure scenario because of financial distress. (2 mark) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B I U Paragraph Arial > V

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts