Question: Question Completion Status: QUESTION 15 14 points Save Answer The following information is given for a bank: Balance-sheet items: (in $ millions) cash and equivalents

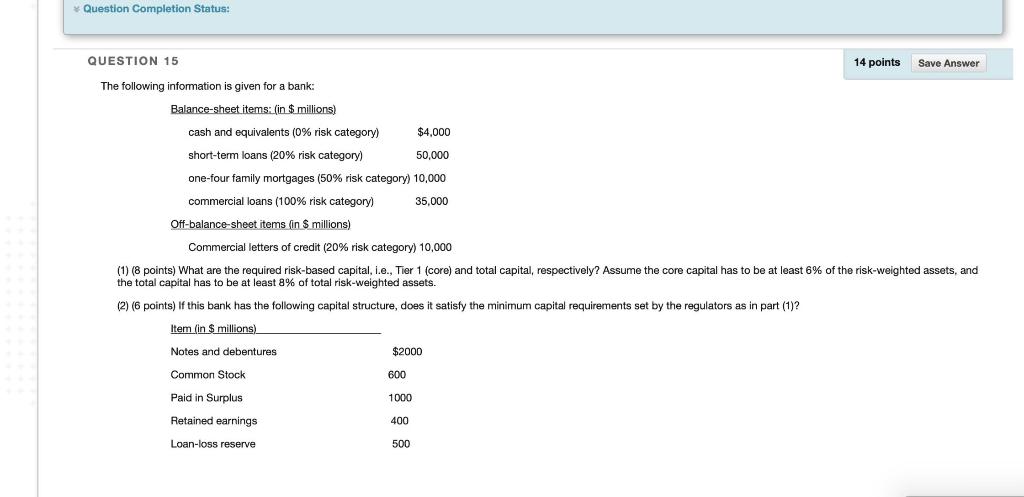

Question Completion Status: QUESTION 15 14 points Save Answer The following information is given for a bank: Balance-sheet items: (in $ millions) cash and equivalents (0% risk category) $4,000 short-term loans (20% risk category) 50,000 one-four family mortgages (50% risk category) 10,000 commercial loans (100% risk category) 35,000 Off-balance-sheet items (in $ millions) Commercial letters of credit (20% risk category) 10,000 (1) (8 points) What are the required risk-based capital, i.e., Tier 1 (core) and total capital, respectively? Assume the core capital has to be at least 6% of the risk-weighted assets, and the total capital has to be at least 8% of total risk-weighted assets. (2) (6 points) If this bank has the following capital structure, does it satisfy the minimum capital requirements set by the regulators as in part (1)? Item (in $ millions) Notes and debentures $2000 Common Stock 600 Paid in Surplus 1000 Retained earnings 400 Loan-loss reserve 500 Question Completion Status: QUESTION 15 14 points Save Answer The following information is given for a bank: Balance-sheet items: (in $ millions) cash and equivalents (0% risk category) $4,000 short-term loans (20% risk category) 50,000 one-four family mortgages (50% risk category) 10,000 commercial loans (100% risk category) 35,000 Off-balance-sheet items (in $ millions) Commercial letters of credit (20% risk category) 10,000 (1) (8 points) What are the required risk-based capital, i.e., Tier 1 (core) and total capital, respectively? Assume the core capital has to be at least 6% of the risk-weighted assets, and the total capital has to be at least 8% of total risk-weighted assets. (2) (6 points) If this bank has the following capital structure, does it satisfy the minimum capital requirements set by the regulators as in part (1)? Item (in $ millions) Notes and debentures $2000 Common Stock 600 Paid in Surplus 1000 Retained earnings 400 Loan-loss reserve 500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts