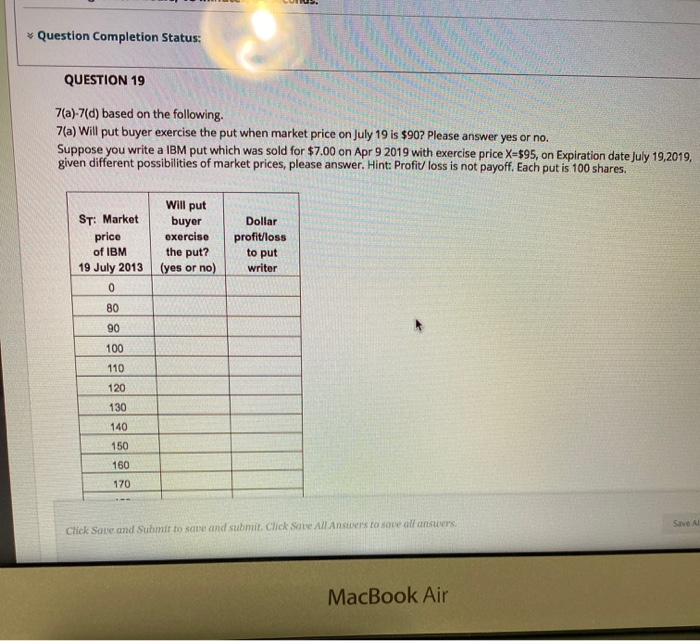

Question: Question Completion Status: QUESTION 19 7(a)-7(d) based on the following. 7(a) Will put buyer exercise the put when market price on July 19 is $90?

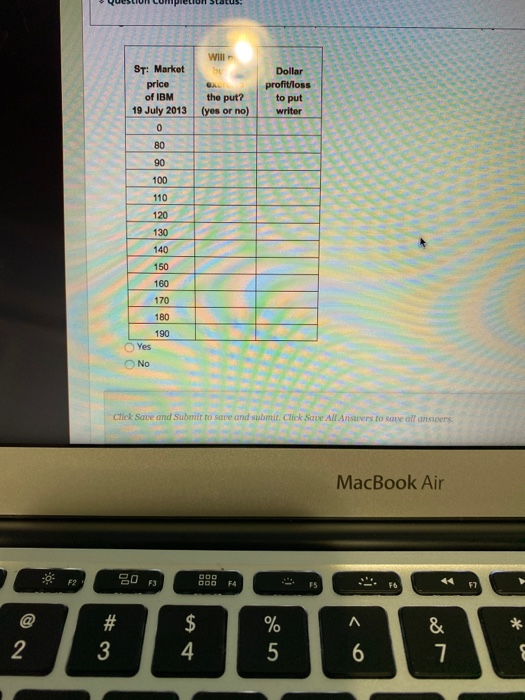

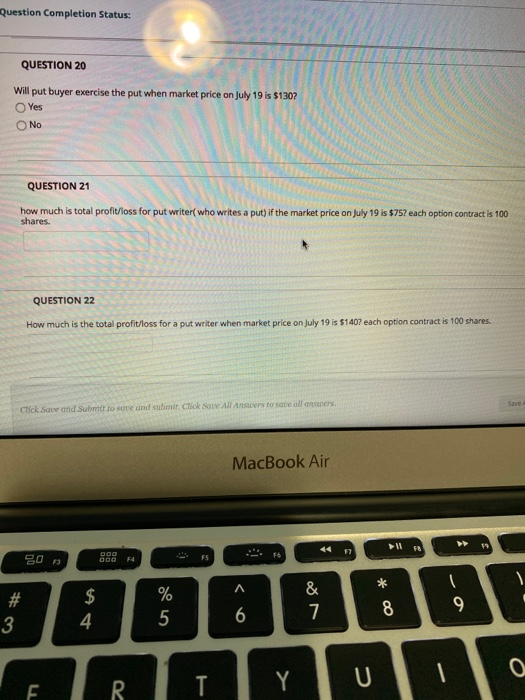

Question Completion Status: QUESTION 19 7(a)-7(d) based on the following. 7(a) Will put buyer exercise the put when market price on July 19 is $90? Please answer yes or no. Suppose you write a IBM put which was sold for $7.00 on Apr 9 2019 with exercise price X=$95, on Expiration date July 19,2019, given different possibilities of market prices, please answer. Hint: Profit/ loss is not payoff. Each put is 100 shares. ST: Market price of IBM 19 July 2013 Will put buyer exercise the put? (yes or no) Dollar profit/loss to put writer 80 90 160 170 Save Click Save and Submit to save and submit. Click Save All Answers to save all answers MacBook Air Question Completion Status: QUESTION 20 Will put buyer exercise the put when market price on July 19 is $130? Yes No QUESTION 21 how much is total profit/loss for put writer who writes a put) if the market price on July 19 is $75each option contract is 100 shares. QUESTION 22 How much is the total profit/loss for a put writer when market price on July 19 is $1407 each option contract is 100 shares. r Click Save and submit to see and submit. Click Save All A to save all ansers MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts