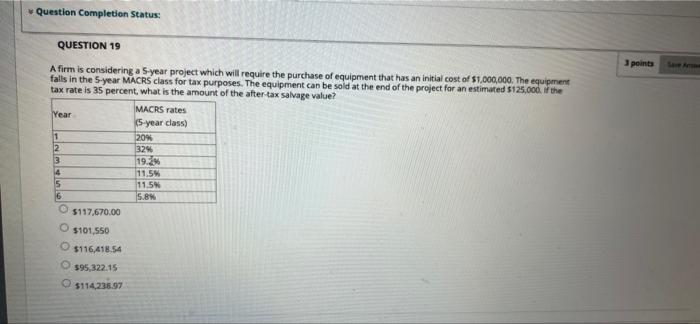

Question: Question Completion Status: QUESTION 19 point A firm is considering a 5-year project which will require the purchase of equipment that has an initial cost

Question Completion Status: QUESTION 19 point A firm is considering a 5-year project which will require the purchase of equipment that has an initial cost of $1,000,000. The equipment falls in the 5-year MACRS class for tax purposes. The equipment can be sold at the end of the project for an estimated $125,000. If the tax rate is 35 percent, what is the amount of the after tax salvage value? MACRS rates Year (5-year class) 20% 2 32% 3 19.2 16 11.5% 11.5% 5.8% $117.670.00 $101.550 $116,418.54 595,322.15 5114.235.97

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts