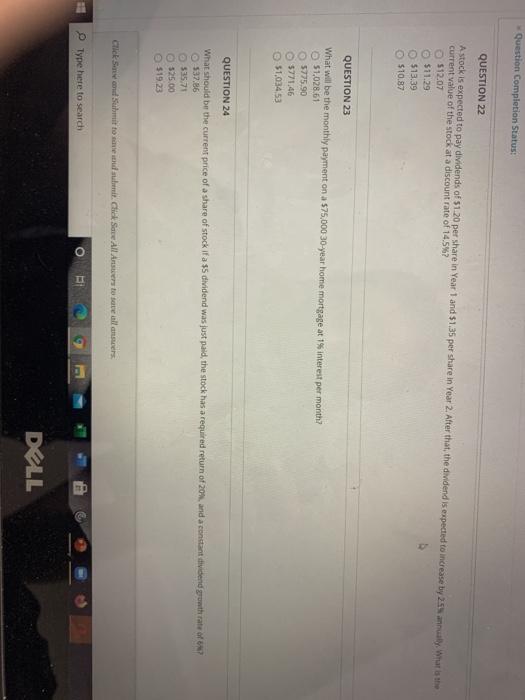

Question: Question Completion Status: QUESTION 22 A stock is expected to pay dividends of $1.20 per share in Year 1 and 51.35 per share in Year

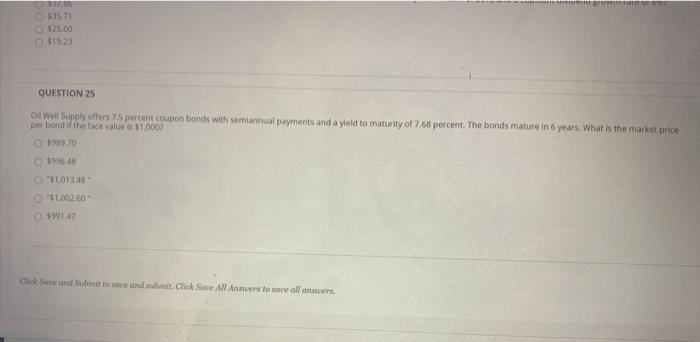

Question Completion Status: QUESTION 22 A stock is expected to pay dividends of $1.20 per share in Year 1 and 51.35 per share in Year 2. After that, the dividend is expected to increase by 25 annually. What is the current value of the stock at a discount rate of 14.5%? 512.07 $11.29 513.39 $10.87 QUESTION 23 What will be the monthly payment on a 575,000 30-year home mortgage at 1% interest per month? 51,028.61 5775.90 5771.46 51,034 53 QUESTION 24 What should be the current price of a share of stock if a 35 dividend was just paid, the stock has a required return of 20%, and a constant dividend growth rate of 537.86 53571 525.00 51923 Chek Scond Submit toe dient. Click Save All Areto save all anses Tyne here to search 1 9 E DELL WS $25.00 QUESTION 25 of Well Supply offers 75 percent coupon bonds with semiannual payments and a yield to maturity of 7.68 percent. The bonds mature in 6 years. What is the market price per bond if the face value is $1,000 598.70 199648 3101340 D51002.60 - 1.47 Chek Submit to wear it. Click Save All Amers to see all ans

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts