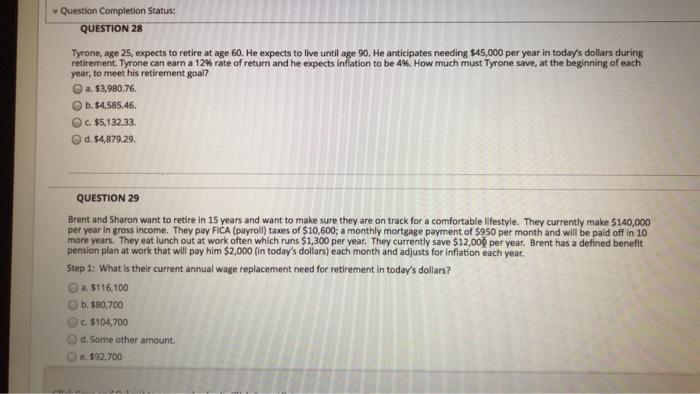

Question: Question Completion Status: QUESTION 28 Tyrone, age 25, expects to retire at age 60. He expects to live until age 90. He anticipates needing $45,000

Question Completion Status: QUESTION 28 Tyrone, age 25, expects to retire at age 60. He expects to live until age 90. He anticipates needing $45,000 per year in today's dollars during retirement. Tyrone can earn a 12% rate of return and he expects inflation to be 44. How much must Tyrone save, at the beginning of each year, to meet his retirement goal? a $3.980.76. b. $4.585.46 c. 55,132.33 d. $4.879.29. QUESTION 29 Brent and Sharon want to retire in 15 years and want to make sure they are on track for a comfortable lifestyle. They currently make $140,000 per year in gross income. They pay FICA (payroll) taxes of $10,600, a monthly mortgage payment of $950 per month and will be paid off in 10 more years. They eat lunch out at work often which runs $1,300 per year. They currently save $12,000 per year. Brent has a defined benefit pension plan at work that will pay him $2,000 (in today's dollars) each month and adjusts for inflation each year. Step 1: What is their current annual wage replacement need for retirement in today's dollars? a $116,100 b. 580.700 c. 5104,700 d. Some other amount. e. $92,700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts