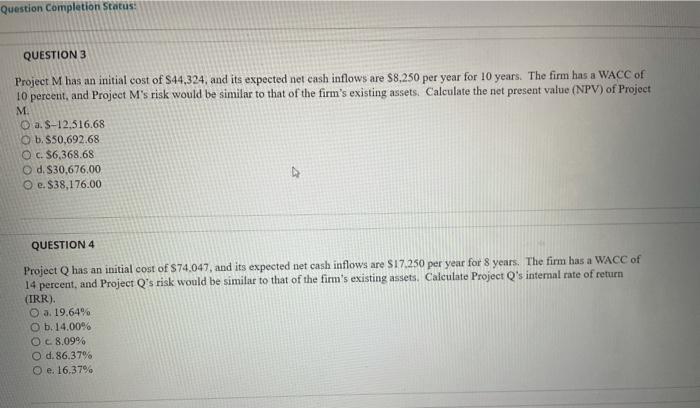

Question: Question Completion Status: QUESTION 3 Project M has an initial cost of $44,324, and its expected net cash inflows are $8,250 per year for 10

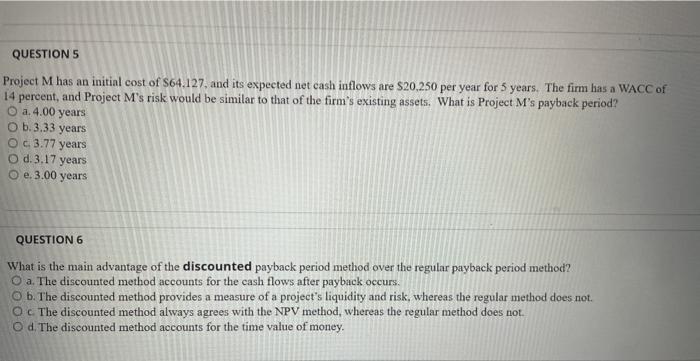

Question Completion Status: QUESTION 3 Project M has an initial cost of $44,324, and its expected net cash inflows are $8,250 per year for 10 years. The firm has a WACC of 10 percent, and Project M's risk would be similar to that of the firm's existing assets. Calculate the net present value (NPV) of Project M a. S-12.516.68 O b. S50,692.68 O c. $6,368.68 d. S30,676.00 O e.$38,176.00 QUESTION 4 Project has an initial cost of $74,047, and its expected net cash inflows are $17.250 per year for 8 years. The firm has a WACC of 14 percent, and Project Q's risk would be similar to that of the firm's existing assets. Calculate Project Q's internal rate of return (IRR). O a. 19.64% O b. 14.00% O c.8.09% O d. 86.37% O e. 16.37% QUESTIONS Project M has an initial cost of $64.127, and its expected net cash inflows are $20.250 per year for 5 years. The firm has a WACC of 14 percent, and Project M's risk would be similar to that of the firm's existing assets. What is Project M's payback period? O a.4.00 years O b.3.33 years OG 3.77 years O d.3.17 years O e. 3.00 years QUESTION 6 What is the main advantage of the discounted payback period method over the regular payback period method? O a. The discounted method accounts for the cash flows after payback occurs. O b. The discounted method provides a measure of a project's liquidity and risk, whereas the regular method does not O c The discounted method always agrees with the NPV method, whereas the regular method does not Od. The discounted method accounts for the time value of money

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts