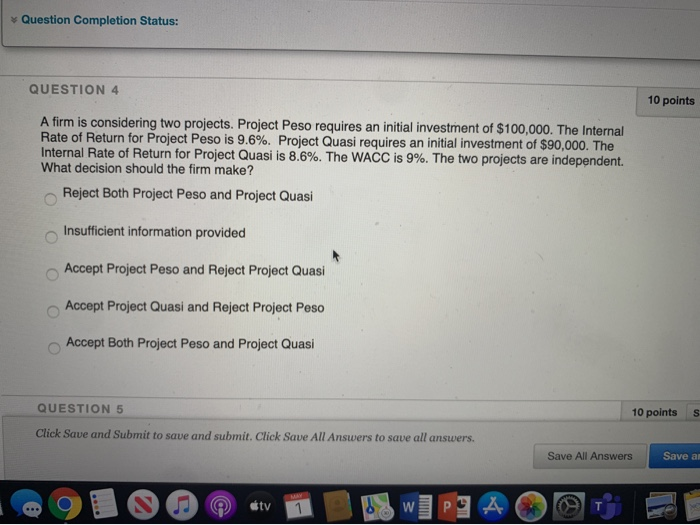

Question: Question Completion Status: QUESTION 4 10 points A firm is considering two projects. Project Peso requires an initial investment of $100,000. The Internal Rate of

Question Completion Status: QUESTION 4 10 points A firm is considering two projects. Project Peso requires an initial investment of $100,000. The Internal Rate of Return for Project Peso is 9.6%. Project Quasi requires an initial investment of $90,000. The Internal Rate of Return for Project Quasi is 8.6%. The WACC is 9%. The two projects are independent. What decision should the firm make? Reject Both Project Peso and Project Quasi Insufficient information provided Accept Project Peso and Reject Project Quasi Accept Project Quasi and Reject Project Peso Accept Both Project Peso and Project Quasi 10 points QUESTION 5 Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Save All Answers Save a Save a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts