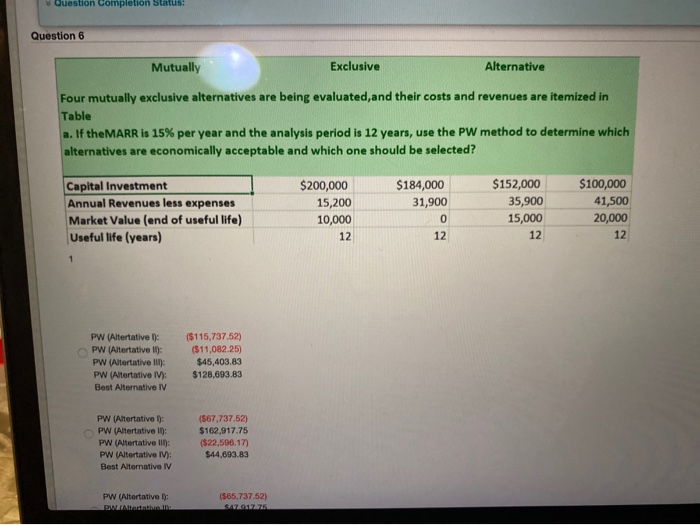

Question: Question completion Status: Question 6 Mutually Exclusive Alternative Four mutually exclusive alternatives are being evaluated, and their costs and revenues are itemized in Table a.

Question completion Status: Question 6 Mutually Exclusive Alternative Four mutually exclusive alternatives are being evaluated, and their costs and revenues are itemized in Table a. If the MARR is 15% per year and the analysis period is 12 years, use the PW method to determine which alternatives are economically acceptable and which one should be selected? Capital Investment Annual Revenues less expenses Market Value (end of useful life) Useful life (years) $200,000 15,200 10,000 12 $184,000 31,900 0 12 $152,000 35,900 15,000 12 $100,000 41,500 20,000 12 1 PW (Alterative 1): PW (Altertative 10: PW (Altertative II) PW (Alterative IV): Best Alternative IV ($115,737.52) ($11,082.25) $45,403.83 $128,693.83 PW (Altertative : PW (Alterative 10: PW (Altertative III: PW (Altertative : Best Alternative IV ($67,737.52) $162,917.75 ($22,596.17) $44,693.83 PW (Alterative : Edit ($65,737.52) SZ

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts