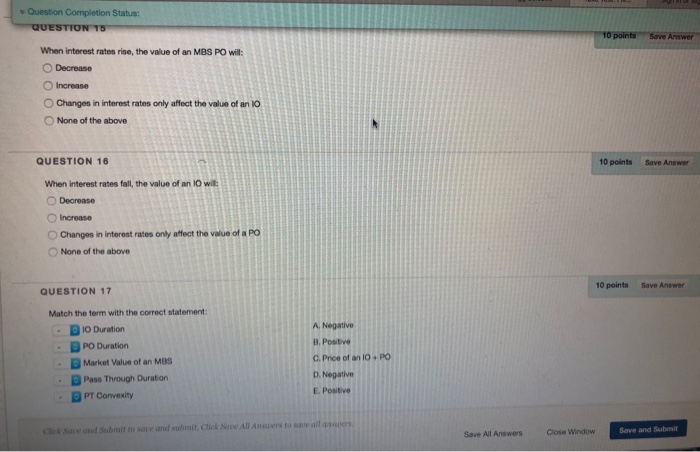

Question: Question Completion Status: QUESTION T5 10 points Save Answer When Interest rates rise, the value of an MBS PO will: Decrease Increase Changes in interest

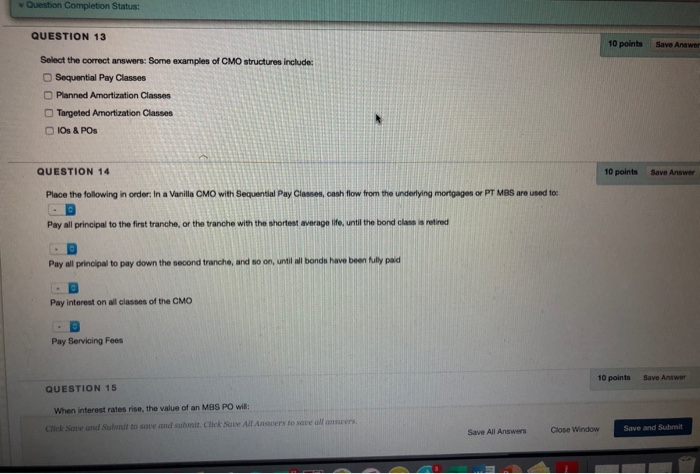

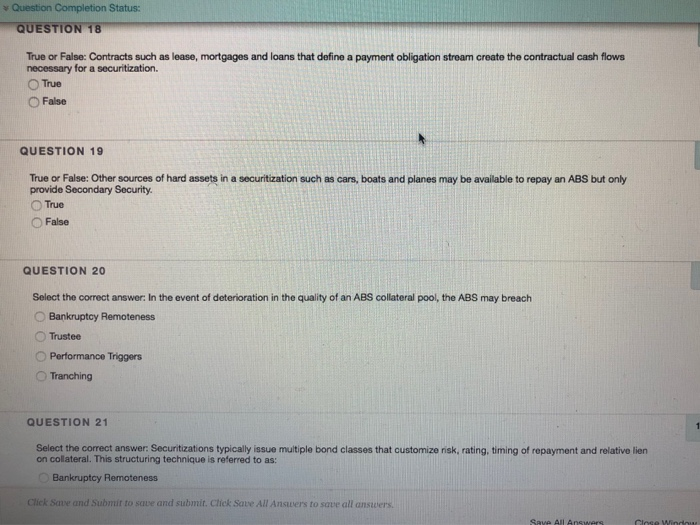

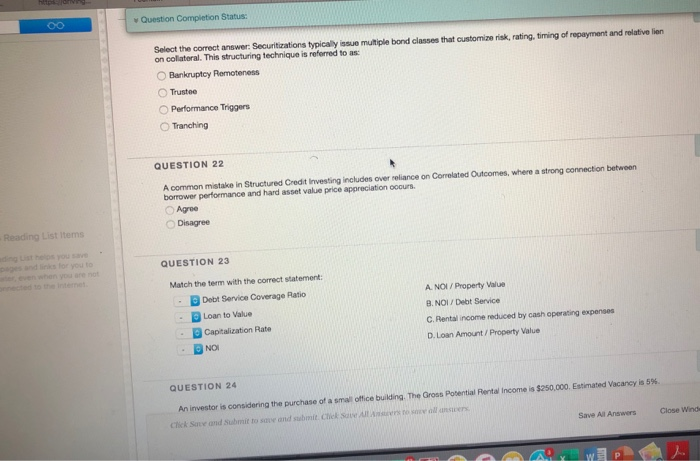

Question Completion Status: QUESTION T5 10 points Save Answer When Interest rates rise, the value of an MBS PO will: Decrease Increase Changes in interest rates only affect the value of an 10 None of the above QUESTION 16 10 points Save Answer When interest rates fall, the value of an 10 wil: Decrease Increase Changes in interest rates only affect the value of a PO None of the above 10 points QUESTION 17 10 pohto save Save Answer A. Negative B Positive Match the term with the correct statement: - D10 Duration DPO Duration - Market Value of an MBS D Pass Through Duration DPT Convexity G. Price of an io. PO D. Negative E Positive Chek Solar S ulton and submit Click Save All An tonella Save All Answers Close Window Save and Submit Question Completion Status: QUESTION 13 10 points Save Answer Select the correct answers: Some examples of CMO structures include: Sequential Pay Classes Planned Amortization Classes Targeted Amortization Classes IOS & POS QUESTION 14 10 points Save Answer Place the following in order: In a Vanilla CMO with Sequential Pay Classes, cash flow from the underlying mortgages or PT MBS are used to - C Pay all principal to the first tranche, or the tranche with the shortest average life until the bond la retired Pay all principal to pay down the second tranche, and so on, until bonds have been ly paid Pay interest on all classes of the CMO Pay Servicing Fees 10 points Save Answer QUESTION 15 When interest rates rise, the value of an MBS PO will: Click Save and Suborult to save and submit Chek Save All Answers to save all ansers Save All Answers Close Window Save and Submit Question Completion Status: QUESTION 18 True or False: Contracts such as lease, mortgages and loans that define a payment obligation stream create the contractual cash flows necessary for a securitization. True False QUESTION 19 True or False: Other sources of hard assets in a securitization such as cars, boats and planes may be available to repay an ABS but only provide Secondary Security. True False QUESTION 20 Select the correct answer: In the event of deterioration in the quality of an ABS collateral pool, the ABS may breach Bankruptcy Remoteness Trustee Performance Triggers Tranching QUESTION 21 Select the correct answer: Securitizations typically issue multiple bond classes that customize nisk, rating, timing of repayment and relative lien on collateral. This structuring technique is referred to as: Bankruptcy Remoteness Click Save and Submit to save and submit. Click Save All Answers to save all answers Close Win Question Completion Status: Select the correct answer: Securitirations typically issue multiple bond classes that customize risk, rating, timing of repayment and relative lien on collateral. This structuring technique is referred to as Bankruptcy Remoteness Trustee Performance Triggers Tranching QUESTION 22 A common mistake in Structured Credit Investing includes over reliance on Correlated Outcomes, where a strong connection between borrower performance and hard asset value price appreciation occurs. Agree Disagree Reading List Items d QUESTION 23 o you to nyot Match the term with the correct statement: Debt Service Coverage Ratio Loan to Value Capitalization Rate NOI A NOL/Property Value B. NOI/Debt Service C. Rental income reduced by cash operating expenses D.Loan Amount Property Value QUESTION 24 An investor is considering the purchase of a small office building. The Gros Potential Rental income is $250,000. Estimated Vacancy is Chek Sore and submit to save and submit Chek Sowe t o oli Save Al Answers Close Wind

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts