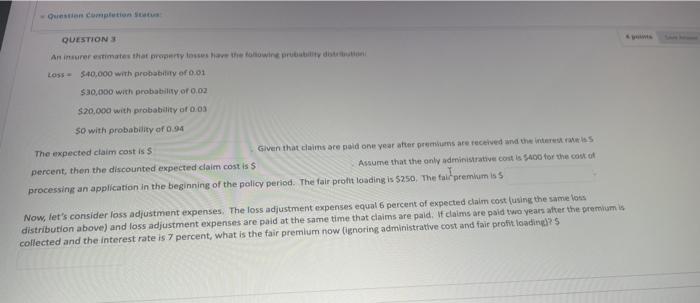

Question: Question completion status QUESTIONS An insurer extimates that property to have the following but it LOSS - $40,000 with probability of 0.01 $30,000 with probability

Question completion status QUESTIONS An insurer extimates that property to have the following but it LOSS - $40,000 with probability of 0.01 $30,000 with probability or 0.02 $20,000 with probability of 0.03 So with probability of 0.94 The expected claim cost is s Given that claims are paid one year after premiums are received the interes percent, then the discounted expected claim cost iss Assume that the only administrative cost is $400 for the cost of processing an application in the beginning of the policy period. The falr profit loading is $250, The tu premium in Now, let's consider loss adjustment expenses. The loss adjustment expenses equal 6 percent of expected claim cost using the same fons distribution above) and loss adjustment expenses are paid at the same time that claims are paid. If claims are paid two years after the premium is collected and the interest rate is 7 percent, what is the fair premium now ignoring administrative cost and fair profit loading

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts