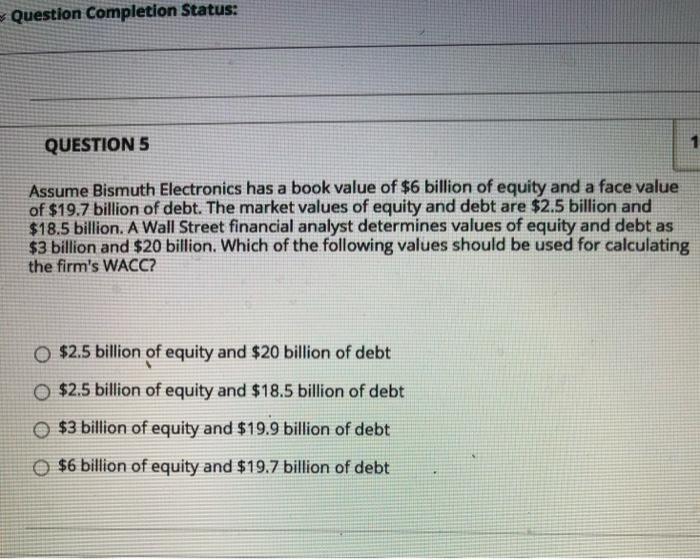

Question: Question Completion Status: QUESTIONS Assume Bismuth Electronics has a book value of $6 billion of equity and a face value of $19.7 billion of debt.

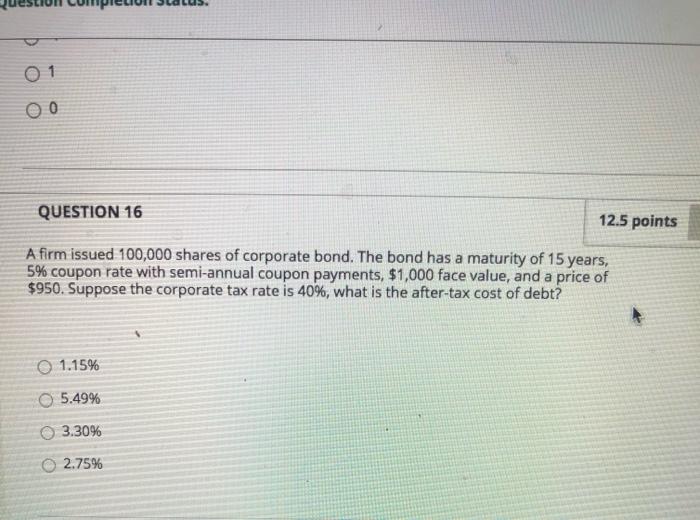

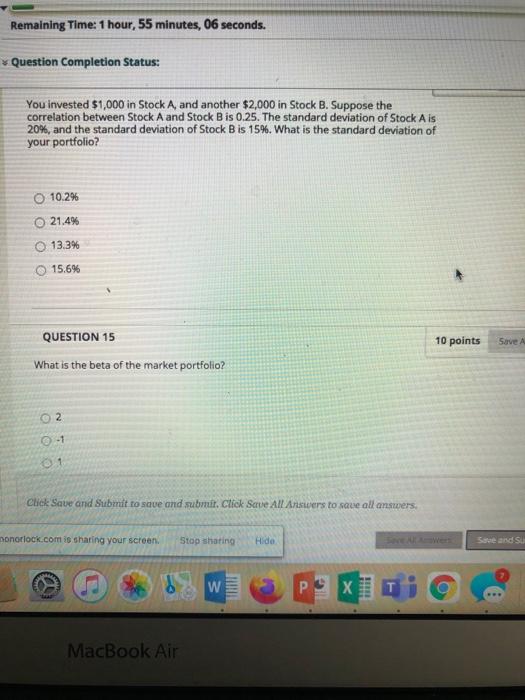

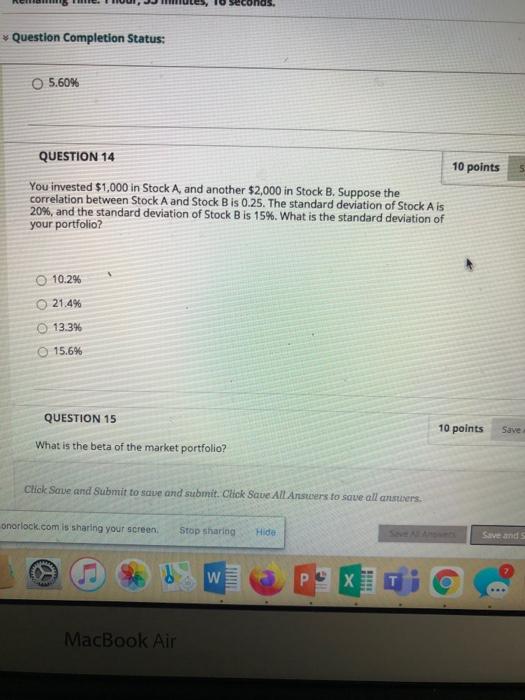

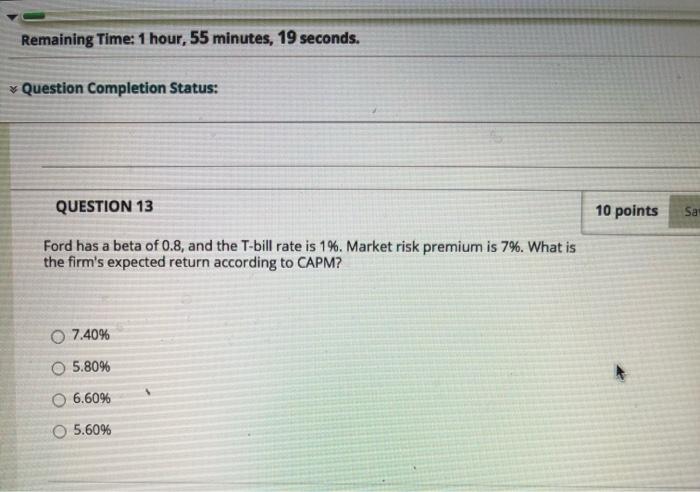

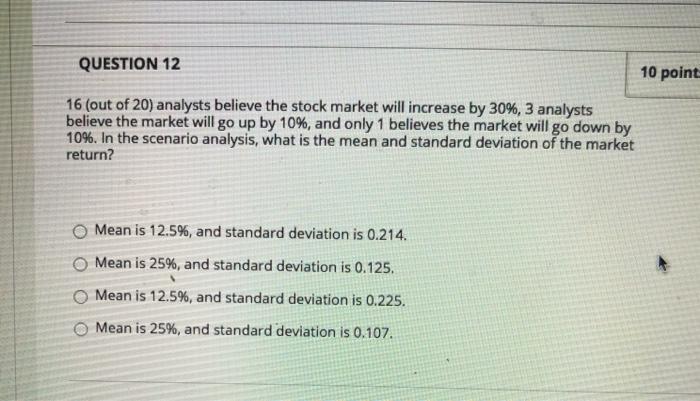

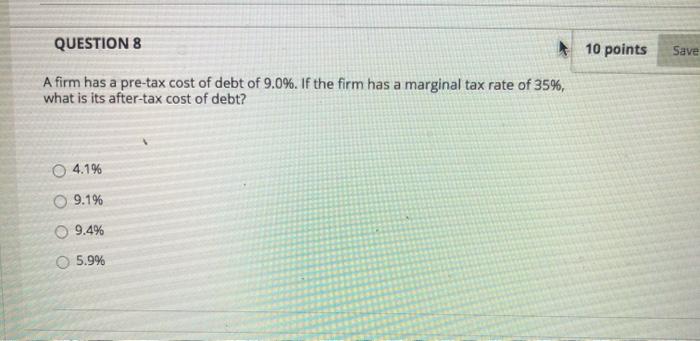

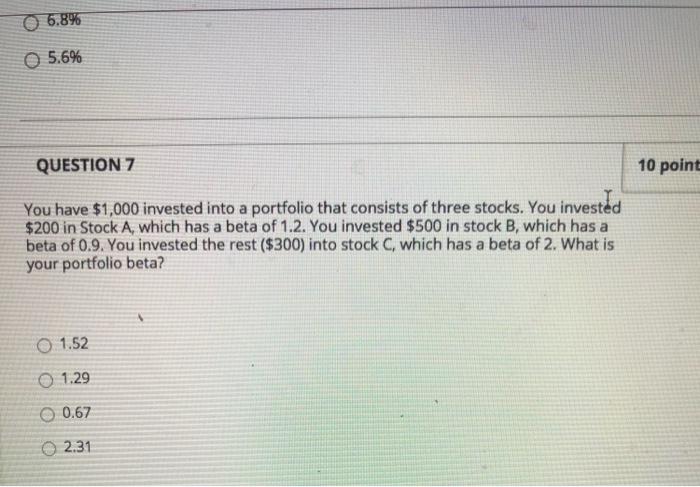

Question Completion Status: QUESTIONS Assume Bismuth Electronics has a book value of $6 billion of equity and a face value of $19.7 billion of debt. The market values of equity and debt are $2.5 billion and $18.5 billion. A Wall Street financial analyst determines values of equity and debt as $3 billion and $20 billion. Which of the following values should be used for calculating the firm's WACC? O $2.5 billion of equity and $20 billion of debt O $2.5 billion of equity and $18.5 billion of debt $3 billion of equity and $19.9 billion of debt $6 billion of equity and $19.7 billion of debt 00 QUESTION 16 12.5 points A firm issued 100,000 shares of corporate bond. The bond has a maturity of 15 years, 5% coupon rate with semi-annual coupon payments, $1,000 face value, and a price of $950. Suppose the corporate tax rate is 40%, what is the after-tax cost of debt? O 1.15% O 5.49% 3.30% 0 2.75% Remaining Time: 1 hour, 55 minutes, 06 seconds. Question Completion Status: You invested $1,000 in Stock A, and another $2,000 in Stock B. Suppose the correlation between Stock A and Stock Bis 0.25. The standard deviation of Stock Ais 20%, and the standard deviation of Stock B is 1596. What is the standard deviation of your portfolio? O 10.2% 21.4% 13.3% 15.6% QUESTION 15 10 points Save A What is the beta of the market portfolio? 2 1 Click Save and Submit to save and submit. Click Save All Answers to save all answers, nonolock.comis sharing your screen Stop sharing Hide See and su W X HH MacBook Air 10 has. * Question Completion Status: 5.60% 10 points QUESTION 14 You invested $1,000 in Stock A, and another $2,000 in Stock B. Suppose the correlation between Stock A and Stock Bis 0.25. The standard deviation of Stock Ais 20%, and the standard deviation of Stock B is 15%. What is the standard deviation of your portfolio? O 10.2% 21.4% 13.3% 15.6% QUESTION 15 10 points Suve What is the beta of the market portfolio? Click Save and Submit to save and submit. Click Save All Ansters to save all answers. onorlock.com is sharing your screen Stop sharing Hide Save and W P HU MacBook Air Remaining Time: 1 hour, 55 minutes, 19 seconds. Question Completion Status: QUESTION 13 10 points Sa Ford has a beta of 0.8, and the T-bill rate is 1%. Market risk premium is 7%. What is the firm's expected return according to CAPM? 7.40% O 5.80% 6.60% 5.60% QUESTION 12 10 point 16 (out of 20) analysts believe the stock market will increase by 30%, 3 analysts believe the market will go up by 10%, and only 1 believes the market will go down by 10%. In the scenario analysis, what is the mean and standard deviation of the market return? Mean is 12.5%, and standard deviation is 0.214. Mean is 25%, and standard deviation is 0.125. Mean is 12.5%, and standard deviation is 0.225. Mean is 25%, and standard deviation is 0.107. QUESTION 8 10 points Save A firm has a pre-tax cost of debt of 9.0%. If the firm has a marginal tax rate of 35%, what is its after-tax cost of debt? 4.1% 9.1% 9.4% 5.9% 6.8% 0 5.6% 10 point QUESTION 7 You have $1,000 invested into a portfolio that consists of three stocks. You invested $200 in Stock A, which has a beta of 1.2. You invested $500 in stock B, which has a beta of 0.9. You invested the rest ($300) into stock C, which has a beta of 2. What is your portfolio beta? O 1.52 01.29 O 0.67 2.31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts