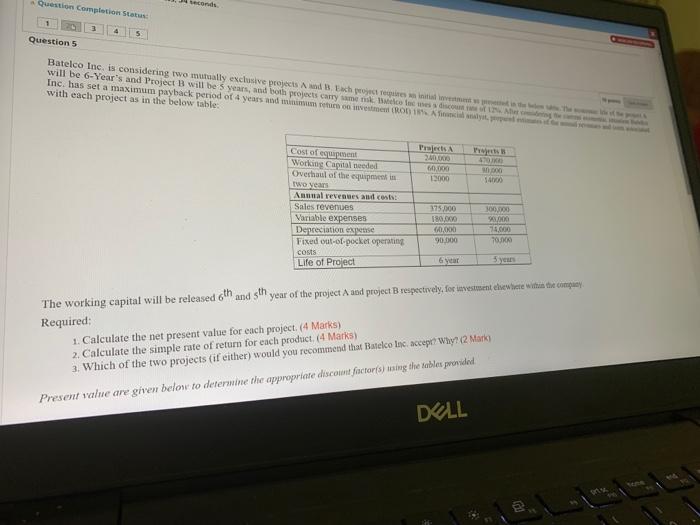

Question: Question Completion Status: seconds 3 5 Question 5 Batelco Inc. is considering two mutually exclusive projects A and B. Each project requires an initial investments

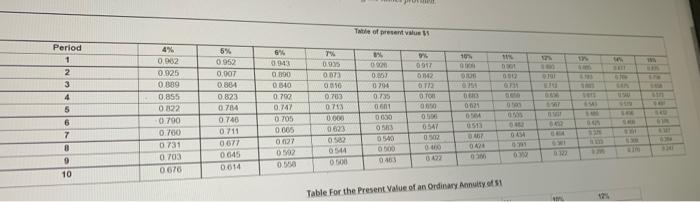

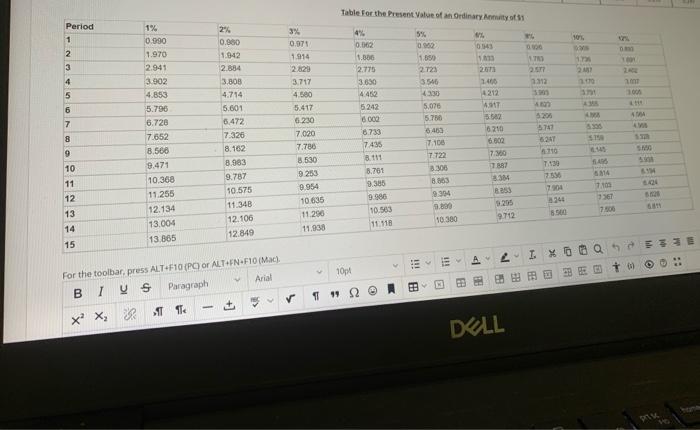

Question Completion Status: seconds 3 5 Question 5 Batelco Inc. is considering two mutually exclusive projects A and B. Each project requires an initial investments in the b will be 6-Year's and Project B will be 5 years, and both projects carry same risk. Batelco Inc uses a discount rate of 12% Abet coming the s Inc. has set a maximum payback period of 4 years and minimum return on investment (ROD) 18% A financial analyst, perpent times of t with each project as in the below table: Projects A Projects B 240,000 Cost of equipment Working Capital needed Overhaul of the equipment in 470K 60,000 90,000 12000 14000 two years Annual revenues and costs:- Sales revenues 375,000 300,000 Variable expenses 180,000 90,000 Depreciation expense 60,000 74,000 Fixed out-of-pocket operating 90,000 70,000 costs Life of Project 6 year 5 years sth year of the project A and project B respectively, for investment elsewhere within the company The working capital will be released 6th and Required: ork 1. Calculate the net present value for each project. (4 Marks) 2. Calculate the simple rate of return for each product. (4 Marks) 3. Which of the two projects (if either) would you recommend that Batelco Inc. accept? Why? (2 Mark) Present value are given below to determine the appropriate discount factor(s) using the tables provided DELL Period 1 2 3 4 5 9 7 8 6 10 4% 0,962 0,925 0.889 0.855 0.822 0.700 0.760 0.731 0.703 0676 5% 0.952 0.007 0.864 0.823 0.784 0.746 0711 0677 0645 0614 6% 0.943 0600 0.840 0.792 0.747 0.705 0.005 0627 0502 0.558 Table of present value $5 7% 8% 9% 0.935 0900 0917 0873 0.857 03142 0510 0794 0772 0703 0.735 0.700 06813 0.713 0601 0850 0621 0630 0.000 0504 0.500 6547 0583 0513 0623 0467 0502 0540 0.582 0500 0400 0544 0424 0300 0422 0.500 0.463 Table For the Present Value of an Ordinary Annuity of $1 10% 9000 BONG 0751 11% 1000 0902 0731 0590 0.50 6452 0454 6w 17% 1000 9191 EFU HAD 6412 IKS am 125 Kam 4.M 6543 6.45 5 1940 9519 HER 5.30 1 VAL 3645 5TH www ww MLS Period 1 1% 2% 0.990 0.860 1.970 1.942 2.941 2.884 3.902 3.808 4.853 4.714 5.796 5.601 6.728 6.472 8 7.652 7:326 9 8.566 8.162 10 9.471 8.983 11 10.368 9.787 12 11.255 10.575 11.348 12.134 13 12.106 13.004 14 12.849 13.865 15 For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). Arial B I VS Paragraph 1 Te Be X X -N567 2 3 4 3% 0.971 1.914 2.829 3.717 4.580 5.417 6.230 7,020 7.786 8.530 9.253 9.954 10.635 11.296 11.9387 Table For the Present Value of an Ordinary Annuity of 311 4% 5% 4% NG 0.062 0.952 1.886 1.850 2.775 2.723 3.630 3.546 4.452 4.330 5242 5,076 6.002 5.756 6.733 6463 7.435 8.111 8.761 9.385 9.986 10.563 11.118 10pt 17 11 52 7,108 7.722 8.306 9.304 9.800 10.380 EY V Ev BBY B 0543 1833 2673 2.400 4212 4317 488 A 6210 6.602 7.360 7.887 8.384 8.853 9.295 9.712 DELL 6 10000 1.783 2.577 3312 3.903 4820 5206 5747 6247 6310 10% 10:00 E 1.796 2487 13.170 371 AM AMA 5.335 5750 1405 6814 7.139 7.536 7.904 244 8.500 IXO Q 7.105 7367 7.506 0% 0800 100% am 3.000 AM 4504 5.400 6.30 6811 5 CEZ BE@ :: Sont

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts