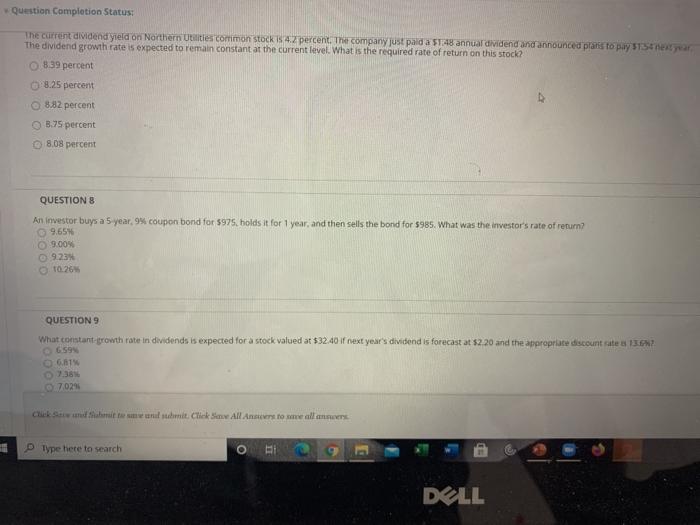

Question: Question Completion Status: The current dividend yield on Northern Utilities common stock is 42 percent. The company just paida 5748 annua dividend and announced plans

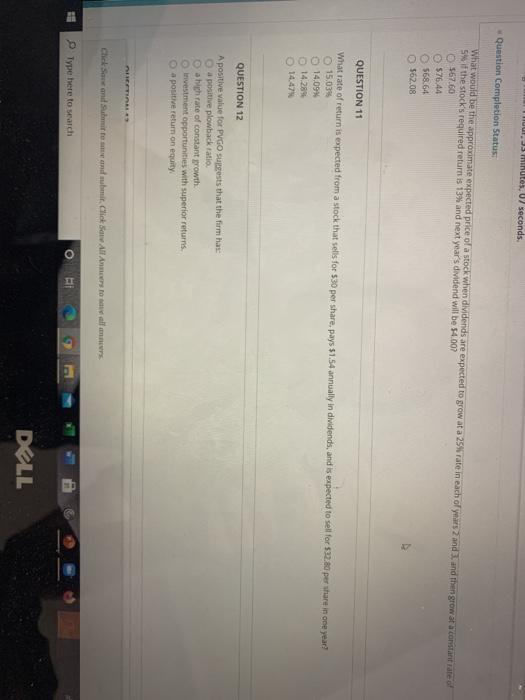

Question Completion Status: The current dividend yield on Northern Utilities common stock is 42 percent. The company just paida 5748 annua dividend and announced plans to pay 31 Setar The dividend growth rate is expected to remain constant at the current level. What is the required rate of return on this stock? 839 percent 8.25 percent 8.82 percent 8.75 percent 8.08 percent QUESTIONS An investor buys a 5 year. 9 coupon bond for $975. holds it for 1 year, and then sells the bond for $985. What was the investor's rate of return? 9.65 9.00% 9.23 10.26 QUESTION 9 What constant growth rate in dividends is expected for a stock valued at $32.40 if next year's dividend is forecast at $2.20 and the appropriate discount rate 13? 681 0 70296 Chikawe utan smittel All Anse to me all answer Type here to search FI DULL Tul, 33 minutes. U7 seconds Question Completion Status: What would be the approximate expected price of a stock when dividends are expected to grow at a 25% rate in each of years 2 and 3 and then grow at a constant rate of Swif the stock's required return is 13% and next year's dividend will be 54.007 567.60 576.44 568.64 362,08 QUESTION 11 What rate of return is expected from a stock that sells for $30 per share, pays $1.54 annually in dividends, and is expected to sell for $22.80 per share in one year! 15.034 14.09% 14.28 14.47 QUESTION 12 A positive value for PVGO sugests that the firm has a positive plowback ratio hich rate of constant growth Investment opportunities with superior returns a positive return on equity TAL Click Save and Submitted and whit. Click Save All Antall ans. Type here to search II DELL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts