Question: Question Completion Status: you earr a pront uurm me rast Uutur years All the answers places the burden of proof on the IRS QUESTION 7

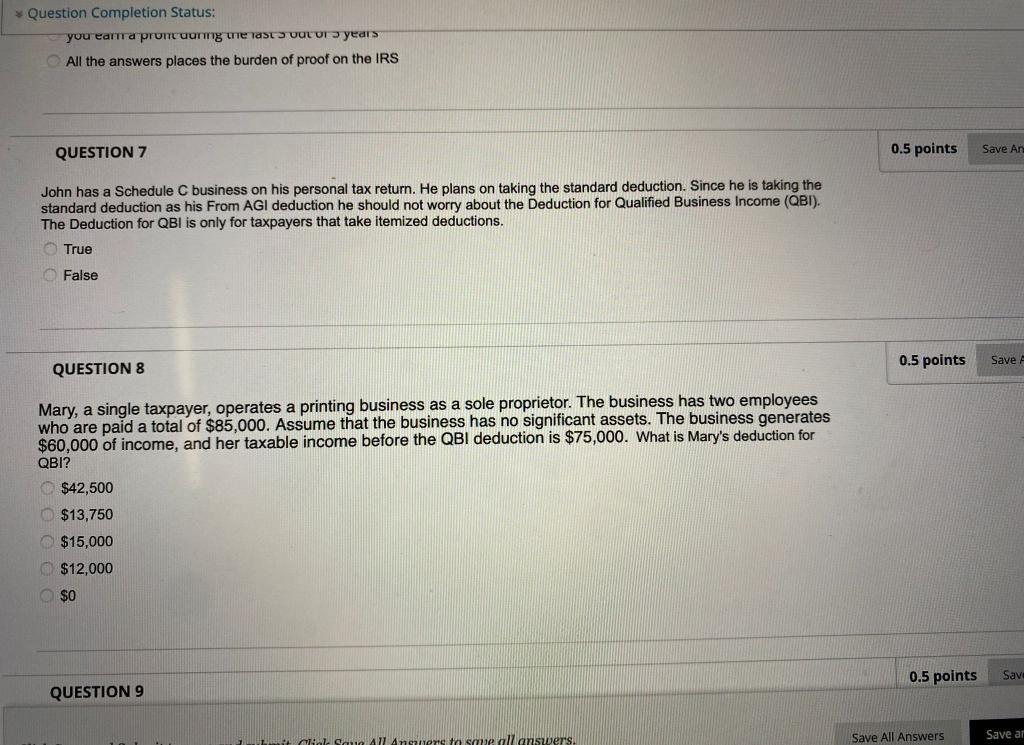

Question Completion Status: you earr a pront uurm me rast Uutur years All the answers places the burden of proof on the IRS QUESTION 7 0.5 points Save An John has a Schedule C business on his personal tax return. He plans on taking the standard deduction. Since he is taking the standard deduction as his From AGI deduction he should not worry about the Deduction for Qualified Business Income (QBI). The Deduction for QBI is only for taxpayers that take itemized deductions. True False Save A QUESTION 8 0.5 points Mary, a single taxpayer, operates a printing business as a sole proprietor. The business has two employees who are paid a total of $85,000. Assume that the business has no significant assets. The business generates $60,000 of income, and her taxable income before the QBI deduction is $75,000. What is Mary's deduction for $42,500 $13,750 $15,000 $12,000 $0 0.5 points Save QUESTION 9 Clinl Small Answers to sme nll answers Save All Answers Save ar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts