Question: Question Consider a growth model augmented with nonrenewable resources (like in Module 7). The production function is given by: Y = BKXEL--- Let the capital

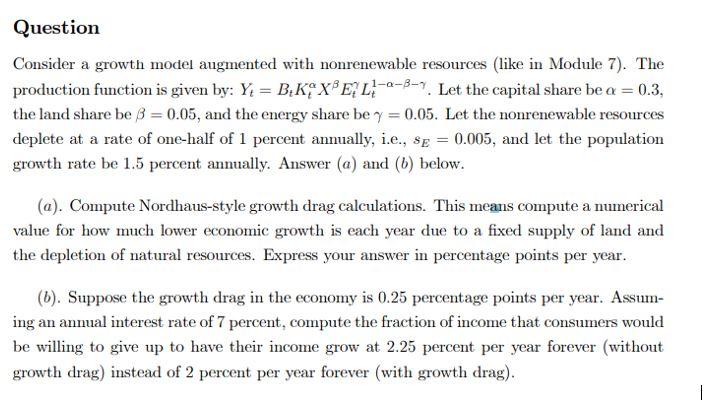

Question Consider a growth model augmented with nonrenewable resources (like in Module 7). The production function is given by: Y = BKXEL--- Let the capital share be a = 0.3, the land share be 3 = 0.05, and the energy share be y = 0.05. Let the nonrenewable resources deplete at a rate of one-half of 1 percent annually, i.e., sE = 0.005, and let the population growth rate be 1.5 percent annually. Answer (a) and (b) below. (a). Compute Nordhaus-style growth drag calculations. This means compute a numerical value for how much lower economic growth is each year due to a fixed supply of land and the depletion of natural resources. Express your answer in percentage points per year. (b). Suppose the growth drag in the economy is 0.25 percentage points per year. Assum- ing an annual interest rate of 7 percent, compute the fraction of income that consumers would be willing to give up to have their income grow at 2.25 percent per year forever (without growth drag) instead of 2 percent per year forever (with growth drag). 1 Question Consider a growth model augmented with nonrenewable resources (like in Module 7). The production function is given by: Y = BKXEL--- Let the capital share be a = 0.3, the land share be 3 = 0.05, and the energy share be y = 0.05. Let the nonrenewable resources deplete at a rate of one-half of 1 percent annually, i.e., sE = 0.005, and let the population growth rate be 1.5 percent annually. Answer (a) and (b) below. (a). Compute Nordhaus-style growth drag calculations. This means compute a numerical value for how much lower economic growth is each year due to a fixed supply of land and the depletion of natural resources. Express your answer in percentage points per year. (b). Suppose the growth drag in the economy is 0.25 percentage points per year. Assum- ing an annual interest rate of 7 percent, compute the fraction of income that consumers would be willing to give up to have their income grow at 2.25 percent per year forever (without growth drag) instead of 2 percent per year forever (with growth drag). 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts