Question: Question: Consider again Problem 2 and discuss it in the context of real options. Are there real options and what are they worth? You are

Question: Consider again Problem 2 and discuss it in the context of real options. Are there real options and what are they worth?

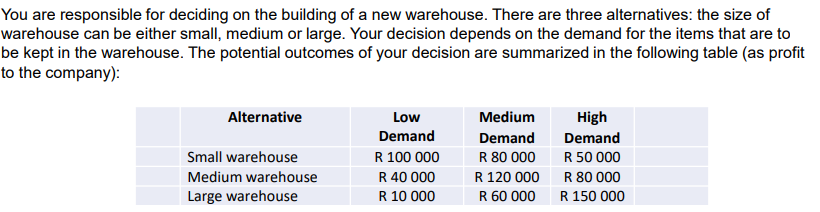

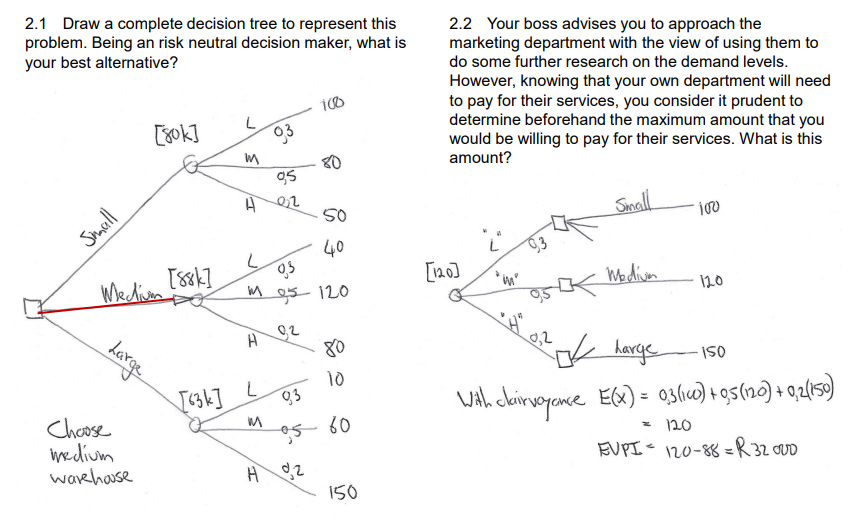

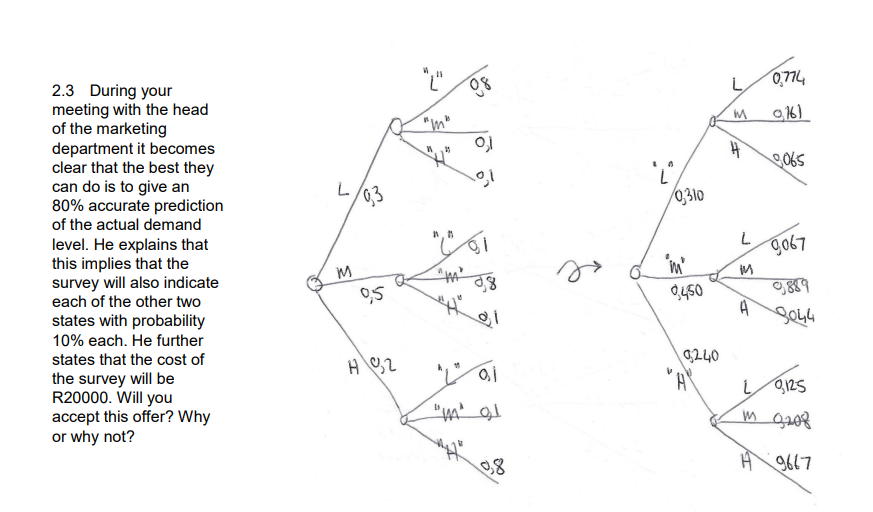

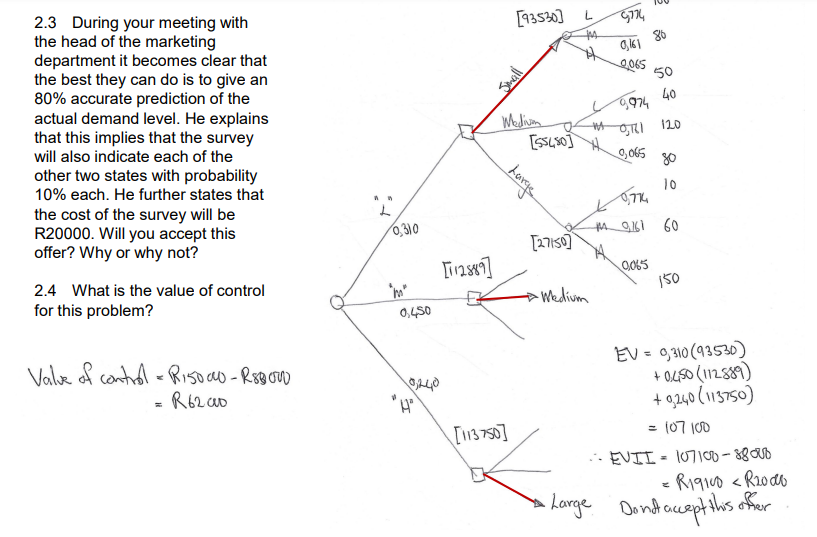

You are responsible for deciding on the building of a new warehouse. There are three alternatives: the size of warehouse can be either small, medium or large. Your decision depends on the demand for the items that are to be kept in the warehouse. The potential outcomes of your decision are summarized in the following table (as profit to the company): 2.1 Draw a complete decision tree to represent this problem. Being an risk neutral decision maker, what is your best alternative? 2.2 Your boss advises you to approach the marketing department with the view of using them to do some further research on the demand levels. However, knowing that your own department will need to pay for their services, you consider it prudent to determine beforehand the maximum amount that you would be willing to pay for their services. What is this amount? With clairvoyance E(x)=0,3(100)+0,5(120)+0,2(150) =120 EVPI =12088=R32000 2.3 During your meeting with the head of the marketing department it becomes clear that the best they can do is to give an 80% accurate prediction of the actual demand level. He explains that this implies that the survey will also indicate each of the other two states with probability 10% each. He further states that the cost of the survey will be R20000. Will you accept this offer? Why or why not? 2.3 During your meeting with the head of the marketing department it becomes clear that the best they can do is to give an 80% accurate prediction of the actual demand level. He explains that this implies that the survey will also indicate each of the other two states with probability 10% each. He further states that the cost of the survey will be R20000. Will you accept this offer? Why or why not? 2.4 What is the value of control for this problem? Valueofcontrd=R15000R80000=R62000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts