Question: Question: Consider the Bertrand duopoly model we discussed in class. Suppose that the market demand function is given by 62(1)) 2 max{100 p, 0}. For

Question:

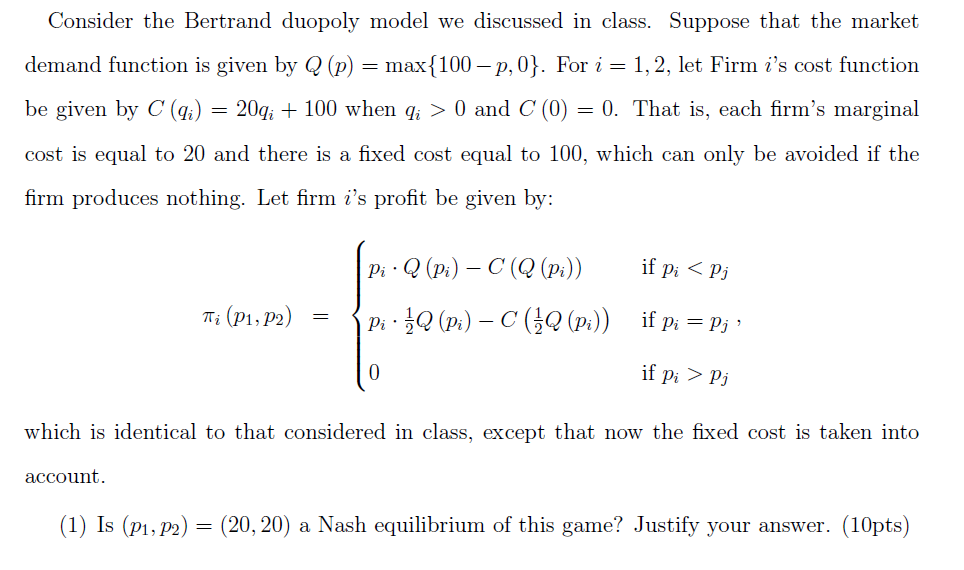

Consider the Bertrand duopoly model we discussed in class. Suppose that the market demand function is given by 62(1)) 2 max{100 p, 0}. For 3' = 1, 2, let Firm i's cost function be given by C (95,) = 20% + 100 when q, > U and C (U) = 0. That is, each rm's marginal cost is equal to 20 and there is a xed cost equal to 100, which can only be avoided if the rm produces nothing. Let rm i's prot be given by: prQ(Paf)C(Q{Pill ifpi p3: which is identical to that considered in class, except that now the xed cost is taken into account . (1) Is (31,392) 2 (20, 20) a Nash equilibrium of this game? Justify your answer. (lUpts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts