Question: Question Content Area Exercise 9-16 (Algorithmic) (LO. 5) Rogers Co., a U.S. multinational corporation, owns 100% of Orange Co., a CFC. Orange Co. has net

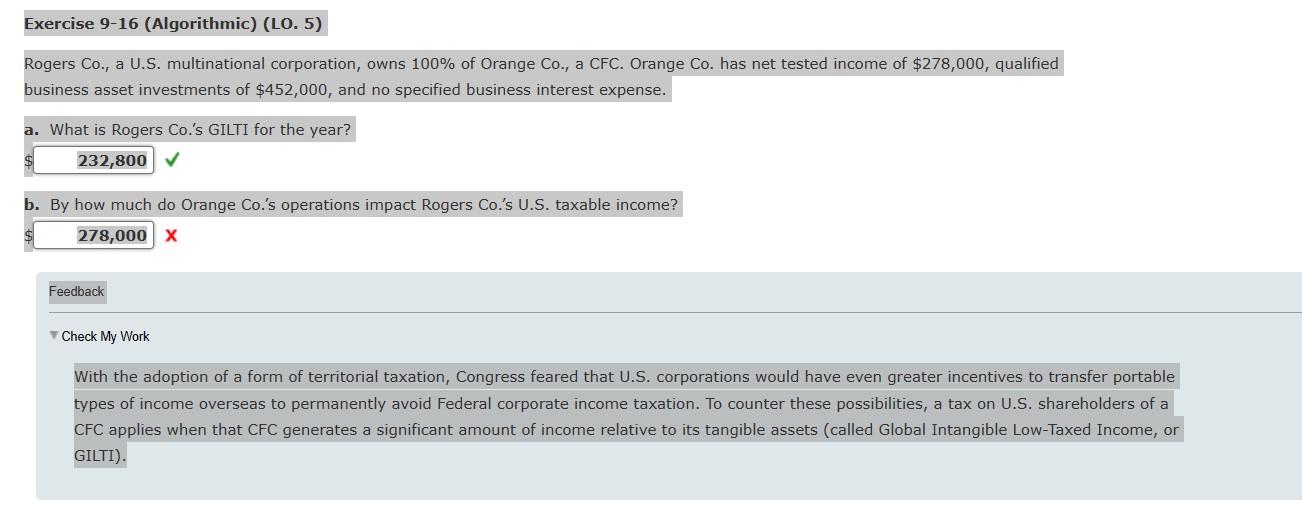

Question Content Area Exercise 9-16 (Algorithmic) (LO. 5) Rogers Co., a U.S. multinational corporation, owns 100% of Orange Co., a CFC. Orange Co. has net tested income of $278,000, qualified business asset investments of $452,000, and no specified business interest expense. a. What is Rogers Co.s GILTI for the year? $fill in the blank 1 232,800 b. By how much do Orange Co.s operations impact Rogers Co.s U.S. taxable income? $fill in the blank 2 278,000 Feedback Area Feedback With the adoption of a form of territorial taxation, Congress feared that U.S. corporations would have even greater incentives to transfer portable types of income overseas to permanently avoid Federal corporate income taxation. To counter these possibilities, a tax on U.S. shareholders of a CFC applies when that CFC generates a significant amount of income relative to its tangible assets (called Global Intangible Low-Taxed Income, or GILTI).

Question Content Area Exercise 9-16 (Algorithmic) (LO. 5) Rogers Co., a U.S. multinational corporation, owns 100% of Orange Co., a CFC. Orange Co. has net tested income of $278,000, qualified business asset investments of $452,000, and no specified business interest expense. a. What is Rogers Co.s GILTI for the year? $fill in the blank 1 232,800 b. By how much do Orange Co.s operations impact Rogers Co.s U.S. taxable income? $fill in the blank 2 278,000 Feedback Area Feedback With the adoption of a form of territorial taxation, Congress feared that U.S. corporations would have even greater incentives to transfer portable types of income overseas to permanently avoid Federal corporate income taxation. To counter these possibilities, a tax on U.S. shareholders of a CFC applies when that CFC generates a significant amount of income relative to its tangible assets (called Global Intangible Low-Taxed Income, or GILTI).

Rogers Co., a U.S. multinational corporation, owns 100% of Orange Co., a CFC. Orange Co. has net tested income of $278,000, qualified business asset investments of $452,000, and no specified business interest expense. a. What is Rogers Co.'s GILTI for the year? b. By how much do Orange Co.'s operations impact Rogers Co.'s U.S. taxable income? x Feedback Theck My Work With the adoption of a form of territorial taxation, Congress feared that U.S. corporations would have even greater incentives to transfer portable types of income overseas to permanently avoid Federal corporate income taxation. To counter these possibilities, a tax on U.S. shareholders of a CFC applies when that CFC generates a significant amount of income relative to its tangible assets (called Global Intangible Low-Taxed Income, or GILTI)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts