Question: Question content area Part 1 Howard Weiss, Inc., is considering building a sensitive new radiation scanning device. His managers believe that there is a probability

Question content area

Part

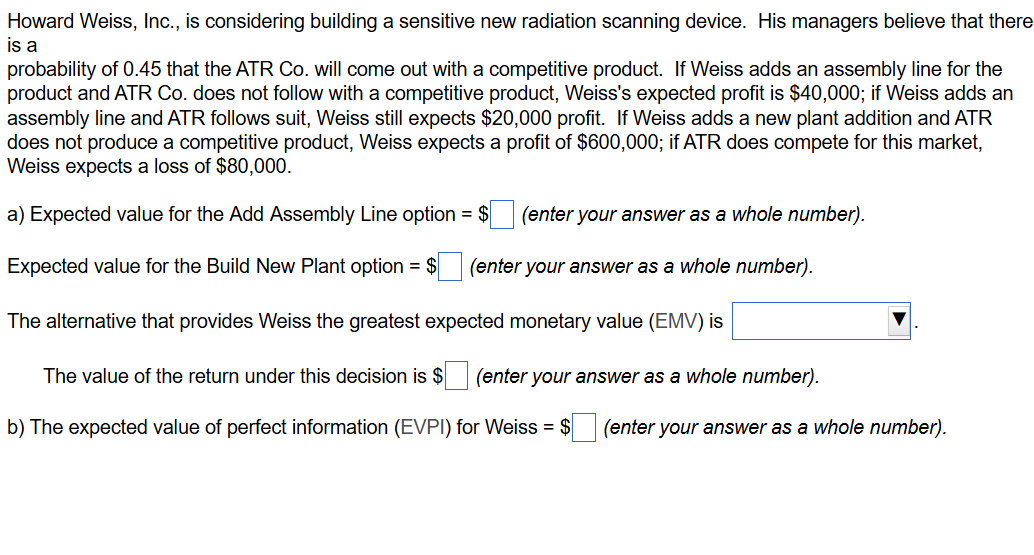

Howard Weiss, Inc., is considering building a sensitive new radiation scanning device. His managers believe that there is a

probability of

that the ATR Co will come out with a competitive product. If Weiss adds an assembly line for the product and ATR Co does not follow with a competitive product, Weiss's expected profit is

$ comma $;

if Weiss adds an assembly line and ATR follows suit, Weiss still expects

$ comma $

profit. If Weiss adds a new plant addition and ATR does not produce a competitive product, Weiss expects a profit of

$ comma $;

if ATR does compete for this market, Weiss expects a loss of

$ comma $

Part

a Expected value for the

Add Assembly LineAddAssemblyLine

option

$enter your response here

enter your answer as a whole number

Part

Expected value for the

Build New PlantBuildNewPlant

option

$enter your response here

enter your answer as a whole number

Part

The alternative that provides Weiss the greatest expected monetary value

EMV

LOADING...

is

Add Assembly Line

Build New Plant

Part

The value of the return under this decision is

$enter your response here

enter your answer as a whole number

Part

b The expected value of perfect information

EVPI

LOADING...

for Weiss

$enter your response here

enter your answer as a whole number Howard Weiss, Inc., is considering building a sensitive new radiation scanning device. His managers believe that there is a probability of that the ATR Co will come out with a competitive product. If Weiss adds an assembly line for the product and ATR Co does not follow with a competitive product, Weiss's expected profit is $ ; if Weiss adds an assembly line and ATR follows suit, Weiss still expects $ profit. If Weiss adds a new plant addition and ATR does not produce a competitive product, Weiss expects a profit of $ ; if ATR does compete for this market, Weiss expects a loss of $

a Expected value for the Add Assembly Line option $ enter your answer as a whole number

Expected value for the Build New Plant option $ enter your answer as a whole number

The alternative that provides Weiss the greatest expected monetary value EMV is

The value of the return under this decision is $

enter your answer as a whole number

b The expected value of perfect information EVPI for Weiss $

enter your answer as a whole number

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock