Question: Question content area top Part 1 In 2 0 2 4 2 0 2 4 , WernerWerner Corporation purchases and places into service a machine.

Question content area top

Part

In

WernerWerner

Corporation purchases and places into service a machine.

WernerWerner

elects Sec. expensing for

$ $

million of its

$ $

million cost. The machine has ayear MACRS recovery period. Assume the halfyear convention applies and that

WernerWerners

taxable incomebefore deducting Sec. expensing exceeds such expensing.

View the MACRS halfyear convention rates.

LOADING...

Read the requirements.

LOADING...

Question content area bottom

Part

Requirement a What is

Werner'sWerner's

total depreciation deduction for the machine for each year of its recovery period if it elects out of bonus depreciation for

Enter amounts in whole number. Use MACRS rates to two decimal places, XXX Round the MACRS depreciation to the nearest dollar. Complete all input fields. Enter a for any zero amounts.

Sec. expense

Bonus depreciation

MACRS depreciation

Total depreciation

Help me solve thisCalculatorAsk my instructor

Clear all

Check answer

popup content starts

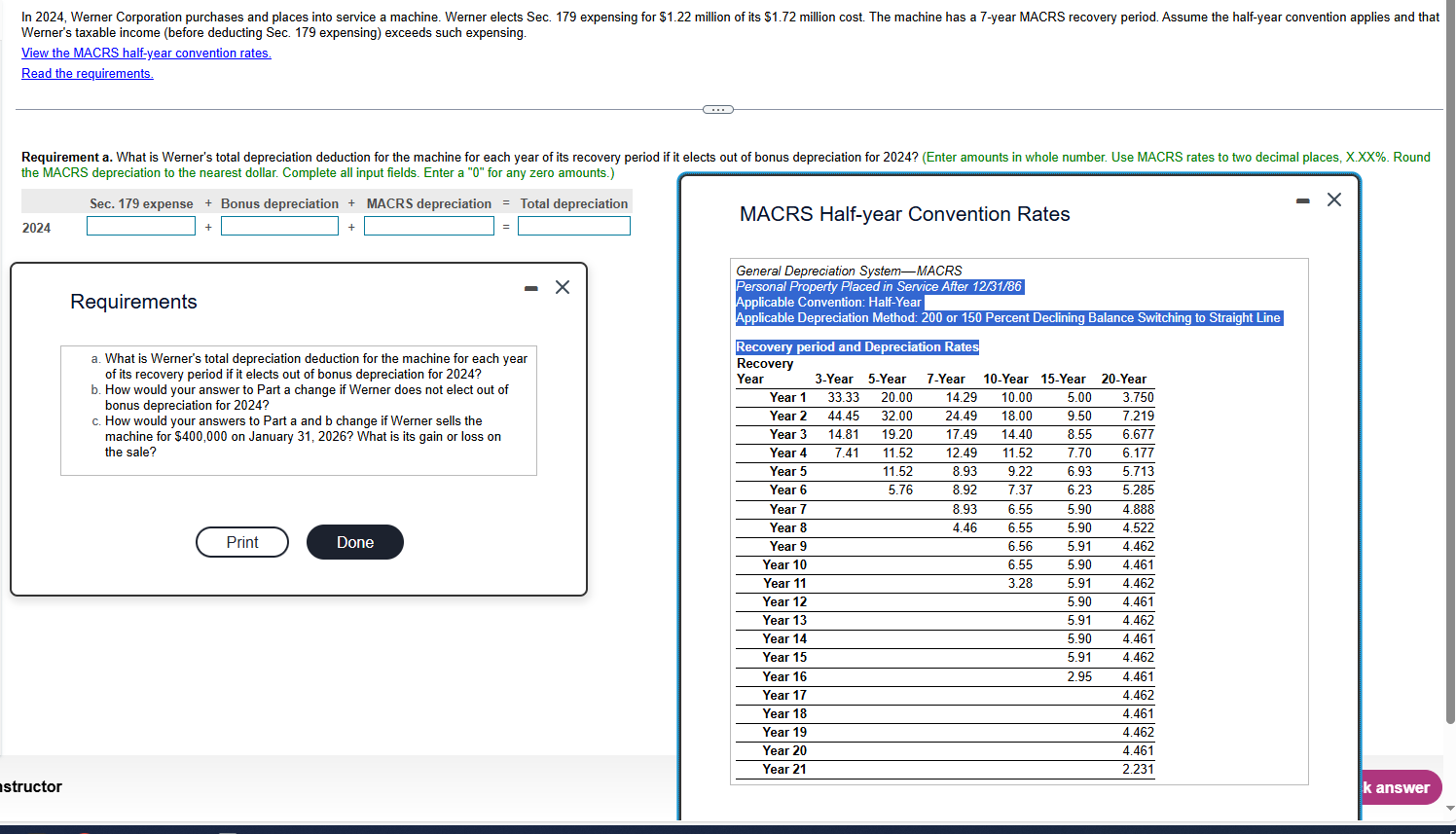

MACRS Halfyear Convention Rates

General Depreciation

Systemlong dashMACRS

Personal Property Placed in Service After

Applicable Convention: HalfYear

Applicable Depreciation Method: or Percent Declining Balance Switching to Straight Line

Recovery period and Depreciation Rates

Recovery Year

Year

Year

Year

Year

Year

Year

Year

Year

Year

Year

Year

Year

Year

Year

Year

Year

Year

Year

Year

Year

Year

Year

Year

Year

Year

Year

Year

popup content ends

PrintDone

popup content starts

Requirements

What is

Werner'sWerner's

total depreciation deduction for the machine for each year of its recovery period if it elects out of bonus depreciation for

How would your answer to Part a change if

WernerWerner

does not elect out of bonus depreciation for

How would your answers to Part a and b change if

WernerWerner

sells the machine for

$ comma $

on January

What is its gain or loss on

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock