Question: Question content area top Part 1 Your company has earnings per share of $ 4 . 0 0 $ 4 . 0 0 . It

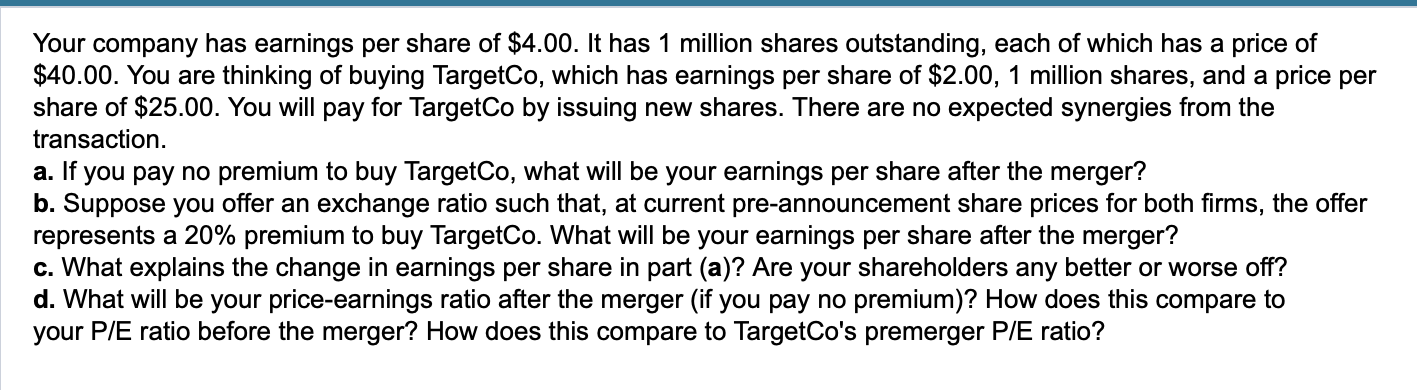

Question content area top Part Your company has earnings per share of $ $ It has million shares outstanding, each of which has a price of $ $ You are thinking of buying TargetCo, which has earnings per share of $ $ million shares, and a price per share of $ $ You will pay for TargetCo by issuing new shares. There are no expected synergies from the transaction. a If you pay no premium to buy TargetCo, what will be your earnings per share after the merger? b Suppose you offer an exchange ratio such that, at current preannouncement share prices for both firms, the offer represents a premium to buy TargetCo. What will be your earnings per share after the merger? c What explains the change in earnings per share in part a Are your shareholders any better or worse off? d What will be your priceearnings ratio after the mergerif you pay no premium How does this compare to your PE ratio before the merger? How does this compare to TargetCo's premerger PE ratio? Your company has earnings per share of $ It has million shares outstanding, each of which has a price of $ You are thinking of buying TargetCo, which has earnings per share of $ million shares, and a price per share of $ You will pay for TargetCo by issuing new shares. There are no expected synergies from the transaction.

a If you pay no premium to buy TargetCo, what will be your earnings per share after the merger?

b Suppose you offer an exchange ratio such that, at current preannouncement share prices for both firms, the offer represents a premium to buy TargetCo. What will be your earnings per share after the merger?

c What explains the change in earnings per share in part a Are your shareholders any better or worse off?

d What will be your priceearnings ratio after the merger if you pay no premium How does this compare to your PE ratio before the merger? How does this compare to TargetCo's premerger PE ratio?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock