Question: Question : Context : X X X X X MIR R fnr Proiept I . (p=1n%) begin{tabular}{|r|r|r|} Year & Cash flows & Cumulative cash flows

Question:

Context:

X

X

X

X

X

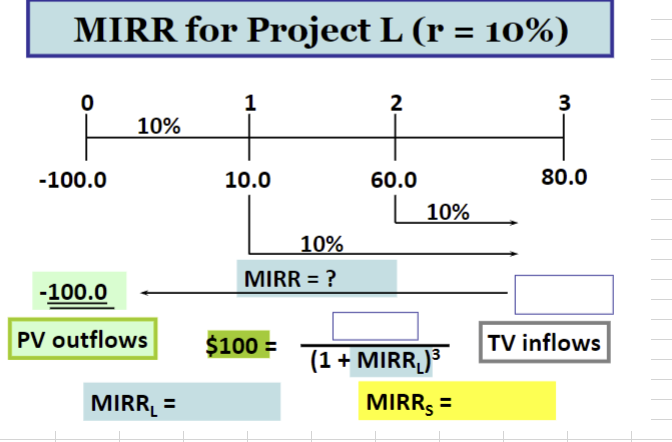

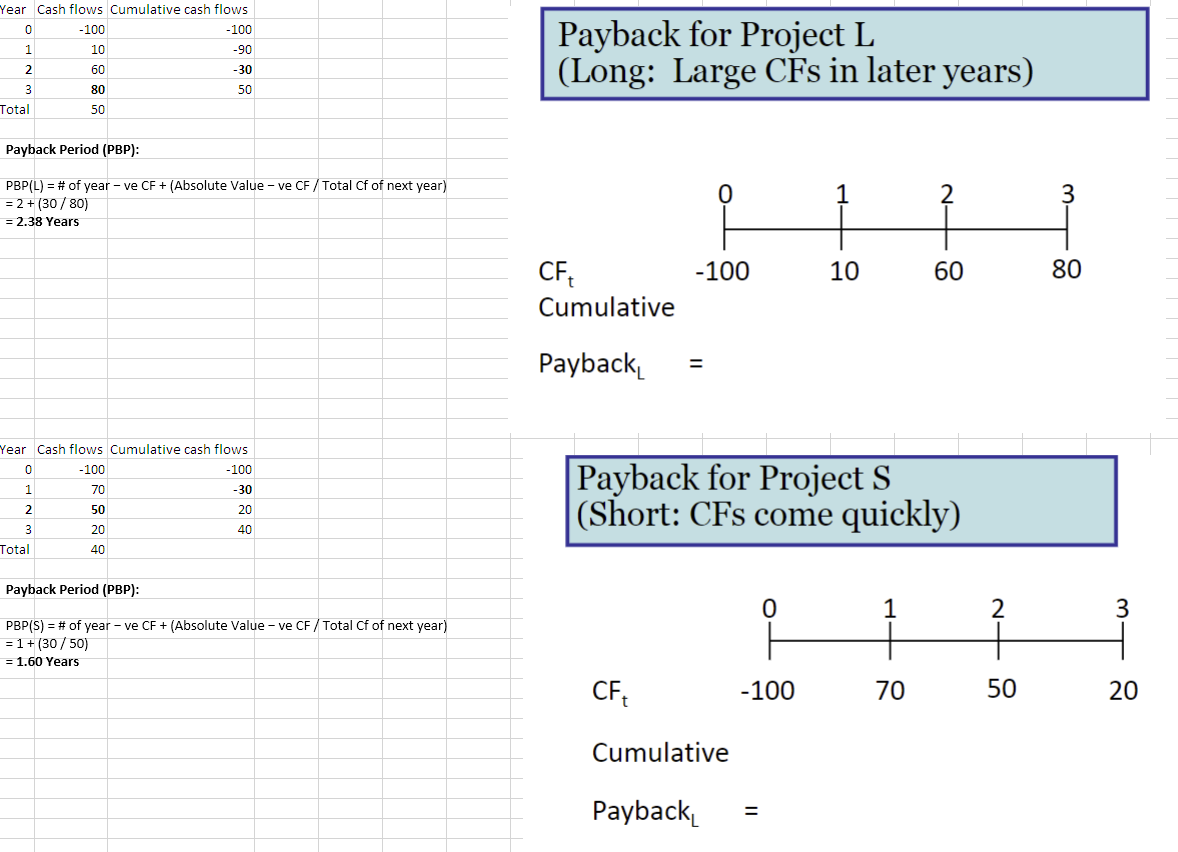

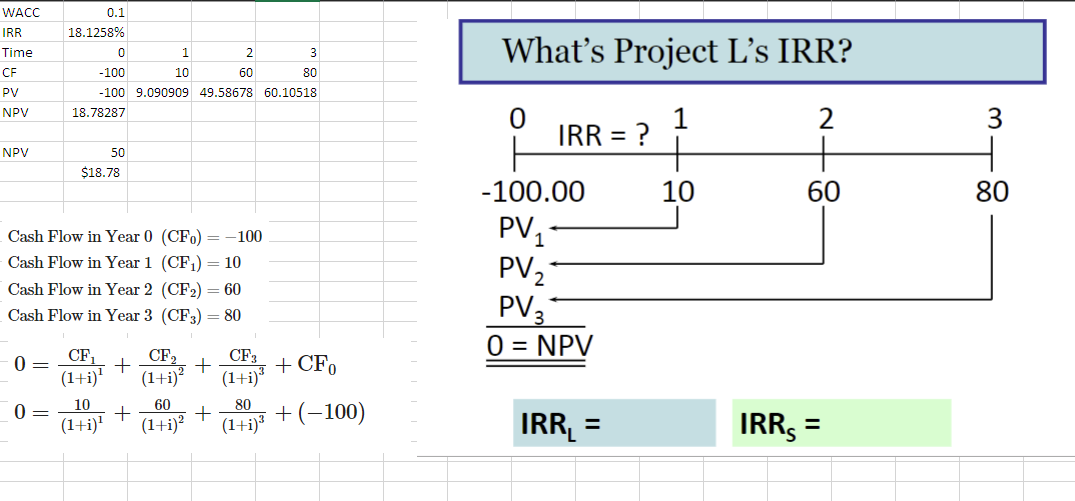

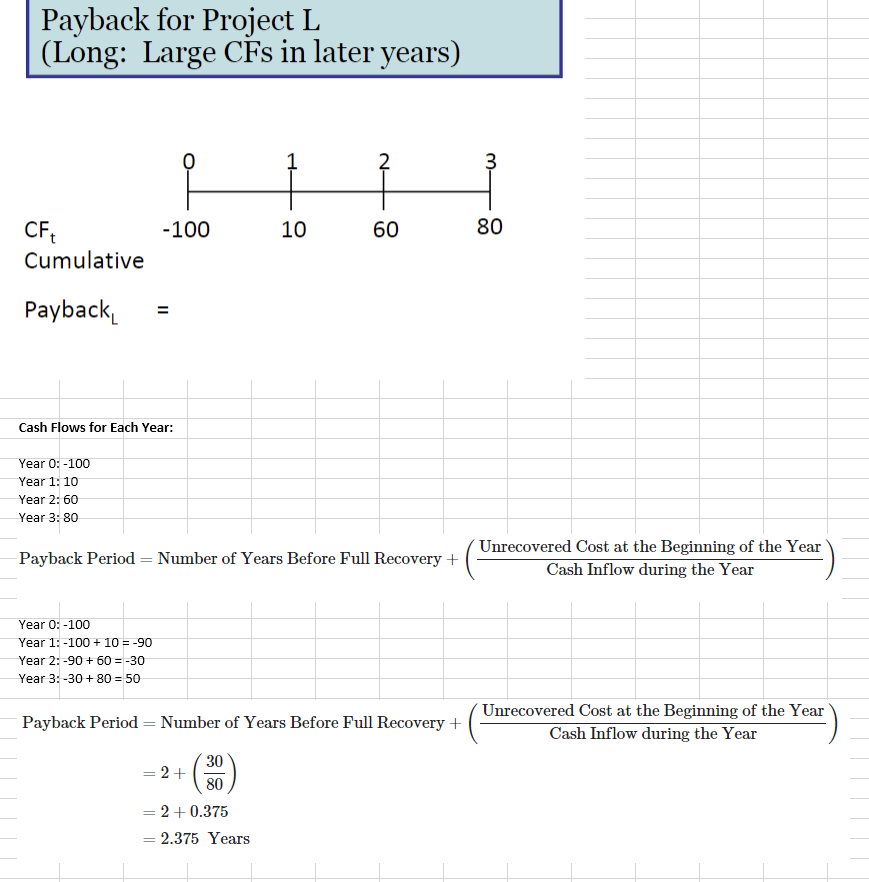

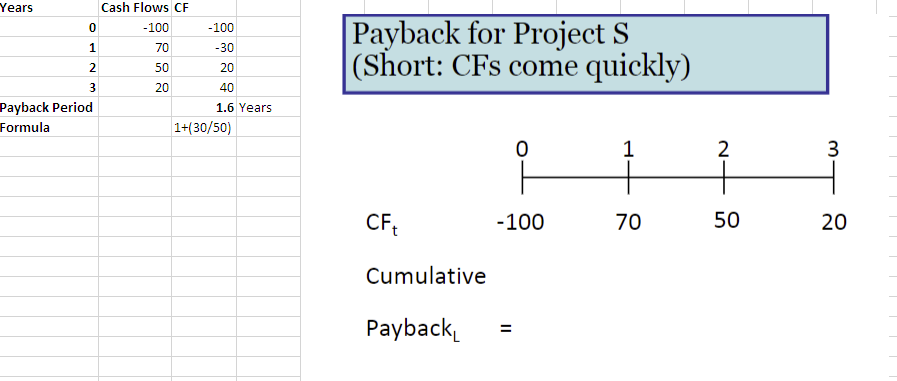

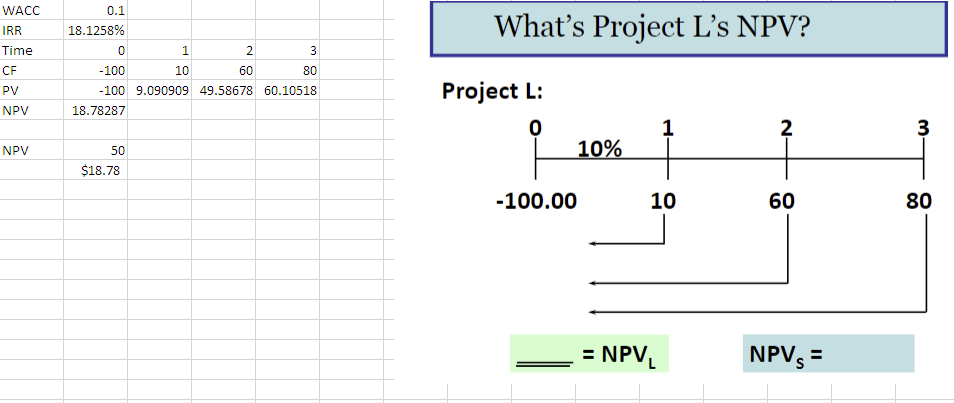

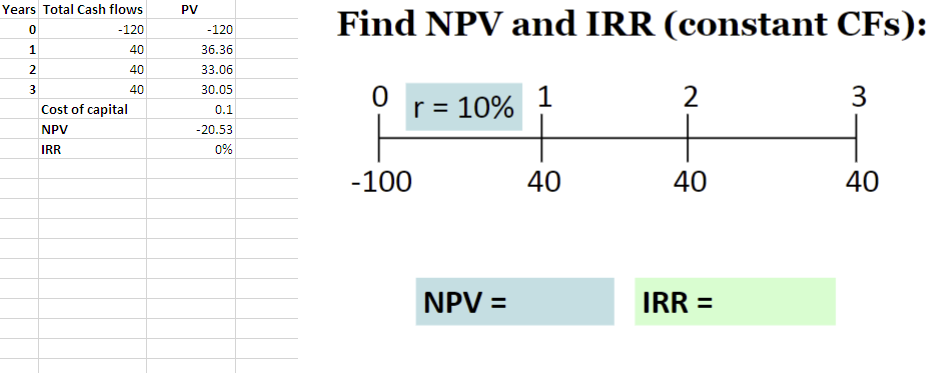

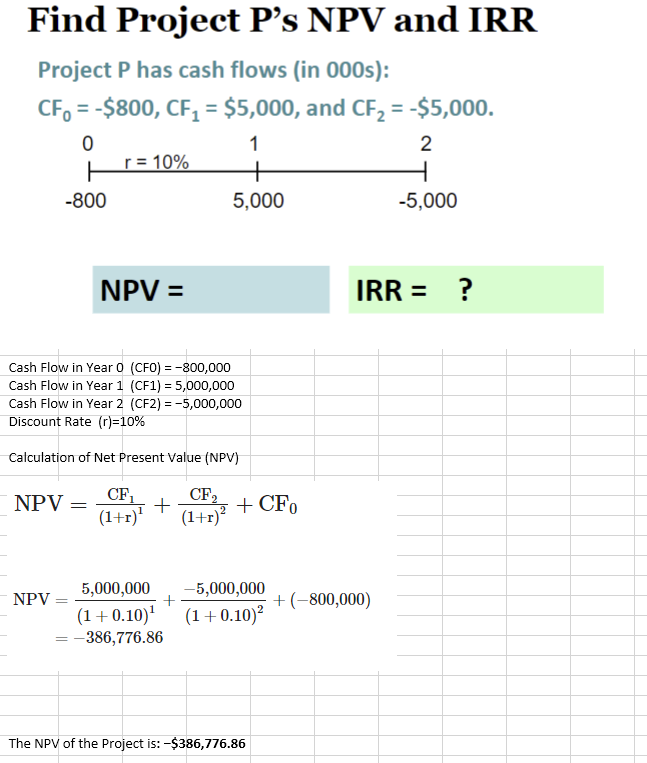

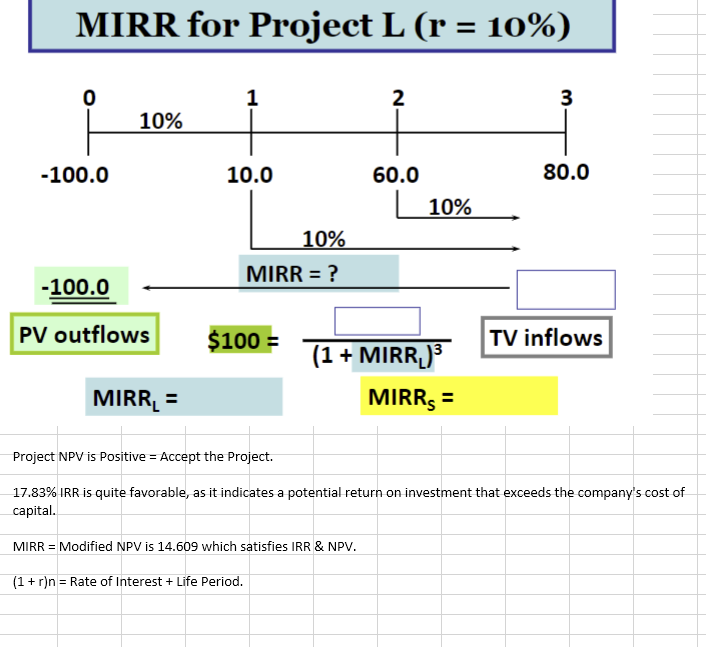

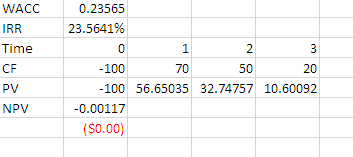

MIR R fnr Proiept I . (p=1n%) \begin{tabular}{|r|r|r|} Year & Cash flows & Cumulative cash flows \\ \hline 0 & -100 & -100 \\ \hline 1 & 10 & -90 \\ \hline 2 & 60 & -30 \\ \hline 3 & 80 & 50 \\ \hline Total & 50 & \\ \hline \end{tabular} Payback Period (PBP): Payback for Project L (Long: Large CFs in later years) CFt Cumulative Payback L= Payback for Project S (Short: CFs come quickly) Cumulative Payback L= What's Project L's IRR? Cash Flow in Year 0(CF0)=100 Cash Flow in Year 1(CF1)=10 Cash Flow in Year 2(CF2)=60 Cash Flow in Year 3(CF3)=80 0=(1+i)1CF1+(1+i)2CF2+(1+i)3CF3+CF00=(1+i)110+(1+i)260+(1+i)380+(100) IRRL=IRRS= Payback for Project L (Long: Large CFs in later years) Cash Flows for Each Year: Year 0:100 Year 1:10 Year 2: 60 Year 3: 80 Year 0: -100 Year 1: 100+10=90 Year 2: 90+60=30 Year 3: 30+80=50 PaybackPeriod=NumberofYearsBeforeFullRecovery+(CashInflowduringtheYearUnrecoveredCostattheBeginningoftheYear)=2+(8030)=2+0.375=2.375Years \begin{tabular}{|l|} \hline Payback for Project S \\ (Short: CFs come quickly) \\ \hline \end{tabular} Project L: Find NPV and IRR (constant CFs): IRR = Find Project P's NPV and IRR Project P has cash flows (in 000s): CF0=$800,CF1=$5,000,andCF2=$5,000. NPV=IRR=? Cash Flow in Year O (CFO) =800,000 Cash Flow in Year 1 (CF1) =5,000,000 Cash Flow in Year 2(CF2)=5,000,000 Discount Rate (r)=10% Calculation of Net Present Value (NPV) NPVNPV=(1+r)1CF1+(1+r)2CF2+CF0=(1+0.10)15,000,000+(1+0.10)25,000,000+(800,000)=386,776.86 The NPV of the Project is: $386,776.86 MIRR for Project L (r=10%) \begin{tabular}{|l|r|r|r|r|} \hline WACC & 0.23565 & & & \\ \hline IRR & 23.5641% & & & \\ \hline Time & 0 & 1 & 2 & 3 \\ \hline CF & -100 & 70 & 50 & 20 \\ \hline PV & -100 & 56.65035 & 32.74757 & 10.60092 \\ \hline NPV & -0.00117 & & & \\ \hline & ($0.00) & & & \\ \hline & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts