Question: QUESTION: D-hedged is 55mil / (1+ 0.05) = 52.38 . Explain how D-unhedged is $50.48 million? Reconsider the junior gold mining company, SKGX Inc, which

QUESTION: D-hedged is 55mil / (1+ 0.05) = 52.38 . Explain how D-unhedged is $50.48 million?

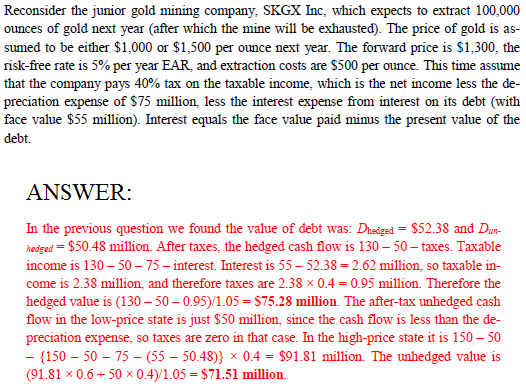

Reconsider the junior gold mining company, SKGX Inc, which expects to extract 100,000 ounces of gold next year (after which the mine will be exhausted.) The price of gold is assumed to be either $1,000 or $1, 500 per ounce next year. The forward price is $1, 300, the risk-free rate is 5% per year EAR, and extraction costs are $500 per ounce. This time assume that the company pays 40% tax on the taxable income, which is the net income less the depreciation expense of $75 million, less the interest expense from interest on its debt (with face value $55 million). Interest equals the face value paid minus the present value of the debt. Reconsider the junior gold mining company, SKGX Inc, which expects to extract 100,000 ounces of gold next year (after which the mine will be exhausted.) The price of gold is assumed to be either $1,000 or $1, 500 per ounce next year. The forward price is $1, 300, the risk-free rate is 5% per year EAR, and extraction costs are $500 per ounce. This time assume that the company pays 40% tax on the taxable income, which is the net income less the depreciation expense of $75 million, less the interest expense from interest on its debt (with face value $55 million). Interest equals the face value paid minus the present value of the debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts