Question: question e) 1) An investor is evaluating their risk position. They have two positions: Security A worth 150,000 with an annual standard deviation of returns

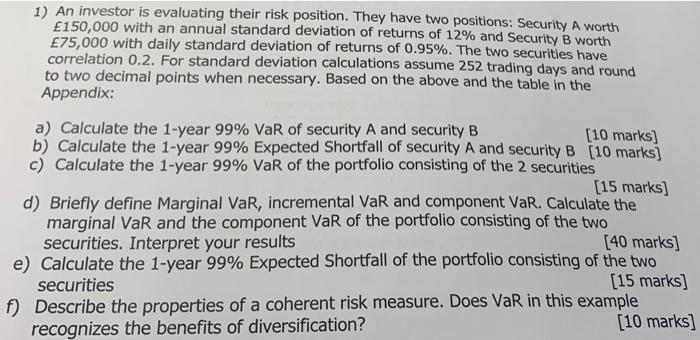

1) An investor is evaluating their risk position. They have two positions: Security A worth 150,000 with an annual standard deviation of returns of 12% and Security B worth 75,000 with daily standard deviation of returns of 0.95%. The two securities have correlation 0.2. For standard deviation calculations assume 252 trading days and round to two decimal points when necessary. Based on the above and the table in the Appendix: a) Calculate the 1-year 99% VaR of security A and security B [10 marks) b) Calculate the 1-year 99% Expected Shortfall of security A and security B (10 marks c) Calculate the 1-year 99% VaR of the portfolio consisting of the 2 securities [15 marks] d) Briefly define Marginal Var, incremental VaR and component VaR. Calculate the marginal VaR and the component VaR of the portfolio consisting of the two securities. Interpret your results [40 marks] e) Calculate the 1-year 99% Expected Shortfall of the portfolio consisting of the two [15 marks] securities f) Describe the properties of a coherent risk measure. Does VaR in this example [10 marks] recognizes the benefits of diversification

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts