Question: Question E - Using the percentage of sales forecast method fill in the chart below. Sales are forecasted at $50,000,000 for Year 2. The debt-holders

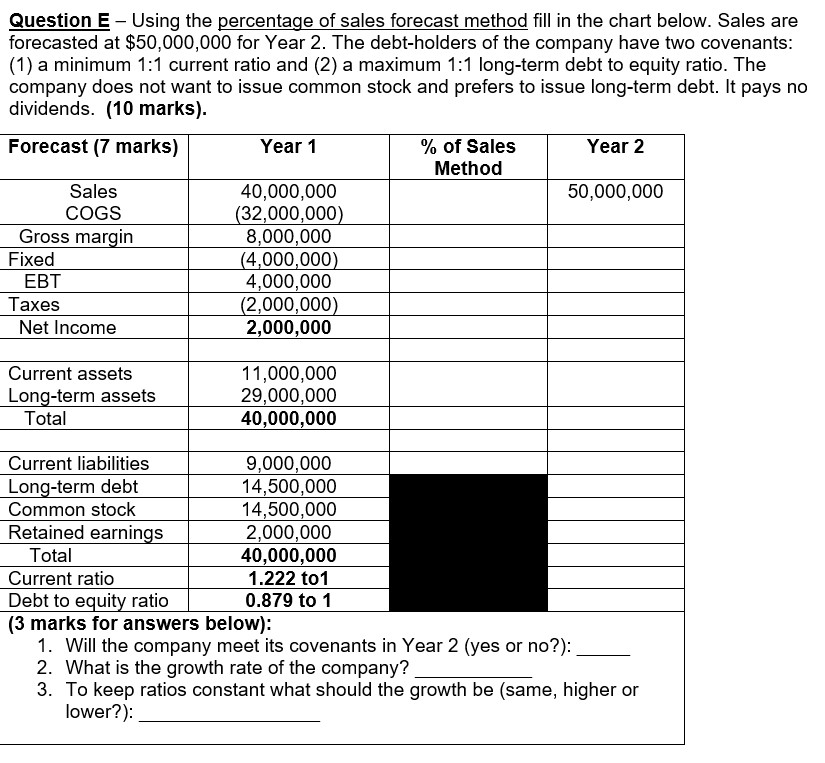

Question E - Using the percentage of sales forecast method fill in the chart below. Sales are forecasted at $50,000,000 for Year 2. The debt-holders of the company have two covenants: (1) a minimum 1:1 current ratio and (2) a maximum 1:1 long-term debt to equity ratio. The company does not want to issue common stock and prefers to issue long-term debt. It pays no dividends. (10 marks). Forecast (7 marks) Year 1 % of Sales Year 2 Method Sales 40,000,000 50,000,000 COGS (32,000,000) Gross margin 8,000,000 Fixed (4,000,000) EBT 4,000,000 Taxes (2,000,000) Net Income 2,000,000 Current assets Long-term assets Total 11,000,000 29,000,000 40,000,000 Current liabilities 9,000,000 Long-term debt 14,500,000 Common stock 14,500,000 Retained earnings 2,000,000 Total 40,000,000 Current ratio 1.222 to 1 Debt to equity ratio 0.879 to 1 (3 marks for answers below): 1. Will the company meet its covenants in Year 2 (yes or no?): 2. What is the growth rate of the company? 3. To keep ratios constant what should the growth be (same, higher or lower?)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts