Question: Question E7-16 Question CE-17 E7.16 For Starbucks (SBUX), the following table has information for revenues. PM, and ATO for the past 4 years: Fiscal 2014

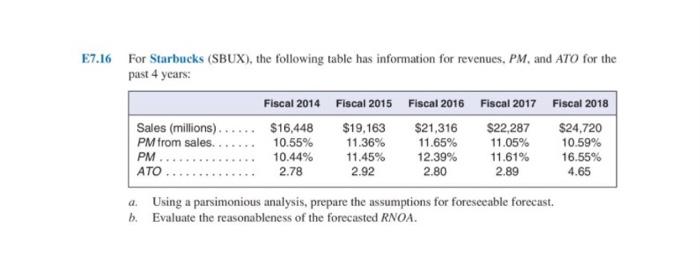

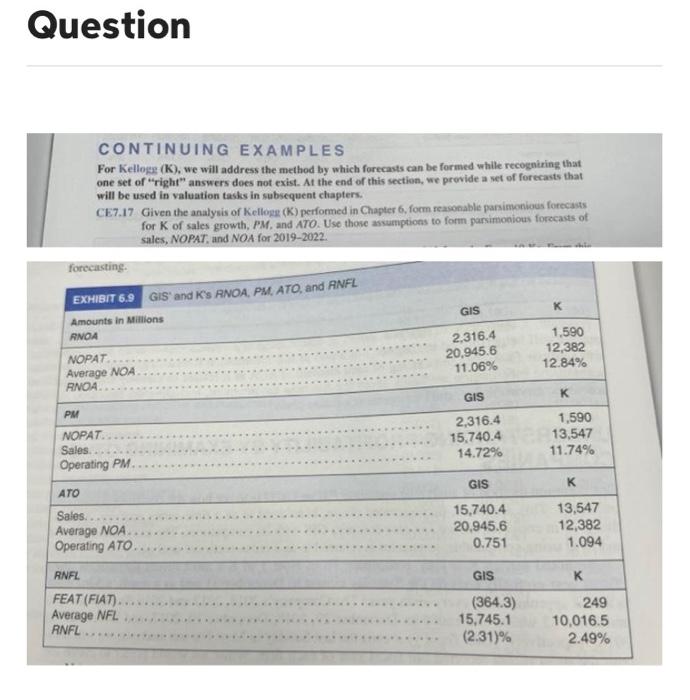

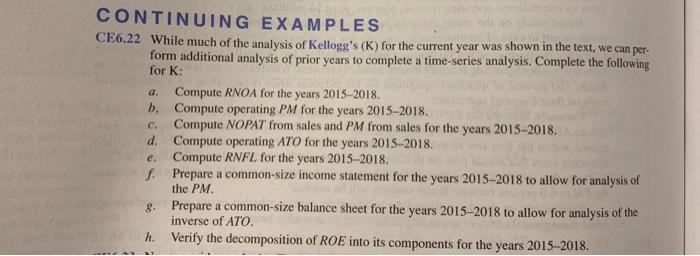

E7.16 For Starbucks (SBUX), the following table has information for revenues. PM, and ATO for the past 4 years: Fiscal 2014 Fiscal 2015 Fiscal 2016 Fiscal 2017 Fiscal 2018 Sales (millions).. $16,448 $19,163 $21,316 $22,287 $24,720 PM from sales. 10.55% 11.36% 11.65% 11.05% 10.59% PM. 10.44% 11.45% 12.39% 11.61% 16.55% ATO 2.78 2.92 2.80 2.89 4.65 a. Using a parsimonious analysis, prepare the assumptions for foreseeable forecast. b. Evaluate the reasonableness of the forecasted RNOA. Question CONTINUING EXAMPLES For Kellogg (K), we will address the method by which forecasts can be formed while recognizing that one set of "right" answers does not exist. At the end of this section, we provide a set of forecasts that will be used in valuation tasks in subsequent chapters. CE7.17 Given the analysis of Kellogg (K) performed in Chapter 6, form reasonable parsimonious forecasts for K of sales growth, PM, and ATO. Use those assumptions to form parsimonious forecasts of sales, NOPAT, and NOA for 2019-2022. forecasting. EXHIBIT 6.9 GIS and K's RNOA, PM, ATO, and RNFL K GIS Amounts in Millions RNOA 2,316.4 1,590 NOPAT 20,945.6 12,382 Average NOA. 11.06% 12.84% RNOA.. GIS K PM NOPAT 2,316.4 1,590 15,740.4 13,547 Sales. Operating PM. 14.72% 11.74% ATO GIS K Sales. 15,740.4 13,547 Average NOA. Operating ATO. 20,945.6 12,382 0.751 1.094 RNFL GIS K FEAT (FIAT) Average NFL RNFL ***** (364.3) 15,745.1 (2.31)% 249 10,016.5 2.49% CONTINUING EXAMPLES CE6.22 While much of the analysis of Kellogg's (K) for the current year was shown in the text, we can per- form additional analysis of prior years to complete a time-series analysis. Complete the following for K: Compute RNOA for the years 2015-2018. b. Compute operating PM for the years 2015-2018. c. Compute NOPAT from sales and PM from sales for the years 2015-2018. d. Compute operating ATO for the years 2015-2018. e. Compute RNFL for the years 2015-2018. f. Prepare a common-size income statement for the years 2015-2018 to allow for analysis of the PM. 8. Prepare a common-size balance sheet for the years 2015-2018 to allow for analysis of the inverse of ATO. h. Verify the decomposition of ROE into its components for the years 2015-2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts