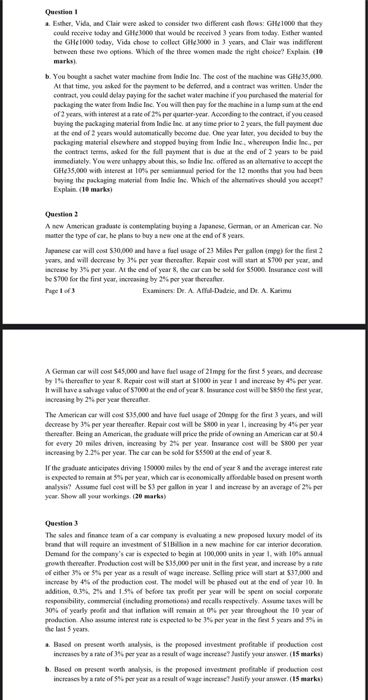

Question: Question Esther, Vida, and Clair were asked to consider two different cash flows: GH 1000 that they could receive today and GH 3000 that would

Question Esther, Vida, and Clair were asked to consider two different cash flows: GH 1000 that they could receive today and GH 3000 that would be received 3 years from todry, Esther wanted the GH 1000 today. Vida chose to collect GHc2000 in 3 years, and Clair was indifferent between these two options. Which of the three women made the right choice? Explain (10 b. You bought a sachet water machine from Indie Ine. The cost of the machine was GH35,000 At that time, you asked for the payment to be deferred, and a contract was writien. Under the contract, you could delay paying for the sachet water machine if you purchased the material for packaging the water from Indie Ine. You will then pay for the machine in a lump sum at the end of 2 years with interest at a rate of 2% per quarter-year. According to the contract, if you ceased buying the packaging material from Indie Inc. at any time prior to 2 years, the full payment due at the end of 2 years would automatically become da. One year later, you decided to buy the packaging material elsewhere and stopped buying from Indie Inc. Whereupon Indie Inc., per the contract terms, asked for the full payment that is due at the end of 2 years to be paid immediately. You were unhappy about this, so Indie In offered as an alternative to accept the GH35,000 with interest at 10% per semiannual period for the 12 months that you had been buying the packaging material from Indie Inc. Which of the alternatives should you accept? Explain. (10 marks) Question A new American graduate is contemplating buying a Japanese, German, or an American car. No matter the type of car, he plans to buy a new one at the end of years. Japanese car will cost $30,000 and have a feel usage of 23 Miles Per gallon (mg) for the first 2 years, and will decrease by 3% per year thereafter Repair cost will start at $700 per year, and increase by 3% per year. At the end of year, the car can be sold for $5000. Insurance cost will be 5700 for the first year, increasing by 2% per year thereafter Examiners: Dr. A. All-Dadzie, and Dr. A. Karimu A German car will cost $45.000 and have fuel usage of 2 mpg for the first years, and decrease by thereafter to year R. Repair cost will start at $1000 in year and increase by 4% per year. It will have a calage value of S7000 at the end of year 8. Insurance cost will be s850 the first year, increasing by 2% per year thereafter. The American car will cost $35,000 and have fue usage of 20mpg for the first 3 years, and will decrease by 3% per year thereafter. Repair cost will be $800 in year , increasing by 4% per year thereafter. Being an American, the graduate will price the pride of owning an American car at 50.4 for every 20 miles driven, increasing by 2% per year. Insurance cost will be $800 per year increasing by 2.2% per year. The car can be sold for S5500 at the end of year If the graduate anticipates driving 150000 miles by the end of year 8 and the average interest rate is expected to remain as per year, which car is economically affordable based on present worth analysis? Assume fuel cost will be 53 rallon in year 1 and increase by an average of 2% per year. Show all your working (20 marks) Question The sales and finance team of a car company is evaluating a new proposed luxury model of its brand that will require an investment of Billion in a new machine for car interior decoration Demand for the company's car is expected to begin at 100.000 units in year 1, with 10% annual growth thereafter. Production cost will be $35.000 per unit in the first year, and increase by arte of either 3% per year as a result of wage increase Selling price will start at $37,000 and increase by 4% of the prodaction cost. The model will be phased out at the end of year 10. In addition, 0.3%, 2% and 15% of before tax profit per year will be spent on social corporate responsibility, commercial (including promotions and recalls respectively. Assume taxes will be 30% of yearly profit and that inflation will remain at 0% per year throughout the 10 year of production. Also assume interest rate is expected to be 3% per year in the first 5 years and 5% in the last years . Based on present worth malysis, is the proposed investment profitable ir production cost increases by a rate of 3% per year as a result of wage increase? Justify your answer. (15 marks) b. Based on present worth analysis, is the proposed investment profitable if production cost increases by a rate of 5% per year as a result of wage increase? Justify your answer. (15 marks) Question Esther, Vida, and Clair were asked to consider two different cash flows: GH 1000 that they could receive today and GH 3000 that would be received 3 years from todry, Esther wanted the GH 1000 today. Vida chose to collect GHc2000 in 3 years, and Clair was indifferent between these two options. Which of the three women made the right choice? Explain (10 b. You bought a sachet water machine from Indie Ine. The cost of the machine was GH35,000 At that time, you asked for the payment to be deferred, and a contract was writien. Under the contract, you could delay paying for the sachet water machine if you purchased the material for packaging the water from Indie Ine. You will then pay for the machine in a lump sum at the end of 2 years with interest at a rate of 2% per quarter-year. According to the contract, if you ceased buying the packaging material from Indie Inc. at any time prior to 2 years, the full payment due at the end of 2 years would automatically become da. One year later, you decided to buy the packaging material elsewhere and stopped buying from Indie Inc. Whereupon Indie Inc., per the contract terms, asked for the full payment that is due at the end of 2 years to be paid immediately. You were unhappy about this, so Indie In offered as an alternative to accept the GH35,000 with interest at 10% per semiannual period for the 12 months that you had been buying the packaging material from Indie Inc. Which of the alternatives should you accept? Explain. (10 marks) Question A new American graduate is contemplating buying a Japanese, German, or an American car. No matter the type of car, he plans to buy a new one at the end of years. Japanese car will cost $30,000 and have a feel usage of 23 Miles Per gallon (mg) for the first 2 years, and will decrease by 3% per year thereafter Repair cost will start at $700 per year, and increase by 3% per year. At the end of year, the car can be sold for $5000. Insurance cost will be 5700 for the first year, increasing by 2% per year thereafter Examiners: Dr. A. All-Dadzie, and Dr. A. Karimu A German car will cost $45.000 and have fuel usage of 2 mpg for the first years, and decrease by thereafter to year R. Repair cost will start at $1000 in year and increase by 4% per year. It will have a calage value of S7000 at the end of year 8. Insurance cost will be s850 the first year, increasing by 2% per year thereafter. The American car will cost $35,000 and have fue usage of 20mpg for the first 3 years, and will decrease by 3% per year thereafter. Repair cost will be $800 in year , increasing by 4% per year thereafter. Being an American, the graduate will price the pride of owning an American car at 50.4 for every 20 miles driven, increasing by 2% per year. Insurance cost will be $800 per year increasing by 2.2% per year. The car can be sold for S5500 at the end of year If the graduate anticipates driving 150000 miles by the end of year 8 and the average interest rate is expected to remain as per year, which car is economically affordable based on present worth analysis? Assume fuel cost will be 53 rallon in year 1 and increase by an average of 2% per year. Show all your working (20 marks) Question The sales and finance team of a car company is evaluating a new proposed luxury model of its brand that will require an investment of Billion in a new machine for car interior decoration Demand for the company's car is expected to begin at 100.000 units in year 1, with 10% annual growth thereafter. Production cost will be $35.000 per unit in the first year, and increase by arte of either 3% per year as a result of wage increase Selling price will start at $37,000 and increase by 4% of the prodaction cost. The model will be phased out at the end of year 10. In addition, 0.3%, 2% and 15% of before tax profit per year will be spent on social corporate responsibility, commercial (including promotions and recalls respectively. Assume taxes will be 30% of yearly profit and that inflation will remain at 0% per year throughout the 10 year of production. Also assume interest rate is expected to be 3% per year in the first 5 years and 5% in the last years . Based on present worth malysis, is the proposed investment profitable ir production cost increases by a rate of 3% per year as a result of wage increase? Justify your answer. (15 marks) b. Based on present worth analysis, is the proposed investment profitable if production cost increases by a rate of 5% per year as a result of wage increase? Justify your answer. (15 marks)