Question: Question EVA - Does It Really Work? 1 4 1 5 Nathan Fleming could hardly wait to get back to his corporate headquarters in Philadelphia,

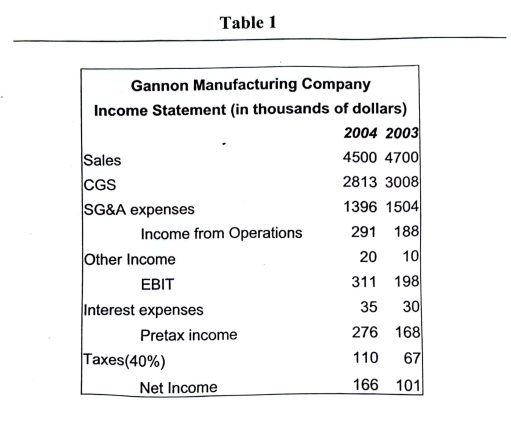

Question EVA Does It Really Work? Nathan Fleming could hardly wait to get back to his corporate headquarters in Philadelphia, Pennsylvania and share all the useful information that he had gathered on performance evaluation, with his colleagues in the finance department. Nathan was the Vice President of Finance at Gannon Manufacturing Company, a small sized firm with annual sales ranging from million to million dollars. The president of the company, Ed Brown, had recently heard about the effectiveness of the "economic value added EVA measure of corporate performance at an executive summit and was interested in exploring its use for Gannon Manufacturing. He therefore, asked Nathan to attend a twoday workshop entitled "EVAIt really works!" hosted by Stern, Stewart, and Company at their headquarters in New York, NY Nathan had been impressed by the quality of the presentations put on by the staff of Stern, Stewart and Company. One brochure in particular, he thought, summarized it all very well see Exhibit Thelist of companies that had adopted EVA as an evaluation measure was growing by leaps and bounds see Exhibit Furthermore, the empirical evidence linking the EVA performance yardstick with shareholder wealth creation was quite striking. In one of the studies done on of Stern, Stewart's clients, it was reported that: On average, investments in the shares of these companies produced more wealth after five years than equal investments in shares of competitors with similar market capitalization. Companies that used the full Stern Stewart compensation architecture did even better. Investment in their shares produced more wealth over five years than equal investments in their competitors. Overall, the Stern Stewart clients created some $ billion more in market value than they would have if they had performed the same as their competitors." Stern Stewart & Co This finding, thought Nathan, would be of particular interest to the folks at corporate headquarters, since plans were in the offing for taking the company public. He figured that he better prepare an outline. for the finance staff to use when calculating the firm's EVA see Exhibit Nathan knew that once the necessary financial details were worked out, the calculations would be easy to follow. He realized that since it waas a small company, many of the adjustments suggested by Stern, Stewart & Company would not apply to Gannon Manufacturing. What would apply, though, would be the adjustment of $ in and $ in paid as salaries to the owners as part of net operating profits before taxes, rather than as an expenditure, since it was an investment in the future of the firm. Nathan glanced over the steps necessary to calculate EVA, which he had jotted down, and then at the latest annual financial statements of Gannon Manufacturing see Tables and He realized that he would need to gather some more specific information before he could come up with a reasonably accurate measure of Gannon Manufacturing Company's EVA. He figured that he had better wait till he was back in Philadelphia. Please do the step like in the Exhibit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock