Question: Question example shows you how to do it Save Homework: Chapter 14 Homework ve - Goo 7 of 7 (5 complete) HW Score: 68.77%, 4.81

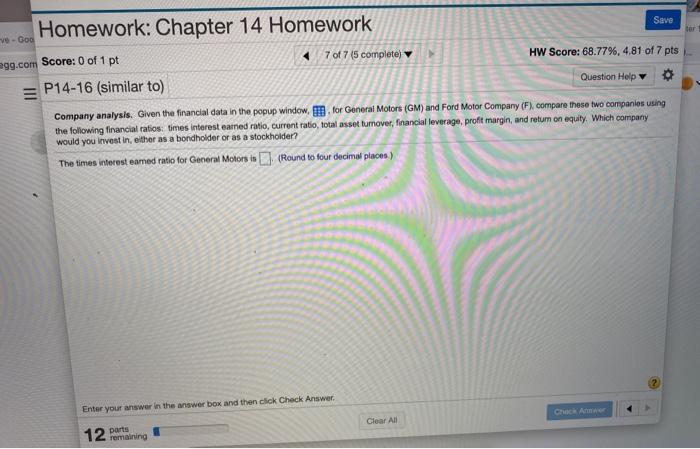

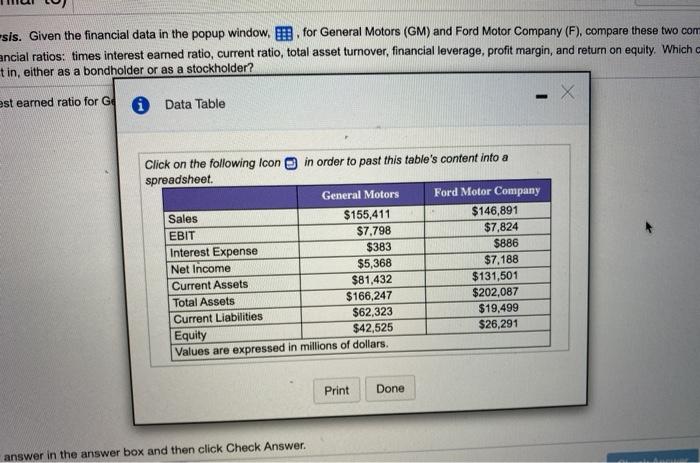

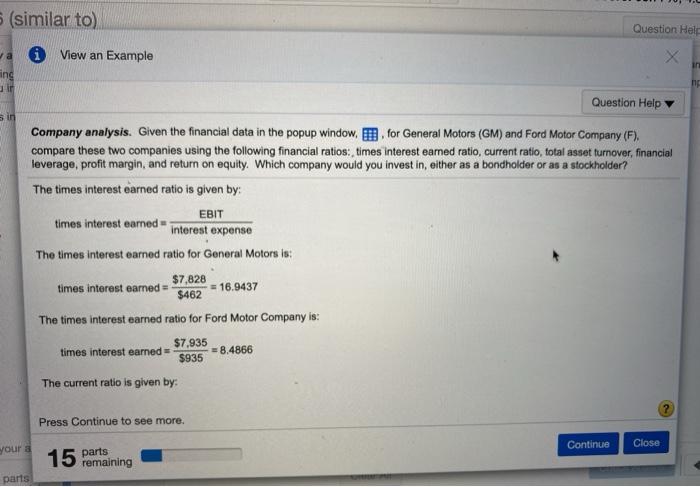

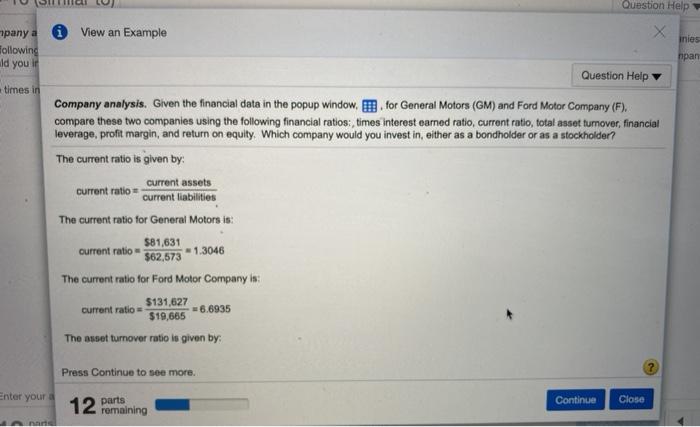

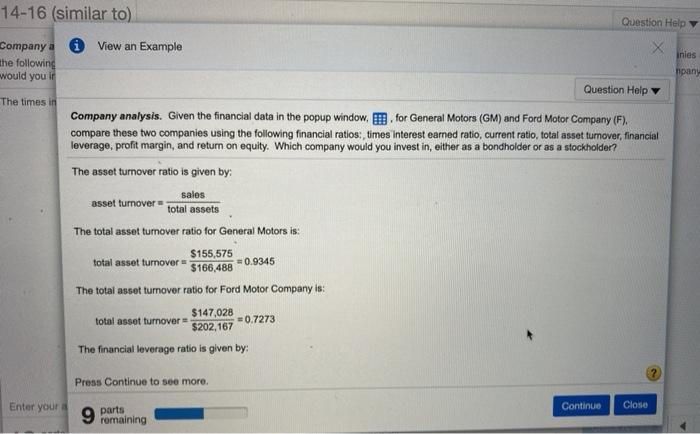

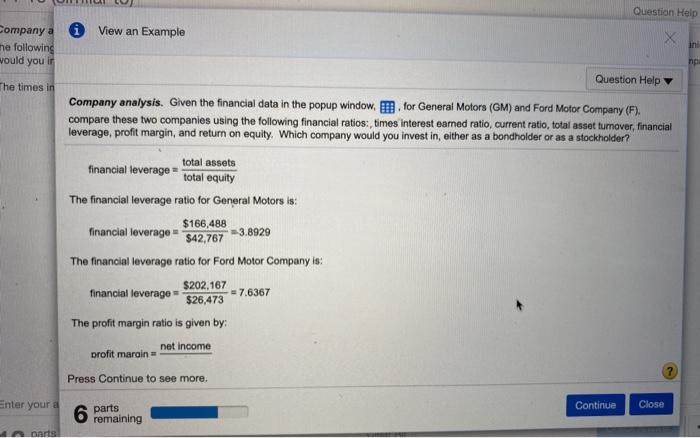

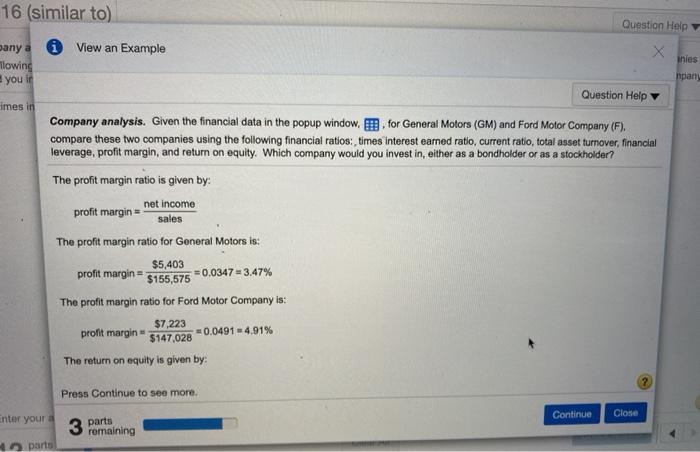

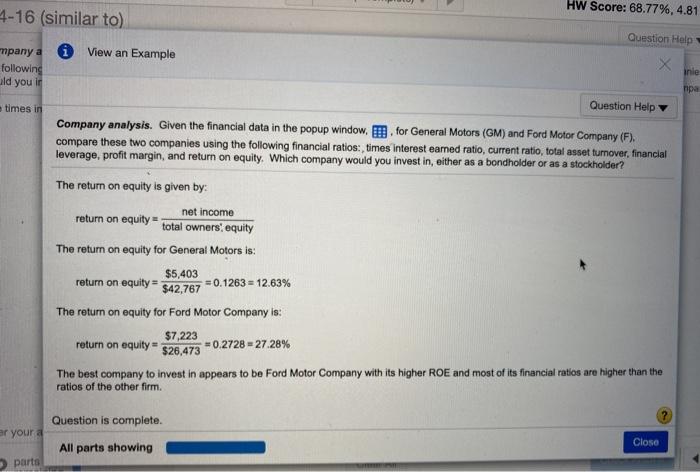

Save Homework: Chapter 14 Homework ve - Goo 7 of 7 (5 complete) HW Score: 68.77%, 4.81 of 7 pts agg.com Score: 0 of 1 pt P14-16 (similar to) Question Help Company analysis. Given the financial data in the popup window, for General Motors (GM) and Ford Motor Company (F), compare these two companies using the following financial ratios: times interest earned ratio, current ratio, total asset turnover, financial leverage, profit margin, and return on equity. Which company would you invest in either as a bondholder or as a stockholder? The times interest eamed ratio for General Motors in (Round to four decimal places) Enter your answer in the answer box and then click Check Answer C Am Clear All 12 parts remaining sis. Given the financial data in the popup window, for General Motors (GM) and Ford Motor Company (F), compare these two com ancial ratios: times interest earned ratio, current ratio, total asset turnover, financial leverage, profit margin, and return on equity. Which tin, either as a bondholder or as a stockholder? est earned ratio for G Data Table X Click on the following Icon in order to past this table's content into a spreadsheet. General Motors Ford Motor Company Sales $155,411 $146,891 EBIT $7,798 $7,824 Interest Expense $383 $886 Net Income $5,368 $7,188 Current Assets $81,432 $131,501 Total Assets $ 166,247 $202,087 Current Liabilities $62,323 $19,499 Equity $42,525 $26,291 Values are expressed in millions of dollars. Print Done answer in the answer box and then click Check Answer. 5 (similar to) Question Help a i View an Example ing Question Help Sin Company analysis. Given the financial data in the popup window, D. for General Motors (GM) and Ford Motor Company (F). compare these two companies using the following financial ratios: times interest eamed ratio, current ratio, total asset turnover, financial leverage, profit margin, and return on equity. Which company would you invest in, either as a bondholder or as a stockholder? The times interest earned ratio is given by: EBIT times interest eamed Interest expense The times interest eamed ratio for General Motors is: $7,828 times interest earned = = 16.9437 $462 The times interest earned ratio for Ford Motor Company is: times interest earned $7.935 = 8.4866 $935 The current ratio is given by: Press Continue to see more. Continue Close your a 15 parts remaining parts 14-16 (similar to) Question Help * View an Example x Company a the following would you if inles mpany Question Help The times in total assets Company analysis. Given the financial data in the popup window, for General Motors (GM) and Ford Motor Company (F). compare these two companies using the following financial ratlos: times interest earned ratio, current ratio, total asset tumover, financial leverage, profit margin, and return on equity. Which company would you invest in, either as a bondholder or as a stockholder? The asset turnover ratio is given by: sales asset turnover = The total asset turnover ratio for General Motors is: $155,575 total asset turnover = $166,488 The total asset turnover ratio for Ford Motor Company is: $147,028 total asset turnover - 5202,167 The financial leverage ratio is given by: =0.9345 0.7273 Press Continue to see more. Enter your Continue Close 9 parts romaining Question Help i View an Example Company a the following would you ir np. Question Help The times in Company analysis. Given the financial data in the popup window. Ifor General Motors (GM) and Ford Motor Company (F). compare these two companies using the following financial ratios: times interest earned ratio, current ratio, total asset tumover, financial leverage, profit margin, and return on equity, which company would you invest in, either as a bondholder or as a stockholder? total assets financial leverage total equity The financial leverage ratio for General Motors is: $166,488 financial leverage $42,767 3.8929 The financial leverage ratio for Ford Motor Company is: $202,167 financial leverage = 7.6367 $26,473 The profit margin ratio is given by profit margin = net Income Press Continue to see more. Enter your Continue Close 6 parts remaining Anarts 16 (similar to) Question Help i View an Example any a llowing you if inles mpany imes in Question Help Company analysis. Given the financial data in the popup window. II. for General Motors (GM) and Ford Motor Company (F). compare these two companies using the following financial ratios: times interest earned ratio, current ratio, total asset tumover, financial leverage, profit margin, and return on equity. Which company would you invest in, either as a bondholder or as a stockholder The profit margin ratio is given by: profit margin net income sales The profit margin ratio for General Motors is: $5,403 profit margin- $155,575 = 0.0347 = 3.47% The profit margin ratio for Ford Motor Company is: $7,223 profit margin- $147,028 =0.0491-4.91% The return on equity is given by: Press Continue to see more. Continue Close Enter your 3 parts remaining parts HW Score: 68.77%, 4.81 4-16 (similar to) Question Help View an Example mpany a following ald you i X inle times in Question Help Company analysis. Given the financial data in the popup window. Ifor General Motors (GM) and Ford Motor Company (F). compare these two companies using the following financial ratios: times interest eared ratio, current ratio, total asset turnover, financial leverage, profit margin, and return on equity. Which company would you invest in, either as a bondholder or as a stockholder? The return on equity is given by: return on equity = net income total owners, equity The return on equity for General Motors is: return on equity = $42,767 $5,403 = 0.1263 = 12.63% The return on equity for Ford Motor Company is: $7,223 return on equity - $26.473 +0.2728 27.28% The best company to invest in appears to be Ford Motor Company with its higher ROE and most of its financial ratios are higher than the ratios of the other firm. Question is complete. er your a Close All parts showing parts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts