Question: Question: Explain how you calculated the stage 1 after tax salvage values for the land building, and equipment. Why in some cases did the firm

Question: Explain how you calculated the stage 1 after tax salvage values for the land building, and equipment. Why in some cases did the firm have to pay taxes on the sale of the asset but in other cases earned a tax credit on the sale of the asset?

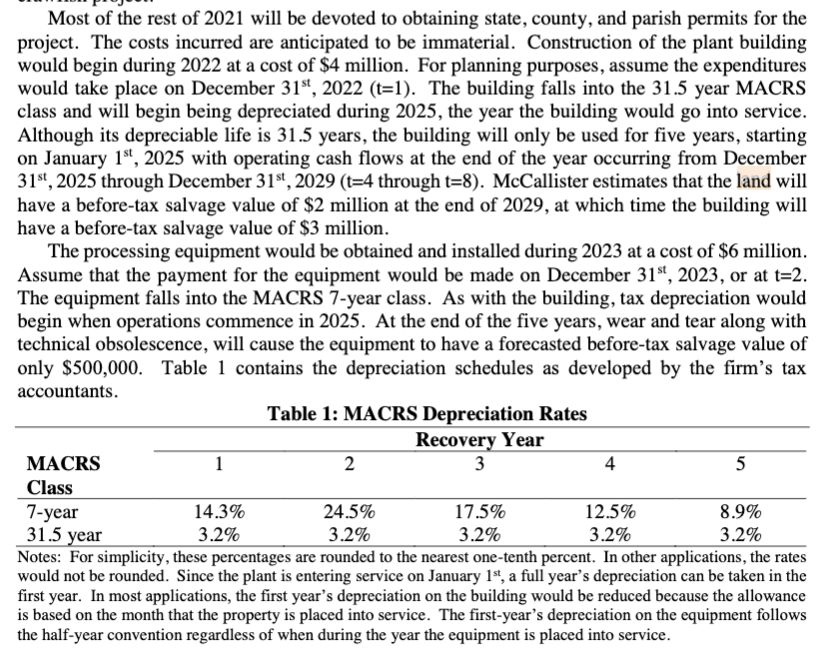

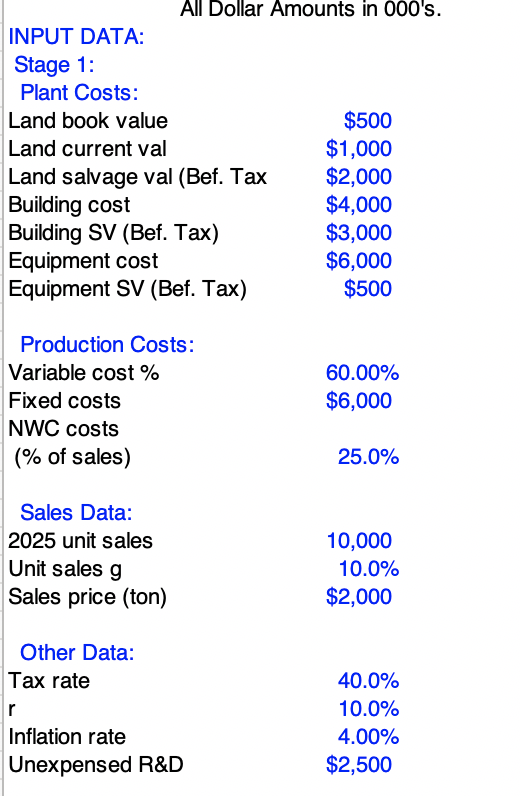

Most of the rest of 2021 will be devoted to obtaining state, county, and parish permits for the project. The costs incurred are anticipated to be immaterial. Construction of the plant building would begin during 2022 at a cost of $4 million. For planning purposes, assume the expenditures would take place on December 31st, 2022 (t=1). The building falls into the 31.5 year MACRS class and will begin being depreciated during 2025, the year the building would go into service. Although its depreciable life is 31.5 years, the building will only be used for five years, starting on January 18, 2025 with operating cash flows at the end of the year occurring from December 31st, 2025 through December 31st, 2029 (t=4 through t=8). McCallister estimates that the land will have a before-tax salvage value of $2 million at the end of 2029, at which time the building will have a before-tax salvage value of $3 million. The processing equipment would be obtained and installed during 2023 at a cost of $6 million. Assume that the payment for the equipment would be made on December 31st, 2023, or at t=2. The equipment falls into the MACRS 7-year class. As with the building, tax depreciation would begin when operations commence in 2025. At the end of the five years, wear and tear along with technical obsolescence, will cause the equipment to have a forecasted before-tax salvage value of only $500,000. Table 1 contains the depreciation schedules as developed by the firm's tax accountants. Table 1: MACRS Depreciation Rates Recovery Year MACRS 1 2. 3 4 5 Class 7-year 14.3% 24.5% 17.5% 12.5% 8.9% 31.5 year 3.2% 3.2% 3.2% 3.2% 3.2% Notes: For simplicity, these percentages are rounded to the nearest one-tenth percent. In other applications, the rates would not be rounded. Since the plant is entering service on January 1st, a full year's depreciation can be taken in the first year. In most applications, the first year's depreciation on the building would be reduced because the allowance is based on the month that the property is placed into service. The first-year's depreciation on the equipment follows the half-year convention regardless of when during the year the equipment is placed into service. All Dollar Amounts in 000's. INPUT DATA: Stage 1: Plant Costs: Land book value $500 Land current val $1,000 Land salvage val (Bef. Tax $2,000 Building cost $4,000 Building SV (Bef. Tax) $3,000 Equipment cost $6,000 Equipment SV (Bef. Tax) $500 Production Costs: Variable cost % Fixed costs NWC costs (% of sales) 60.00% $6,000 25.0% Sales Data: 2025 unit sales Unit sales g Sales price (ton) 10,000 10.0% $2,000 Other Data: Tax rate r Inflation rate Unexpensed R&D 40.0% 10.0% 4.00% $2,500 Most of the rest of 2021 will be devoted to obtaining state, county, and parish permits for the project. The costs incurred are anticipated to be immaterial. Construction of the plant building would begin during 2022 at a cost of $4 million. For planning purposes, assume the expenditures would take place on December 31st, 2022 (t=1). The building falls into the 31.5 year MACRS class and will begin being depreciated during 2025, the year the building would go into service. Although its depreciable life is 31.5 years, the building will only be used for five years, starting on January 18, 2025 with operating cash flows at the end of the year occurring from December 31st, 2025 through December 31st, 2029 (t=4 through t=8). McCallister estimates that the land will have a before-tax salvage value of $2 million at the end of 2029, at which time the building will have a before-tax salvage value of $3 million. The processing equipment would be obtained and installed during 2023 at a cost of $6 million. Assume that the payment for the equipment would be made on December 31st, 2023, or at t=2. The equipment falls into the MACRS 7-year class. As with the building, tax depreciation would begin when operations commence in 2025. At the end of the five years, wear and tear along with technical obsolescence, will cause the equipment to have a forecasted before-tax salvage value of only $500,000. Table 1 contains the depreciation schedules as developed by the firm's tax accountants. Table 1: MACRS Depreciation Rates Recovery Year MACRS 1 2. 3 4 5 Class 7-year 14.3% 24.5% 17.5% 12.5% 8.9% 31.5 year 3.2% 3.2% 3.2% 3.2% 3.2% Notes: For simplicity, these percentages are rounded to the nearest one-tenth percent. In other applications, the rates would not be rounded. Since the plant is entering service on January 1st, a full year's depreciation can be taken in the first year. In most applications, the first year's depreciation on the building would be reduced because the allowance is based on the month that the property is placed into service. The first-year's depreciation on the equipment follows the half-year convention regardless of when during the year the equipment is placed into service. All Dollar Amounts in 000's. INPUT DATA: Stage 1: Plant Costs: Land book value $500 Land current val $1,000 Land salvage val (Bef. Tax $2,000 Building cost $4,000 Building SV (Bef. Tax) $3,000 Equipment cost $6,000 Equipment SV (Bef. Tax) $500 Production Costs: Variable cost % Fixed costs NWC costs (% of sales) 60.00% $6,000 25.0% Sales Data: 2025 unit sales Unit sales g Sales price (ton) 10,000 10.0% $2,000 Other Data: Tax rate r Inflation rate Unexpensed R&D 40.0% 10.0% 4.00% $2,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts