Question: Question: explain the appropriate financial reporting treatment making reference to relevant accounting standards; and set out the accounting adjustments required to correct the financial statements

Question:

explain the appropriate financial reporting treatment making reference to relevant accounting standards; and

set out the accounting adjustments required to correct the financial statements for Metalwise plc for the year ended 31 December 2020.

If there is any information need more, plz comment

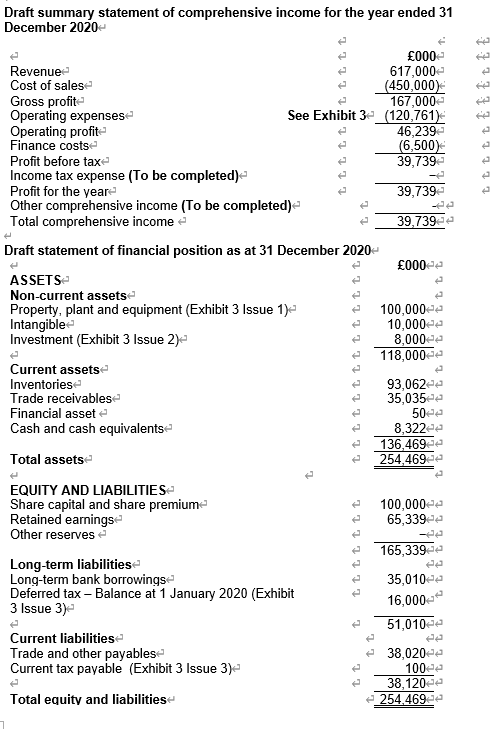

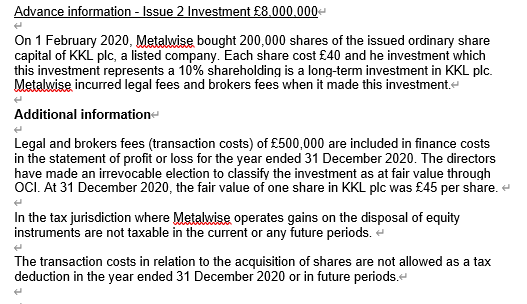

Draft summary statement of comprehensive income for the year ended 31 December 2020- Et ttttt ttttt tt :39.739 000 Revenue 617,000 Cost of sales- (450,000) Gross profit 167,000 Operating expenses See Exhibit 3e_(120,761) Operating profite 46,239 Finance costs (6,500) Profit before tax 39,739 Income tax expense (To be completed) Profit for the year 39,739 Other comprehensive income (To be completed) Total comprehensive income e Draft statement of financial position as at 31 December 2020- 000 ASSETS Non-current assets Property, plant and equipment (Exhibit 3 Issue 1) 100,000- Intangible 10,000 Investment (Exhibit 3 Issue 2) 118,000 Current assets Inventoriese Trade receivables 35,035 Financial assete Cash and cash equivalents 8,322 136,46920 Total assets 254,469 :93,062 tttt 100,000 100,000 q :65,339 - EQUITY AND LIABILITIES Share capital and share premium Retained earnings Other reserves 2 Long-term liabilities Long-term bank borrowingse Deferred tax - Balance at 1 January 2020 (Exhibit 3 Issue 3) ttttttt - 165,339 :35,010 16,000- 51,010 ee Current liabilities Trade and other payables- Current tax payable (Exhibit 3 Issue 3) 38,020 100 100- 38,120- 254.4699 Total equity and liabilities Advance information - Issue 2 Investment 8.000.000- On 1 February 2020, Metalwise bought 200,000 shares of the issued ordinary share capital of KKL plc, a listed company. Each share cost 40 and he investment which this investment represents a 10% shareholding is a long-term investment in KKL plc. Metalwise incurred legal fees and brokers fees when it made this investment- Additional information Legal and brokers fees (transaction costs) of 500,000 are included in finance costs in the statement of profit or loss for the year ended 31 December 2020. The directors have made an irrevocable election to classify the investment as at fair value through OCI. At 31 December 2020, the fair value of one share in KKL plc was 45 per share. In the tax jurisdiction where Metalwise operates gains on the disposal of equity instruments are not taxable in the current or any future periods. The transaction costs in relation to the acquisition of shares are not allowed as a tax deduction in the year ended 31 December 2020 or in future periods. e Draft summary statement of comprehensive income for the year ended 31 December 2020- Et ttttt ttttt tt :39.739 000 Revenue 617,000 Cost of sales- (450,000) Gross profit 167,000 Operating expenses See Exhibit 3e_(120,761) Operating profite 46,239 Finance costs (6,500) Profit before tax 39,739 Income tax expense (To be completed) Profit for the year 39,739 Other comprehensive income (To be completed) Total comprehensive income e Draft statement of financial position as at 31 December 2020- 000 ASSETS Non-current assets Property, plant and equipment (Exhibit 3 Issue 1) 100,000- Intangible 10,000 Investment (Exhibit 3 Issue 2) 118,000 Current assets Inventoriese Trade receivables 35,035 Financial assete Cash and cash equivalents 8,322 136,46920 Total assets 254,469 :93,062 tttt 100,000 100,000 q :65,339 - EQUITY AND LIABILITIES Share capital and share premium Retained earnings Other reserves 2 Long-term liabilities Long-term bank borrowingse Deferred tax - Balance at 1 January 2020 (Exhibit 3 Issue 3) ttttttt - 165,339 :35,010 16,000- 51,010 ee Current liabilities Trade and other payables- Current tax payable (Exhibit 3 Issue 3) 38,020 100 100- 38,120- 254.4699 Total equity and liabilities Advance information - Issue 2 Investment 8.000.000- On 1 February 2020, Metalwise bought 200,000 shares of the issued ordinary share capital of KKL plc, a listed company. Each share cost 40 and he investment which this investment represents a 10% shareholding is a long-term investment in KKL plc. Metalwise incurred legal fees and brokers fees when it made this investment- Additional information Legal and brokers fees (transaction costs) of 500,000 are included in finance costs in the statement of profit or loss for the year ended 31 December 2020. The directors have made an irrevocable election to classify the investment as at fair value through OCI. At 31 December 2020, the fair value of one share in KKL plc was 45 per share. In the tax jurisdiction where Metalwise operates gains on the disposal of equity instruments are not taxable in the current or any future periods. The transaction costs in relation to the acquisition of shares are not allowed as a tax deduction in the year ended 31 December 2020 or in future periods. e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts