Question: question (f) and (g) hope u can explain more specific, please , thank u allocated to written section elements. Bond Par Value Annual Coupon Years

question (f) and (g) hope u can explain more specific, please , thank u

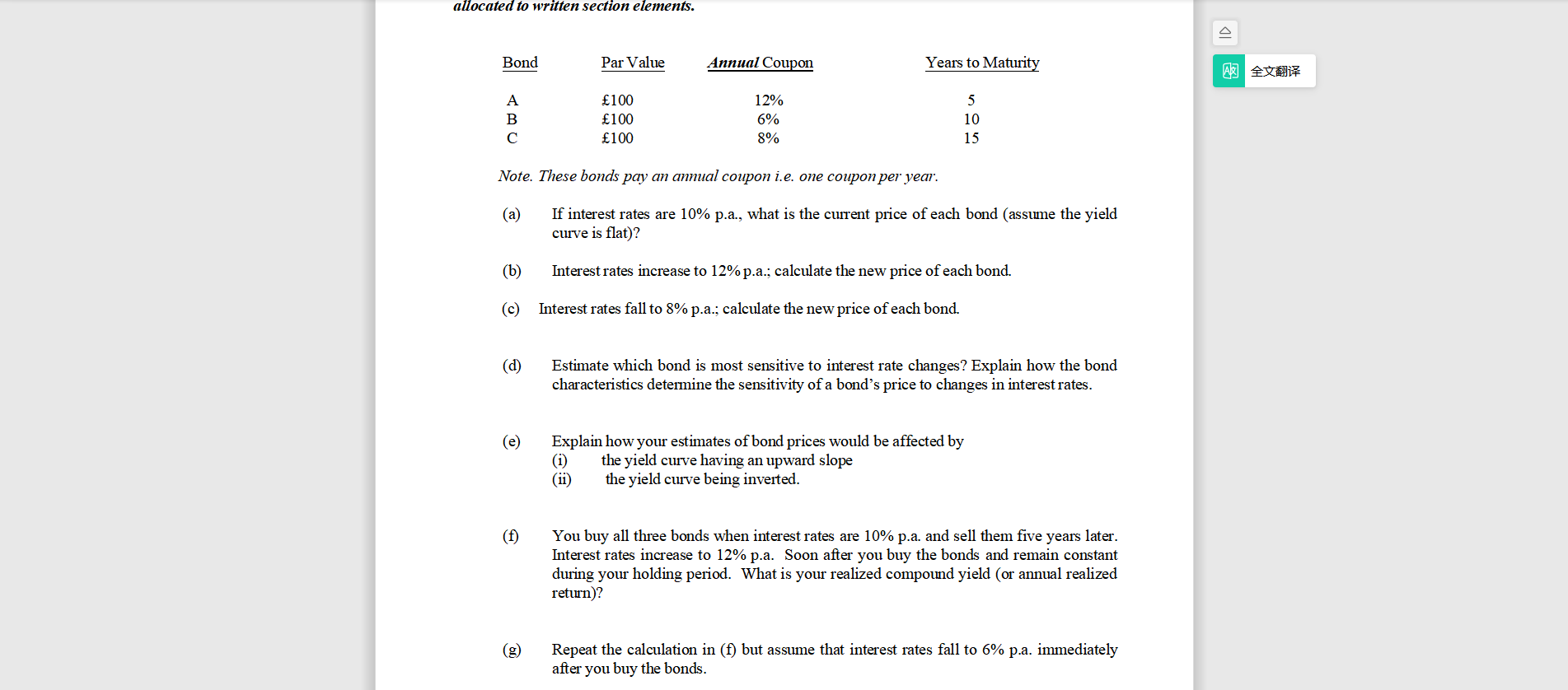

allocated to written section elements. Bond Par Value Annual Coupon Years to Maturity A B 100 100 100 12% 6% 8% 5 10 15 Note. These bonds pay an annual coupon i.e. one coupon per year. (a) If interest rates are 10% p.a., what is the current price of each bond (assume the yield curve is flat)? (6) Interest rates increase to 12%p.a., calculate the new price of each bond. (c) Interest rates fall to 8% p.a., calculate the new price of each bond. (d) Estimate which bond is most sensitive to interest rate changes? Explain how the bond characteristics determine the sensitivity of a bond's price to changes in interest rates. (e) Explain how your estimates of bond prices would be affected by (1) the yield curve having an upward slope the yield curve being inverted. (f) You buy all three bonds when interest rates are 10% p.a. and sell them five years later. Interest rates increase to 12% p.a. Soon after you buy the bonds and remain constant during your holding period. What is your realized compound yield (or annual realized return)? Repeat the calculation in (f) but assume that interest rates fall to 6% p.a. immediately after you buy the bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts