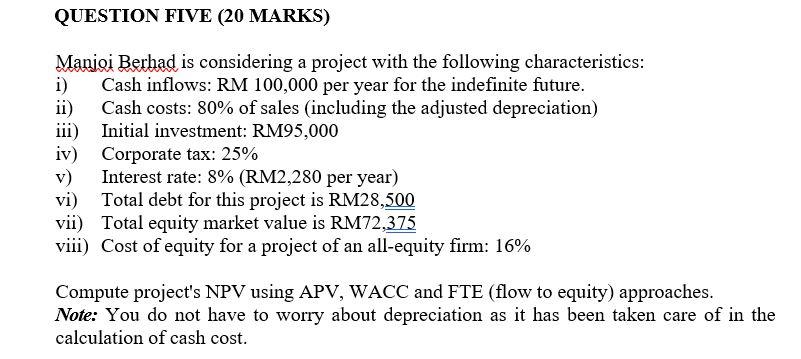

Question: QUESTION FIVE (20 MARKS) Manjoi Berhad is considering a project with the following characteristics: i) Cash inflows: RM 100,000 per year for the indefinite future.

QUESTION FIVE (20 MARKS) Manjoi Berhad is considering a project with the following characteristics: i) Cash inflows: RM 100,000 per year for the indefinite future. ii) Cash costs: 80% of sales (including the adjusted depreciation) iii) Initial investment: RM95,000 iv) Corporate tax: 25% Interest rate: 8% (RM2,280 per year) vi) Total debt for this project is RM28,500 vii) Total equity market value is RM72,375 viii) Cost of equity for a project of an all-equity firm: 16% Compute project's NPV using APV, WACC and FTE (flow to equity) approaches. Note: You do not have to worry about depreciation as it has been taken care of in the calculation of cash cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts