Question: Question Five: (5 Marks) XYZ Bank has an inventory position of 65 million in foreign stock. The spot exchange rates are 0.78125/$.. The beta coefficient

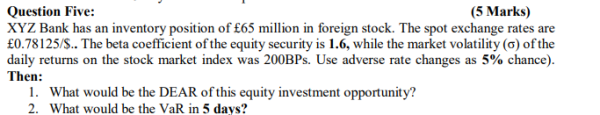

Question Five: (5 Marks) XYZ Bank has an inventory position of 65 million in foreign stock. The spot exchange rates are 0.78125/$.. The beta coefficient of the equity security is 1.6, while the market volatility () of the daily returns on the stock market index was 200BPs. Use adverse rate changes as 5% chance). Then: 1. What would be the DEAR of this equity investment opportunity? 2. What would be the VaR in 5 days

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock