Question: QUESTION FIVE A is a listed company. Your client, Mr B , currently owns 3 0 0 shares in A . Mr B has recently

QUESTION FIVE

A is a listed company. Your client, Mr B currently owns shares in A Mr B has recently received the published financial statements of A for the year ended September X Extracts from these published financial statements, and other relevant information, are given below. is confused by the statements. He is

Page of

unsure how the performance of the company during the year will affect the market value of his shares, but is aware that the published earnings per share EPS is a statistic which is often used by analysts in assessing the performance of listed companies.

Statements of profit or loss year ended September

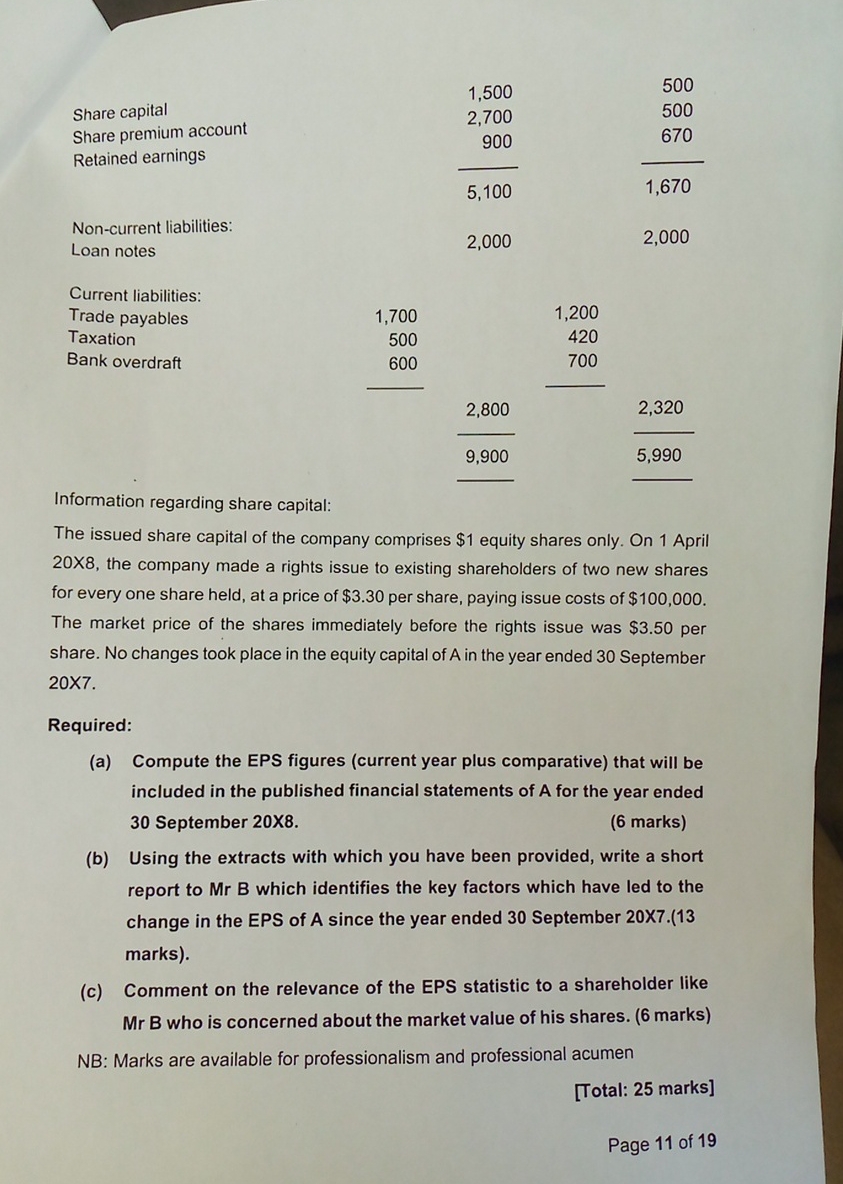

Equity:

Page of

Share capital

Share premium account

Retained earnings

Information regarding share capital:

The issued share capital of the company comprises $ equity shares only. On April X the company made a rights issue to existing shareholders of two new shares for every one share held, at a price of $ per share, paying issue costs of $ The market price of the shares immediately before the rights issue was $ per share. No changes took place in the equity capital of in the year ended September X

Required:

a Compute the EPS figures current year plus comparative that will be included in the published financial statements of A for the year ended September X

marks

b Using the extracts with which you have been provided, write a short report to Mr B which identifies the key factors which have led to the change in the EPS of A since the year ended September X marks

c Comment on the relevance of the EPS statistic to a shareholder like who is concerned about the market value of his shares. marks

NB: Marks are available for professionalism and professional acumen

Total: marks

Page of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock