Question: QUESTION FIVE On March 1 , 2 0 2 4 , Len Horvat receives a $ 1 0 0 , 0 0 0 loan

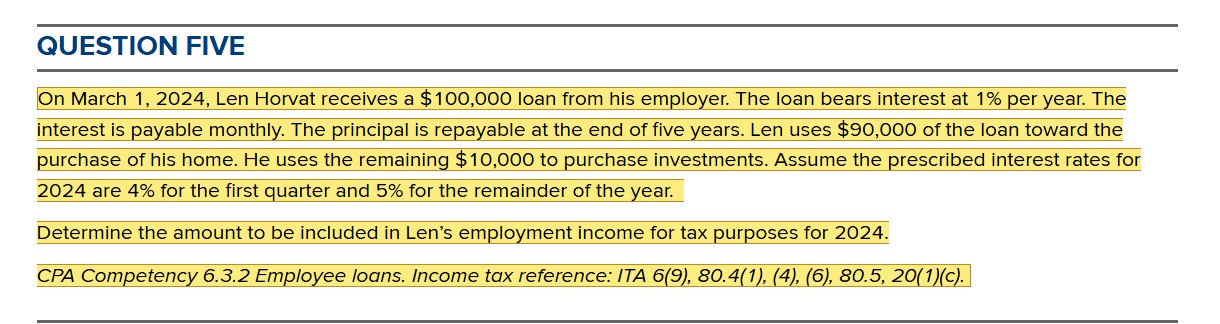

QUESTION FIVE

On March Len Horvat receives a $ loan from his employer. The loan bears interest at per year. The interest is payable monthly. The principal is repayable at the end of five years. Len uses $ of the loan toward the purchase of his home. He uses the remaining $ to purchase investments. Assume the prescribed interest rates for are for the first quarter and for the remainder of the year.

Determine the amount to be included in Len's employment income for tax purposes for

CPA Competency Employee loans. Income tax reference: ITA c

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock