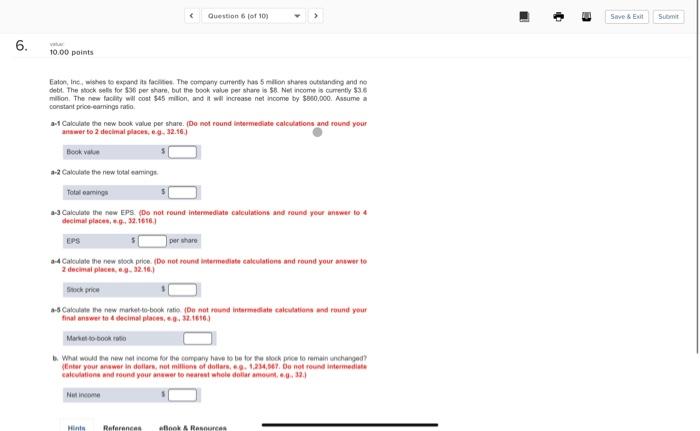

Question: Question for 10) Save & Ex Suomi 6. 10.00 points Eaton, Inc., whes to expand its faces. The company currently has 5 milion shares outstanding

Question for 10) Save & Ex Suomi 6. 10.00 points Eaton, Inc., whes to expand its faces. The company currently has 5 milion shares outstanding and ne debt. The stock sells for $36 per share, but the book value per share is a Nel income is currently 536 milion. The new facility will cost $45 million, and it will increase net income by $800,000. Assume a constant price camins ratio Calculate the new book value por share. Do not round intermediate calculations and round your answer to 2 decimal places, eg.12.16) Book ve 1-2 Calculate the new total camings Totalarning Calculate the new EPS. (Do not found intermediate cateulations and round your wer to 4 decimal places... 32.6616) EPS per share 2-4 Calculate the new stock price. (Do not found intermediate calculations and round your answer to 2 decimal places, og 12.10.) Stock price Cate the new market-book ratio (Do not found intermediate calculation and round your final answer to decimal places, 32.18163 Mars to book toto What would the new come for the company have to be for Mock price to remain unchanged? Enter your answer in dollars, not millions of dollars. 1,234,067. Do not found intermediate calculations and round your newer to a whole dollar amount. 2.) Nation M References nk Rana

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts