Question: Question Four (12 marks). The following table represents ratios for 2020 for Soni Limited, a company in the manufacturing of electronics such as televisions, computers

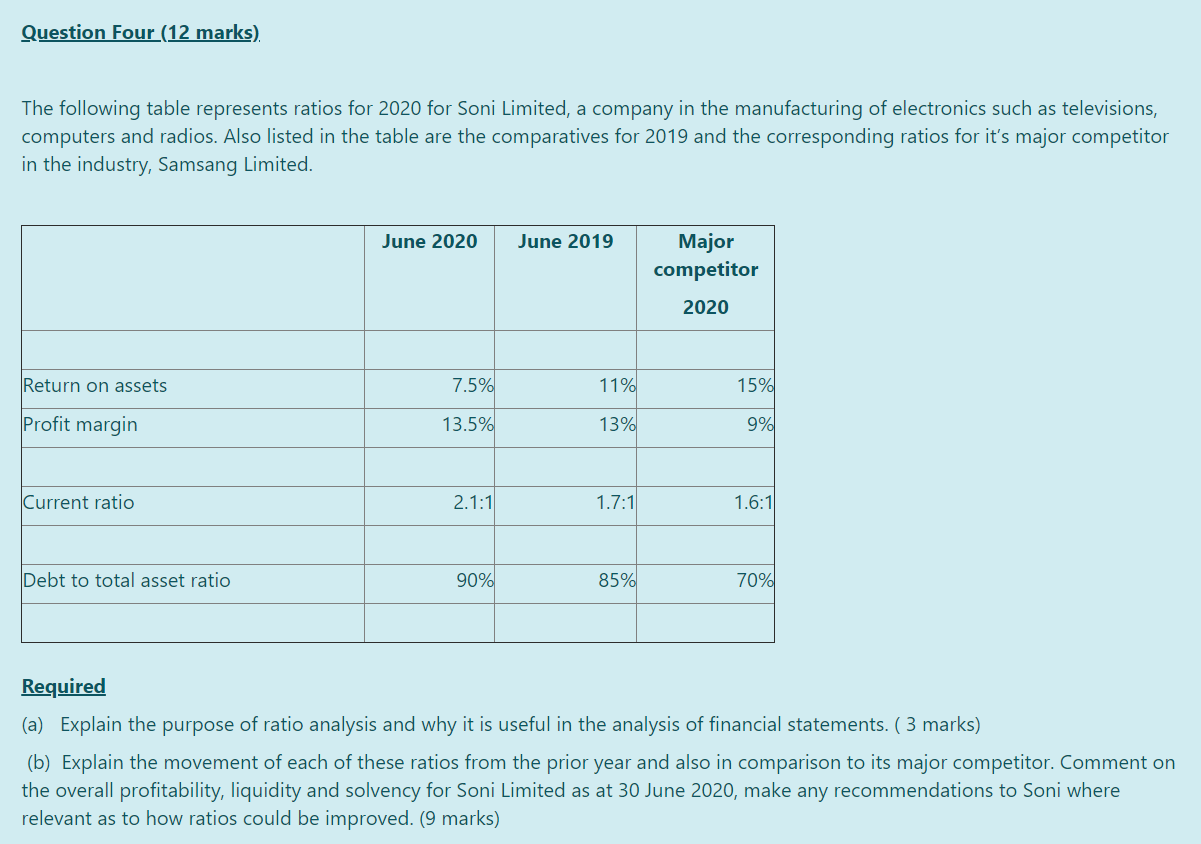

Question Four (12 marks). The following table represents ratios for 2020 for Soni Limited, a company in the manufacturing of electronics such as televisions, computers and radios. Also listed in the table are the comparatives for 2019 and the corresponding ratios for it's major competitor in the industry, Samsang Limited. June 2020 June 2019 Major competitor 2020 Return on assets 7.5% 11% 15% Profit margin 13.5% 13% 9% Current ratio 2.1:1 1.7:1 1.6:1 Debt to total asset ratio 90% 85% 70% Required (a) Explain the purpose of ratio analysis and why it is useful in the analysis of financial statements. (3 marks) (b) Explain the movement of each of these ratios from the prior year and also in comparison to its major competitor. Comment on the overall profitability, liquidity and solvency for Soni Limited as at 30 June 2020, make any recommendations to Soni where relevant as to how ratios could be improved. (9 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts