Question: QUESTION FOUR a) Based on the CAPM. explain in detail how to identify investors who are more risk averse. (10 marks) b) The market price

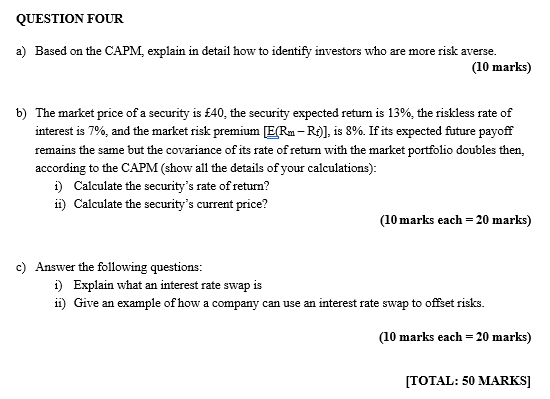

QUESTION FOUR a) Based on the CAPM. explain in detail how to identify investors who are more risk averse. (10 marks) b) The market price of a security is 40, the security expected return is 13%, the riskless rate of interest is 7%, and the market risk premium EfRm Rt)], is 8%. If its expected future payoff remains the same but the covariance of its rate of return with the market portfolio doubles then, according to the CAPM (show all the details of your calculations): 1) Calculate the security's rate of return? ii) Calculate the security's current price? (10 marks each = 20 marks) c) Answer the following questions: i) Explain what an interest rate swap is ii) Give an example of how a company can use an interest rate swap to offset risks. (10 marks each = 20 marks) [TOTAL: 50 MARKS]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts