Question: Question Four Answer all parts Show all your workings (a) Tri-County Bank has assets consisting of $8.2 billion in cash, $45.0 billion of 4.0% fixed

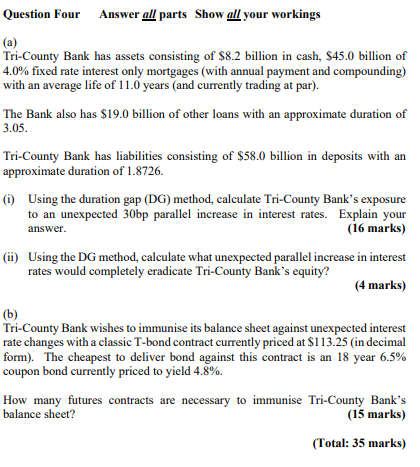

Question Four Answer all parts Show all your workings (a) Tri-County Bank has assets consisting of $8.2 billion in cash, $45.0 billion of 4.0% fixed rate interest only mortgages (with annual payment and compounding) with an average life of 11.0 years (and currently trading at par). The Bank also has $19.0 billion of other loans with an approximate duration of 3.05. Tri-County Bank has liabilities consisting of $58.0 billion in deposits with an approximate duration of 1.8726. (1) Using the duration gap (DG) method, calculate Tri-County Bank's exposure to an unexpected 30bp parallel increase in interest rates. Explain your answer. (16 marks) (ii) Using the DG method, calculate what unexpected parallel increase in interest rates would completely eradicate Tri-County Bank's equity? (4 marks) (b) Tri-County Bank wishes to immunise its balance sheet against unexpected interest rate changes with a classic T-bond contract currently priced at $113.25 (in decimal form). The cheapest to deliver bond against this contract is an 18 year 6.5% coupon bond currently priced to yield 4.8%. How many futures contracts are necessary to immunise Tri-County Bank's balance sheet? (15 marks) (Total: 35 marks) Question Four Answer all parts Show all your workings (a) Tri-County Bank has assets consisting of $8.2 billion in cash, $45.0 billion of 4.0% fixed rate interest only mortgages (with annual payment and compounding) with an average life of 11.0 years (and currently trading at par). The Bank also has $19.0 billion of other loans with an approximate duration of 3.05. Tri-County Bank has liabilities consisting of $58.0 billion in deposits with an approximate duration of 1.8726. (1) Using the duration gap (DG) method, calculate Tri-County Bank's exposure to an unexpected 30bp parallel increase in interest rates. Explain your answer. (16 marks) (ii) Using the DG method, calculate what unexpected parallel increase in interest rates would completely eradicate Tri-County Bank's equity? (4 marks) (b) Tri-County Bank wishes to immunise its balance sheet against unexpected interest rate changes with a classic T-bond contract currently priced at $113.25 (in decimal form). The cheapest to deliver bond against this contract is an 18 year 6.5% coupon bond currently priced to yield 4.8%. How many futures contracts are necessary to immunise Tri-County Bank's balance sheet? (15 marks) (Total: 35 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts