Question: Question Four Suppose Investor A has a power utility function with = 1 . whilst Investor B has a power utility function with = 0

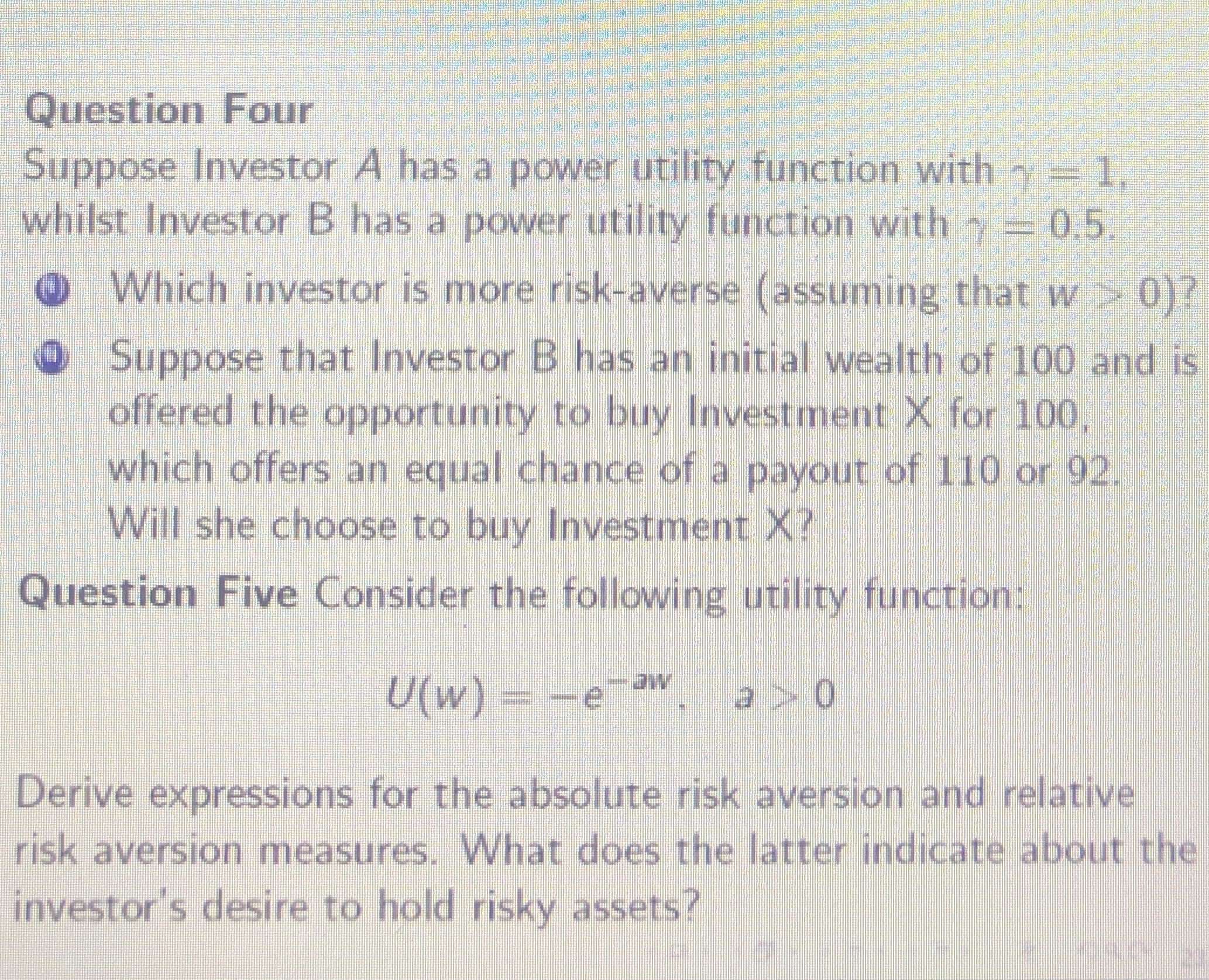

Question Four

Suppose Investor A has a power utility function with whilst Investor B has a power utility function with

Which investor is more riskaverse assuming that

Suppose that Investor B has an initial wealth of and is offered the opportunity to buy Investment X for which offers an equal chance of a payout of or

Will she choose to buy Investment X

Question Five Consider the following utility function:

Derive expressions for the absolute risk aversion and relative risk aversion measures. What does the latter indicate about the investor's desire to hold risky assets?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock