Question: Question Four You are a portfolio manager working for Stratton Financial Solutions. You have computed the following information regarding four stocks listed on the New

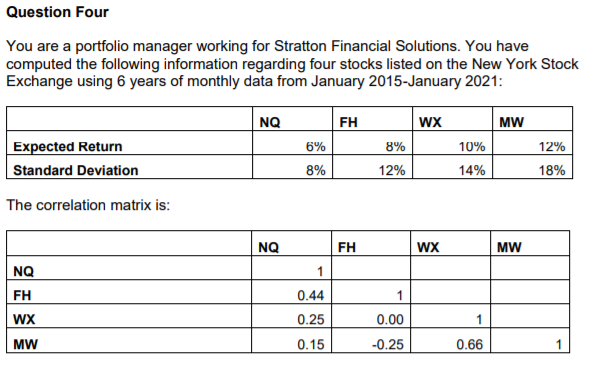

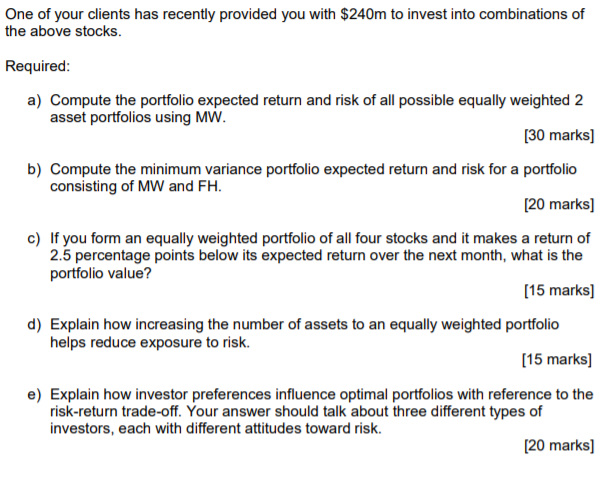

Question Four You are a portfolio manager working for Stratton Financial Solutions. You have computed the following information regarding four stocks listed on the New York Stock Exchange using 6 years of monthly data from January 2015-January 2021: NQ FH wx MW 6% 8% 12% Expected Return Standard Deviation 10% 14% 8% 12% 18% The correlation matrix is: NQ FH WX MW NQ 1 0.44 1 FH WX 0.25 0.00 1 MW 0.15 -0.25 0.66 One of your clients has recently provided you with $240m to invest into combinations of the above stocks. Required: a) Compute the portfolio expected return and risk of all possible equally weighted 2 asset portfolios using MW. [30 marks) b) Compute the minimum variance portfolio expected return and risk for a portfolio consisting of MW and FH. [20 marks] c) If you form an equally weighted portfolio of all four stocks and it makes a return of 2.5 percentage points below its expected return over the next month, what is the portfolio value? [15 marks] d) Explain how increasing the number of assets to an equally weighted portfolio helps reduce exposure to risk. [15 marks] e) Explain how investor preferences influence optimal portfolios with reference to the risk-return trade-off. Your answer should talk about three different types of investors, each with different attitudes toward risk. [20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts