Question: QUESTION FOURQUESTION THREE ( a ) The dollar is selling in Kenya at KES 1 0 2 . 4 0 . If the interest for

QUESTION FOURQUESTION THREE

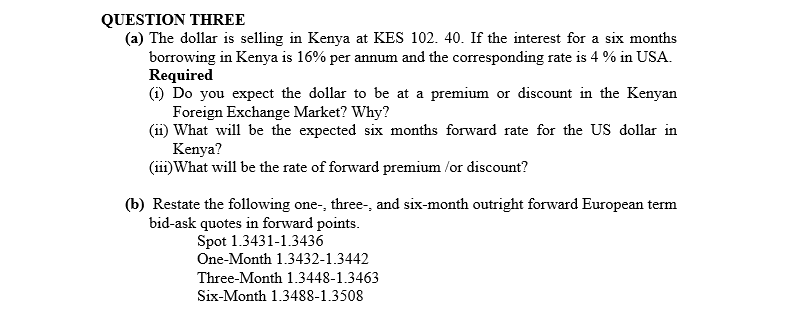

a The dollar is selling in Kenya at KES If the interest for a six months

borrowing in Kenya is per annum and the corresponding rate is in USA.

Required

i Do you expect the dollar to be at a premium or discount in the Kenyan

Foreign Exchange Market? Why?

ii What will be the expected six months forward rate for the US dollar in

Kenya?

iii What will be the rate of forward premium or discount?

b Restate the following one three and sixmonth outright forward European term

bidask quotes in forward points.

Spot

OneMonth

ThreeMonth

SixMonth

Savannah Airways Ltd a Kenyan company, entered into an agreement with Airbus

Incorporated for the purchase of the latest version of their aircraft for a total value of

million Euros payable after months. The current spot exchange rate is KESEUR

Savannah Airways cannot predict the exchange rate in the future, although a six months

forward contract at KES EUR is available.

Required

Explain any three ways in which Savannah could hedge its Foreign Exchange exposure

risk using:

a Forward contract

b Money market operation

c Options

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock