Question: Question from Managerial Accounting. please provide solutions for each part. Thank you iCompany manufactures two models of tablets. The 8-inch Model is a smaller unit

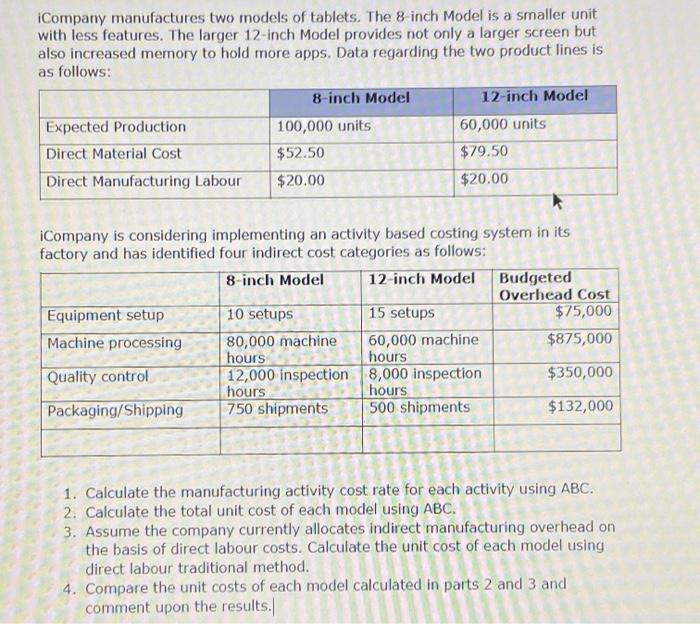

iCompany manufactures two models of tablets. The 8-inch Model is a smaller unit with less features. The larger 12-inch Model provides not only a larger screen but also increased memory to hold more apps. Data regarding the two product lines is as follows: 8-inch Model 12-inch Model Expected Production 100,000 units 60,000 units Direct Material Cost $52.50 $79.50 Direct Manufacturing Labour $20.00 $20.00 iCompany is considering implementing an activity based costing system in its factory and has identified four indirect cost categories as follows: 8-inch Model 12-inch Model Budgeted Overhead Cost Equipment setup 10 setups 15 setups $75,000 Machine processing 80,000 machine 60,000 machine $875,000 hours hours Quality control 12,000 inspection 8,000 inspection $350,000 hours hours Packaging/Shipping 750 shipments 500 shipments $132,000 1. Calculate the manufacturing activity cost rate for each activity using ABC. 2. Calculate the total unit cost of each model using ABC. 3. Assume the company currently allocates indirect manufacturing overhead on the basis of direct labour costs. Calculate the unit cost of each model using direct labour traditional method. 4. Compare the unit costs of each model calculated in parts 2 and 3 and comment upon the results

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts