Question: QUESTION : GET THE ANSWER FROM INFORMATION BELOW : This case is about share repurchase decision. At the time of the decision, the AG's stock

QUESTION :

GET THE ANSWER FROM INFORMATION BELOW :

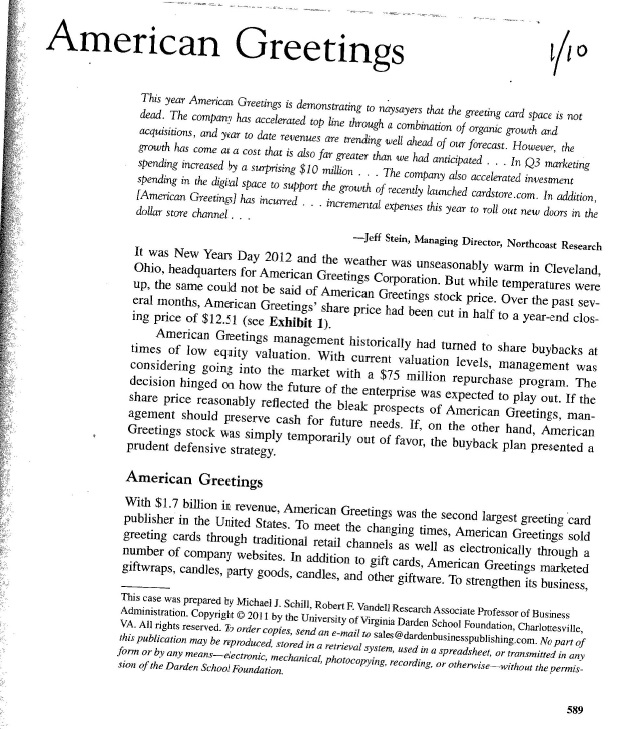

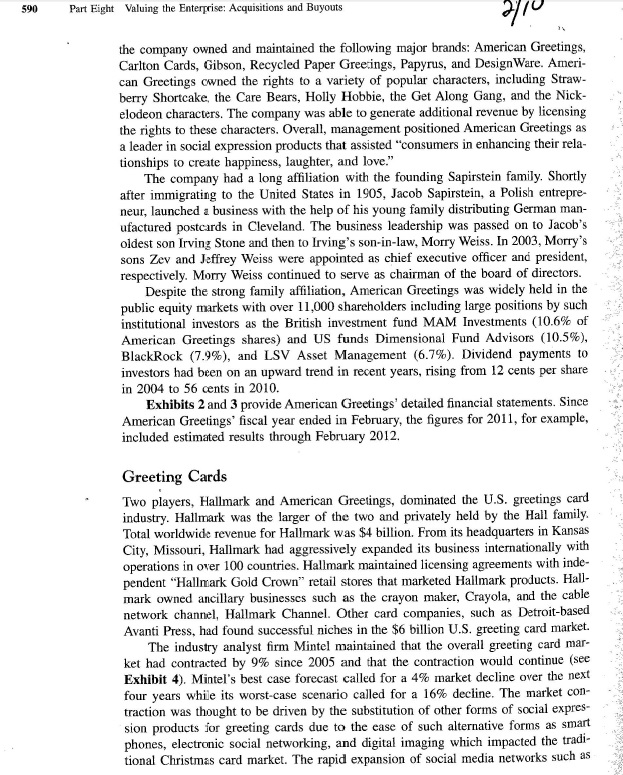

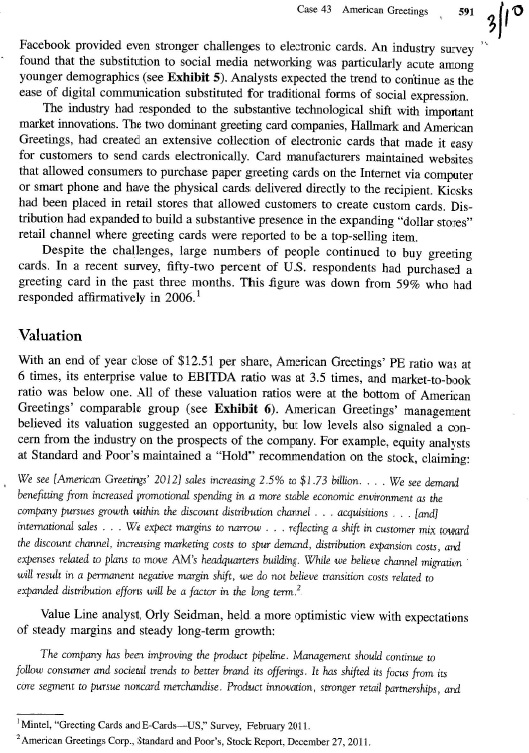

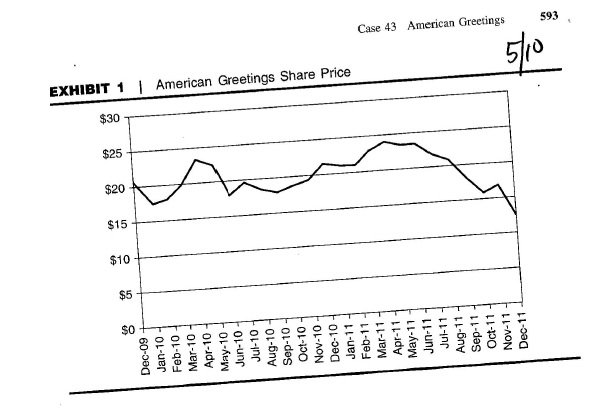

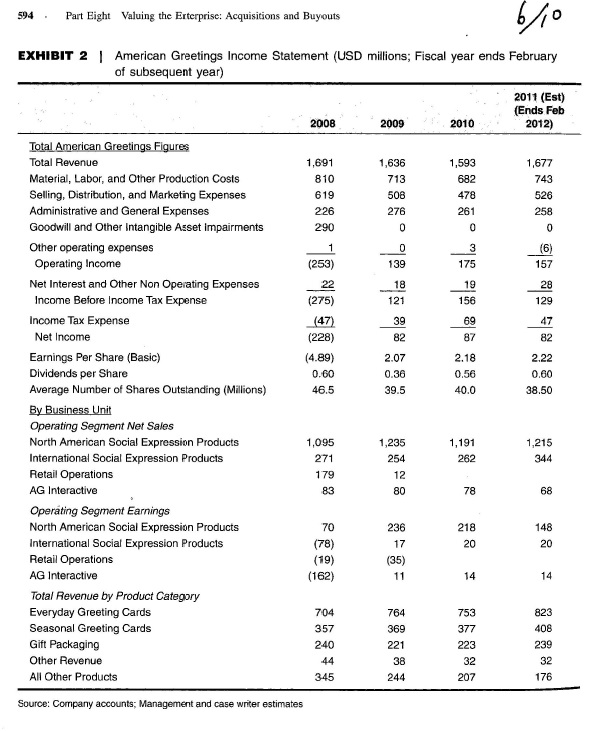

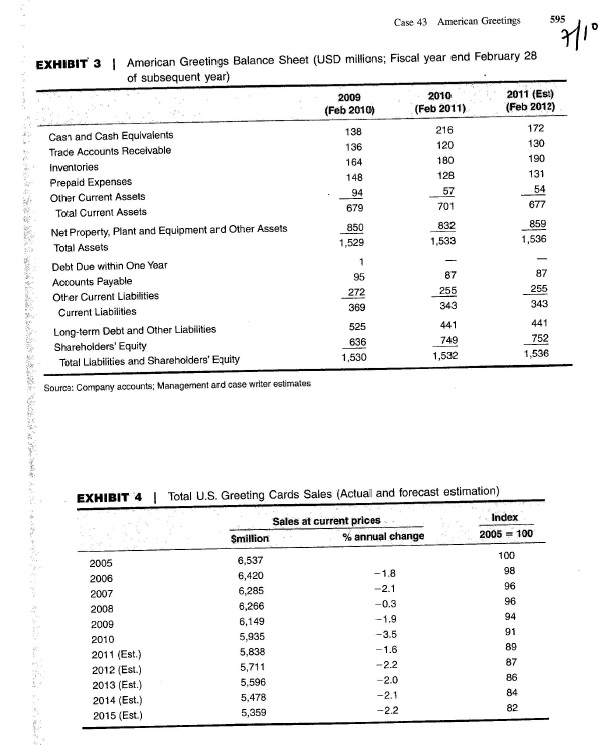

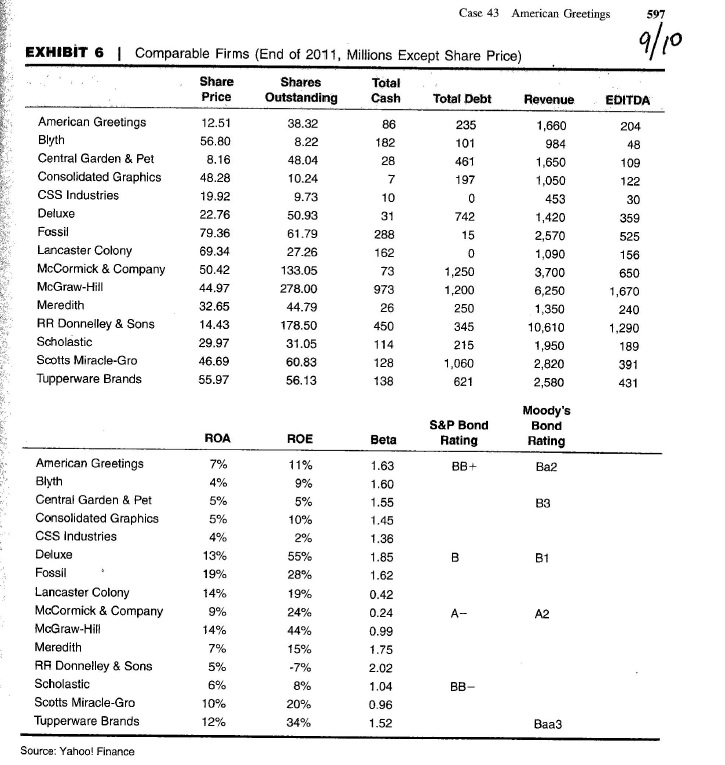

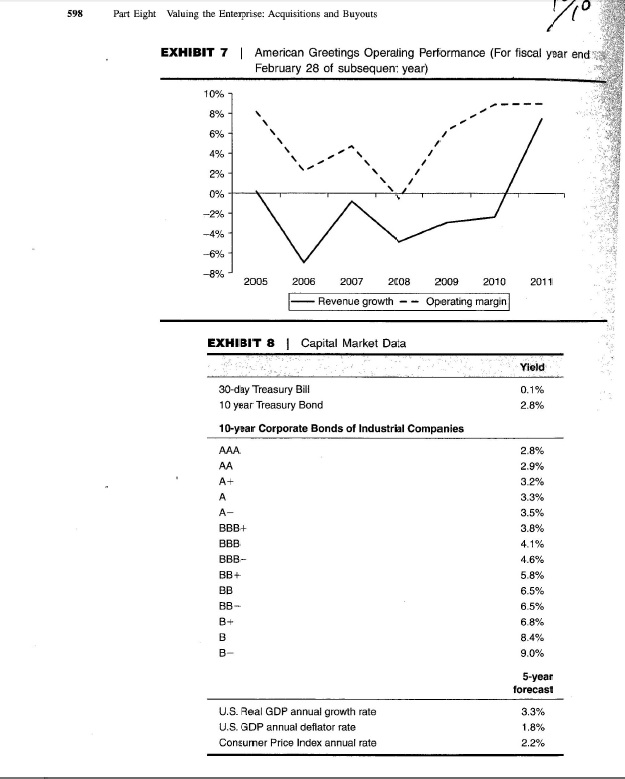

This case is about share repurchase decision. At the time of the decision, the AG's stock traded below valuation multiples of its peers in the industry. Your task is to build a simple model of the company's future cash flows and derived an implied value (share price). Include this 2 questions 1. What are the key drivers of value in your model? 2. Do you recommend repurchasing shares? This case is about share repurchase decision. At the time of the decision, the AG's stock traded below valuation multiples of its peers in the industry. Your task is to build a simple model of the company's future cash flows and derived an implied value (share price). Include this 2 questions 1. What are the key drivers of value in your model? 2. Do you recommend repurchasing shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts