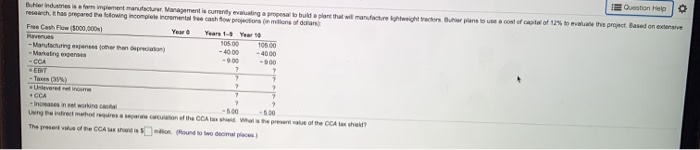

Question: Question Help 0 B. Hier Industries is for implement manual Management is currently valuating araluldahlwillerators and to colofof 12% to evaluate this project Based on

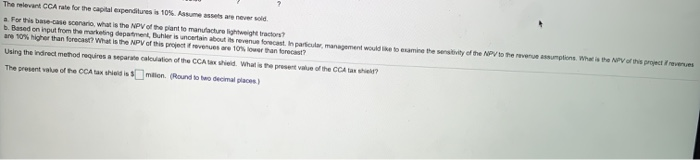

Question Help 0 B. Hier Industries is for implement manual Management is currently valuating araluldahlwillerators and to colofof 12% to evaluate this project Based on extensive research has prepared the following incomplete incrementalechowrooms of Free Cash Flow 5000,000 Menu 10500 10500 - Manufacturing per andare - 40.00 - Maring en - CCA -900 7 EBIT -T) Unever reading 2 - Increases in working 5.00 Unge indirect methods of the CCA What the CCA The present of CGA do Mundo Gomes - The meat CCA rate for the capital expenditures is 10%. Asmes are never wold a. For this buse-case scenario what is the NPV of the plant to manufacture lightweight tractors b. Based on input from the marketing department, but is not about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions Who's project revenues are 10% higher than force? What is the NPV of this project revenues are 10% lower than forecast? Using the indirect method requires a parte calculation of the CCA tax shield. What is the present value of the CCA tah? The present value of the CCA taxis milion Round to be decimale) Question Help 0 B. Hier Industries is for implement manual Management is currently valuating araluldahlwillerators and to colofof 12% to evaluate this project Based on extensive research has prepared the following incomplete incrementalechowrooms of Free Cash Flow 5000,000 Menu 10500 10500 - Manufacturing per andare - 40.00 - Maring en - CCA -900 7 EBIT -T) Unever reading 2 - Increases in working 5.00 Unge indirect methods of the CCA What the CCA The present of CGA do Mundo Gomes - The meat CCA rate for the capital expenditures is 10%. Asmes are never wold a. For this buse-case scenario what is the NPV of the plant to manufacture lightweight tractors b. Based on input from the marketing department, but is not about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions Who's project revenues are 10% higher than force? What is the NPV of this project revenues are 10% lower than forecast? Using the indirect method requires a parte calculation of the CCA tax shield. What is the present value of the CCA tah? The present value of the CCA taxis milion Round to be decimale)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts