Question: Question help 3 1. Historical, Marginal, Projected, Forecasted 2. Added, Subtracted The cost of debt that is relevant when companies are evaluating new investment projects

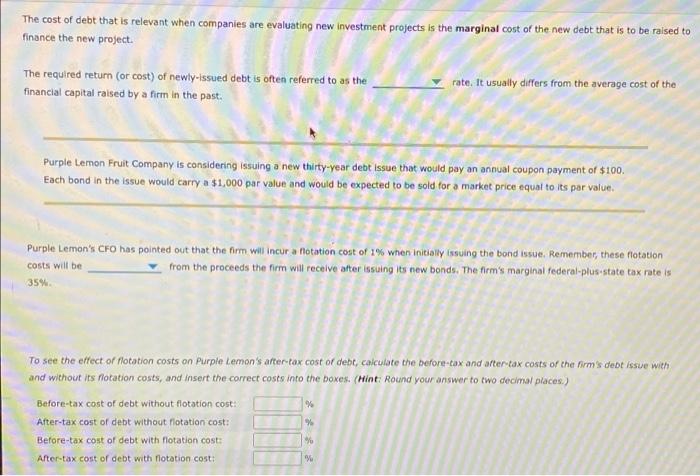

The cost of debt that is relevant when companies are evaluating new investment projects is the marginal cost of the new debt that is to be raised to finance the new project. The required return (or cost) of newly-Issued debt is often referred to as the financial capital raised by a firm in the past. rate. It usually differs from the average cost of the Purple Lemon Fruit Company is considering issuing a new thirty-year debt issue that would pay an annual coupon payment of $100. Each bond in the issue would carry a $1,000 par value and would be expected to be sold for a market price equal to its par value. costs will be Purple Lemon's CFO has pointed out that the firm will incur a rotation cost of 1% when initially issuing the bond issue. Remember, these flotation from the proceeds the firm will receive after issuing its new bonds. The firm's marginal federal-plus-state tax rate is 35% To see the effect of flotation costs on Purple Lemon's arter-tax cost of debt, calculate the before.cax and after-tax costs of the firm's debt issue with and without its flotation costs, and Insert the correct costs into the boxes. (Hint Round your answer to two decimal places.) Before-tax cost of debt without flotation cost: % After-tax cost of debt without rotation cost: Before-tax cost of debt with flotation costs Alter-tax cost of debt with rotation cost: % yu

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts